Key Takeaways From Fed Pause and Forecasts for Further Hikes

This article may be of interest. Here is a section:

Here are key takeaways from the Federal Reserve's interest-rate decision and statement on Wednesday:

Federal Open Market Committee unanimously holds benchmark rate in target range of 5%- 5.25%, as expected, in first pause since starting cycle of increases in early 2022, to “assess additional information and its implications for monetary policy”

New projections show policymakers favor a half-point of additional increases this year, which would push borrowing costs to about 5.6% -- higher than most economists and investors have been expecting

FOMC statement gives clear signal that policymakers will resume tightening by referring to the “extent of additional policy firming that may be appropriate”; prior statement, in May, gave more leeway on whether to hike

Forecasts for economic growth and core inflation rose for 2023, while unemployment projections fell

Fed says economy has expanded at modest pace with robust job gains and low unemployment; inflation remains “elevated”

At Jerome Powell’s press conference he said two important things. The first is they will do whatever is necessary to bring inflation back to 2% on the PCE. The second is that some “below trend growth and higher unemployment” will be required to achieve that goal. The best of all possible worlds is that can be achieved without causing a recession. Unfortunately, that is not a likely scenario given the history of such attempts.

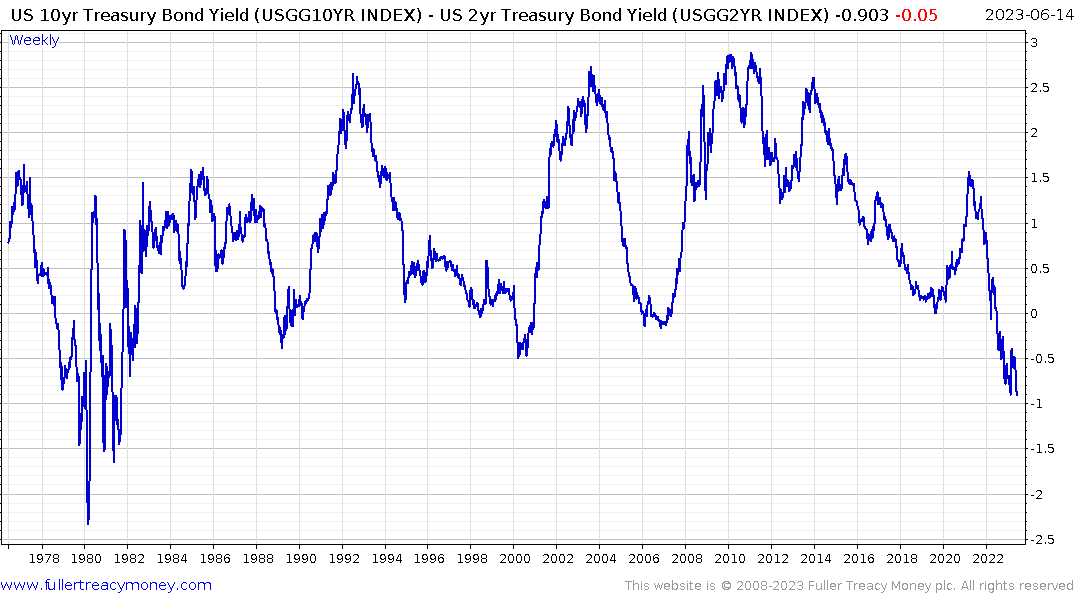

The yield curve spread (10yr-2yr) continues to contract and is approaching the February low. It is quite normal for stock prices to remains firm until the yield curve spread begins to trend back up through zero. That usually happens around the same time that the Fed begins to cut rates in response to a major growth scare.

.png) Crude oil remains finely balanced but my gut tells me the next significant break will be on the downside as demand reacts to tighter liquidity conditions.

Crude oil remains finely balanced but my gut tells me the next significant break will be on the downside as demand reacts to tighter liquidity conditions.