Secular Themes Review June 4th 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on May 7th. These reviews can be found via the search bar using the term “Secular Themes Review”.

The pandemic panic is now one year in the rear-view mirror. It seems to have lost its ability to scare us so that begs the question what happens next? That’s the big conundrum

Some still believe that technology will solve all our problems and that the largest companies in the world will continue get even larger. Others believe that the inflation genie has been released so it is inevitable that bonds will collapse in value. Others believe that we are in for a long grind of subpar growth because the debt is so large, it will sap the will to live out of every speculative asset. Others believe we are in a stock, commodity and property market bubble that could pop at any moment. Still others believe that cryptocurrencies are the solution, though no one is exactly sure what the problem is. So how do we make sense of these divergent views?

Personally, I have a strong feeling of déjà vu. In late 1999 and early 2000 I was selling Optus cable connections door to door in Melbourne. When I tired of backpacking, I went to London and within three weeks had started at Bloomberg. I was amazed at the speed of the Royal Mail. I saw an ad in The Times on a Wednesday for European sales people. I posted my CV that afternoon and had a reply back from Bloomberg delivered the next day. I had an interview on Monday and started on Tuesday. To say they were desperate for sales people is a gross understatement. I was in Belgium, visiting private banks, 10 days later. That was the top of the market and it was evidence of a true mania in the TMT (Telecoms, Media and Technology) sectors.

By the end of the Nasdaq bear market in 2003 the number of Bloomberg terminals being sold to mortgage bankers was surging. I was even offered a job by one. The Dollar was pulling back, there were fears about financial repression, China’s demand for commodities was only beginning, emerging markets were breaking out and gold was completing its base formation. A year later oil broke out.

After shocks to the economy, the Federal Reserve has tended to leave policy loose for longer than is required and is also slow in removing assistance. This occasion appears to be no different. This tendency to overcompensate during crises and reluctance to normalise afterwards is why David used to say the Federal Reserve is a “serial bubble blower”. This nascent bull market is likely to climax in a bubble. However, it is important to remember that bull markets don’t end because of a lack of demand. They end when supply overwhelms all available buyers. That means monitoring liquidity and the issuance of new shares and the creation of new commodity supply is going to be productive in assessing how close to a top we are.

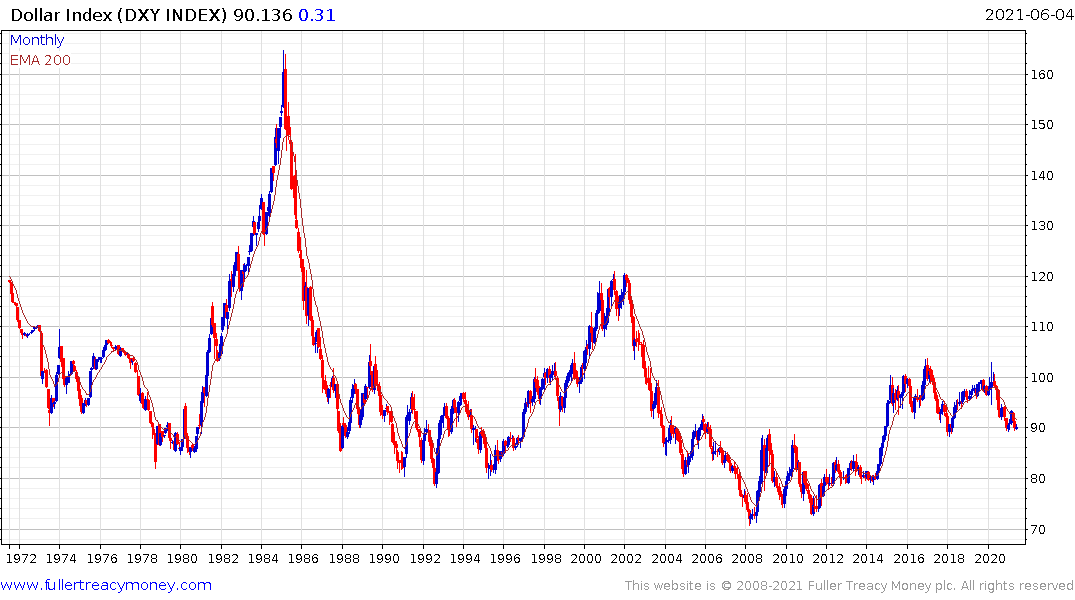

After the TMT peak and 9/11, the Dollar trended lower for seven years. After the credit crisis, the Dollar Index went sideways because Europe’s problems were at least as challenging. As we look ahead at what to expect in the coming years, it is reasonable to conclude the Federal Reserve will be cautious. They will not risk endangering the recovery by tightening policy pre-emptively. They have also gone further in stating they want to see inflation trend higher before introducing a tightening bias.

The rest of the world is further along in their intentions to remove extraordinary assistance. Canada was the first to taper its QE program. Both the UK and Australia are talking about it. The ECB does not want a strong currency but they have so far been reluctant to act to depress the Euro’s value. The Chinese are not thrilled at the prospect of having the world’s strongest currency but they are more concerned with limiting the risk of domestic inflation.

The only major currency the US Dollar is trending higher against is the Japanese Yen. It is trending lower against just about everything else.

Dollar bear markets make the USA less attractive to foreign investors and simultaneously make international markets more attractive to US investors. Contrast the performance of MSCI ex-US in Dollars with the performance of the S&P500 in Euro for example.

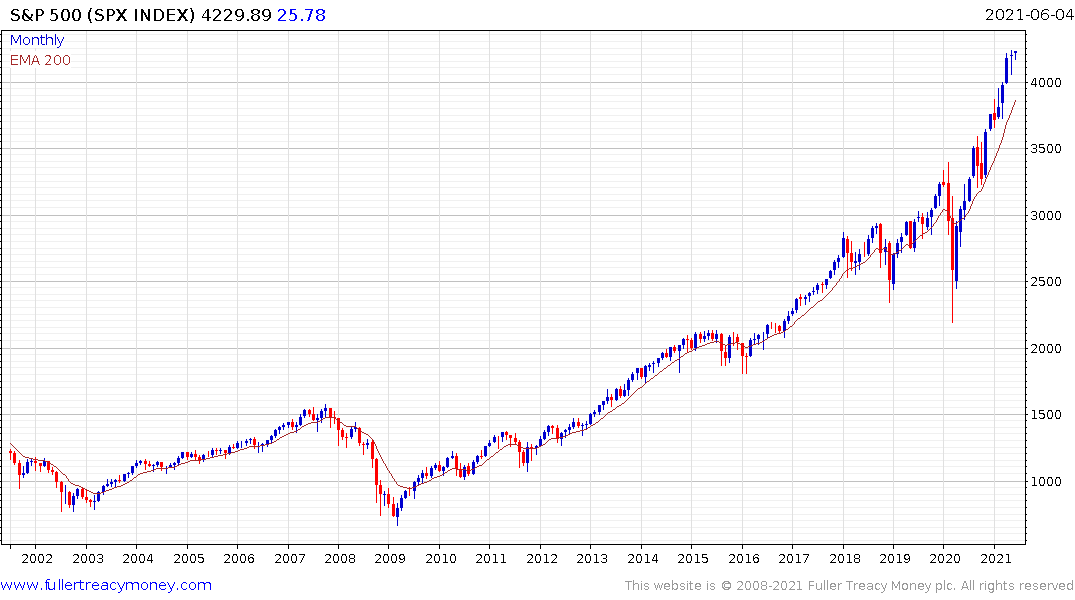

There is no questioning the persistent outperformance of US assets over the last decade. A strong currency, higher interest rates, stronger growth, abundant liquidity and innovation leadership propelled the USA to the position of most attractive market in the world by a wide margin. Investors from everywhere turned up to own a piece of story.

This chart of the MSCI World Ex-US / S&P500 in Euro has base formation characteristics. As we look at the outlook for the next decade the direction of the Dollar is the lynchpin for a recovery in interest in non-US assets of all hues. If the Dollar breaks lower, it will lend significant fuel to the argument investors need to diversify away from anything but the most attractive US assets.

That does not mean Wall Street can’t still rally in nominal terms but significant rotation will be required as an adjustment to the reality of a weak Dollar. The commonality between the above chart and that of the Russell 2000/Nasdaq and the value/growth ratios supports the view that large cap tech is unlikely to remain the growth leader in the evolving recovery. US investors are likely to be better served by avoiding the very largest components of the primary indices and favouring mid-caps and small-caps.

There are large numbers of markets breaking higher in nominal terms as they complete ranges that have lasted decades in some cases. They will become attractive to domestic investors but the flow of money from foreign investors is necessary to create the kinds of returns that make a significant bull market. The following charts are all adjusted for US Dollars for the sake of easy comparison and I’ve used their respective stock market indices because I can get more long-term data than for many of the available ETFs. However, I have also listed the tickers for relevant ETFs after each title.

FTSE-100 rebased to USD Dollars (Ticker EWU US)

FTSE-250 rebased to USD Dollars (Ticker MIDD LN)

Euro STOXX Index rebased to USD Dollars (Ticker FEZ US and SXXPIEX GR for the STOXX 600 in Germany)

German DAX Index rebased to USD Dollars (Ticker EQG US)

Japan’s Nikkei-225 rebased to USD Dollars (Ticker EWJ)

Australian S&P/ASX 200 rebased to USD Dollars (Ticker EWA US)

Canada’s S&P/TSX rebased to USD Dollars (Ticker EWC US)

India’s Nifty Index rebased to USD Dollars (Ticker INDA)

Singapore’s STI rebased to USD Dollars (Ticker EWS US)

Taiwan’s TAIEX rebased to USD Dollars (Ticker EWT)

South Korea rebased to USD Dollars (Ticker EWY)

South Africa Johannesburg All-Share rebased to USD Dollars (Ticker EZA)

Hong Kong Chinese Enterprises Index and the Hang Seng (Ticker EWH)

MSCI China (Ticker MCHI US)

Vietnam rebased to USD Dollars (Ticker VNM)

Malaysia rebased to USD Dollars (Ticker EWM)

Indonesia rebased to US Dollars (Ticker EiDO)

Brazil iBovespa rebased to USD Dollars (Ticker EWZ)

Mexico rebased to USD Dollars (Ticker EWW)

Russia’s RTS (Ticker ERUS)

EMEA rebased to USD Dollars (Ticker EEME)

EMEA rebased to USD Dollars (Ticker EEME)

Historically, some of the best calls this service has made over the decades have been based on commonality. One chart completing a base formation might be an anomaly. When large numbers of charts are completing base formations, it represents a theme with a sound fundamental backing.

It is not difficult to rationalise why such a large rotation is occurring away from the USA. Valuations are elevated and universal basic income has been introduced by stealth. Job creation is undershooting because half the population make more from being unemployed than working. There is no plan for how to correct that condition so companies are being forced to raise wages. To the extent that continues the steady trickle of people taking jobs, politicians will deem the outsized benefits provided to be a success. This is increasingly looking like permanently high fiscal deficits and abundant credit to pay for it. Why hold Dollars when other countries have better balance of payments and stronger currencies? Capital is both global and mobile and it flows relentlessly to the most attractive assets.

Like I said earlier this feels like déjà vu because international markets are turning to outperformance at exactly the same time that commodities are also breaking out.

The LME Metals Index is testing the upper side of a 14-year base formation.

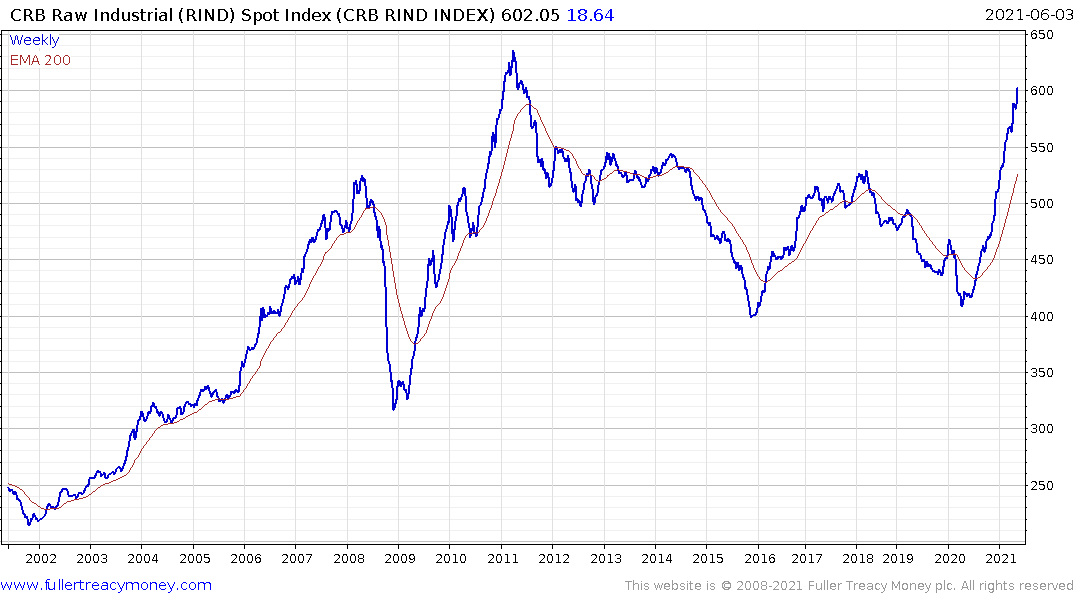

The CRB Raw Industrial Commodities Spot Index is also on the cusp of completing a long-term range.

Copper hit a new all-time high in May and is now consolidating the short-term overbought condition.

Tin is also testing its all-time high.

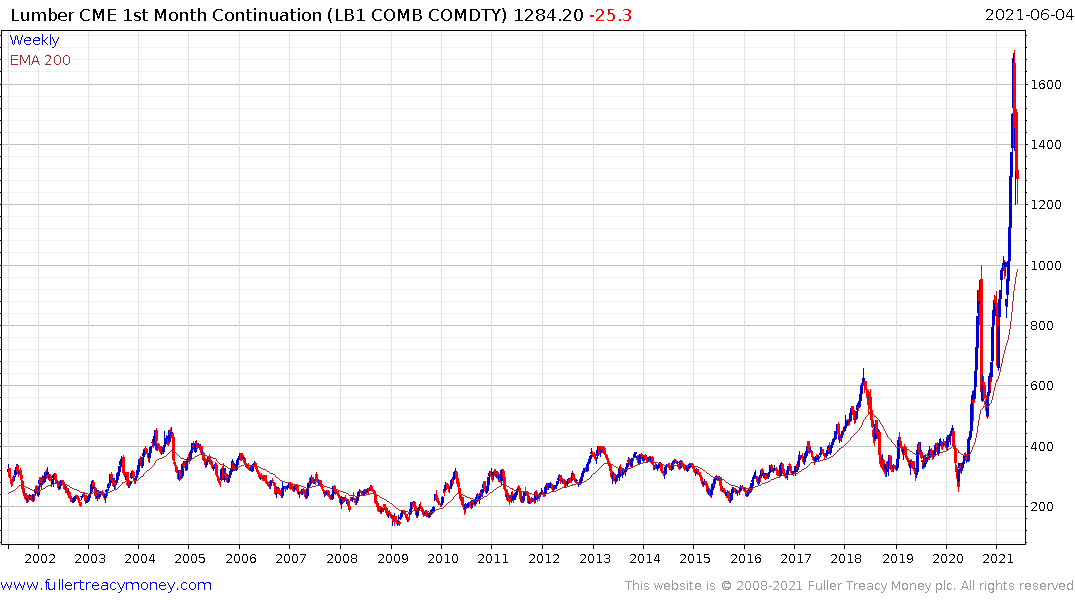

Lumber has taken a step higher reflecting a significant change in the marginal cost of production.

Soybeans continue to trend higher as they test the upper side of a 14-year range.

Arabica coffee has just completed a significant base formation.

Cotton is firming in the region of the upper side of its long base formation.

Wheat also remains on a recovery trajectory.

The Blackrock World Mining Trust remains on a steep recovery.

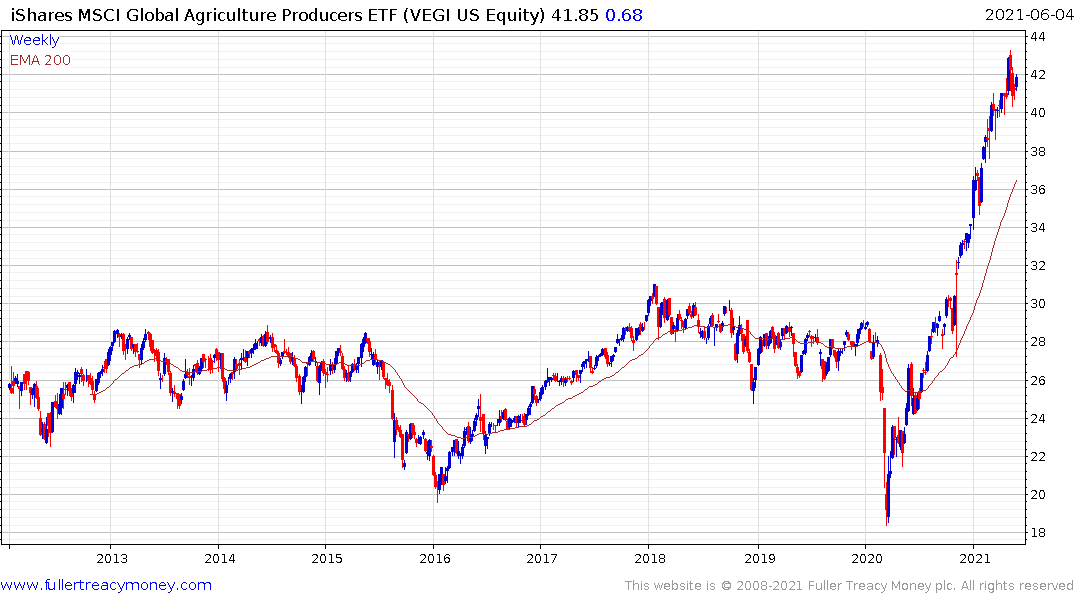

The iShares Global Agriculture Producers also continues to trend higher.

Gold broke out in 2019 and surged during the pandemic to new nominal highs. In purchasing power parity terms, it retested the 2011 peak and has been consolidating since August. It is looking increasingly likely the lows are in and a conservative estimate is we will see new all-time highs this year.

Gold is the ultimate hard asset but it thrives when the purchasing power of fiat currencies is threatened by monetary and fiscal mismanagement. That’s exactly the condition we have today so significant pullbacks can be considered buying opportunities.

Gold miners are value plays in this environment. Many of the well-established companies have all-in sustaining costs below $1000 and as a result have impressive margins on their businesses. The regulatory environment is growing increasingly hostile towards new mining operations and the rising cost of carbon credits means the marginal cost of production for all extractive industries is rising.

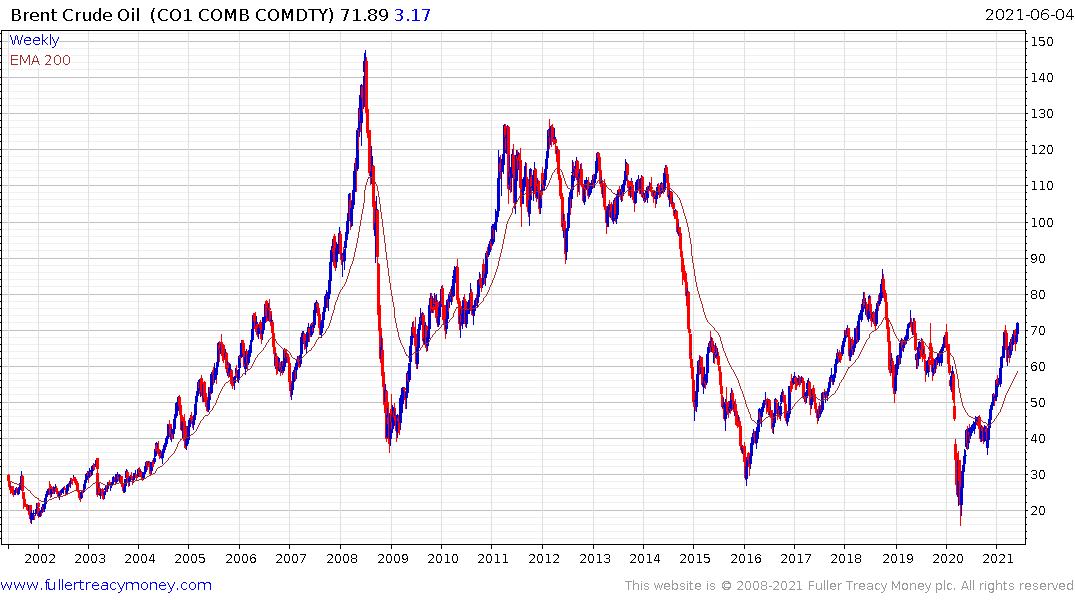

The last commodity bull market was led higher by crude oil because there was simply no way to quickly increase supply to meet rising demand. That’s not true today. After more than a decade of investment in new supply there is no mystery where oil can be found. It is only a matter of price to encourage supply into the market. Nevertheless, oil prices remain on a recovery trajectory.

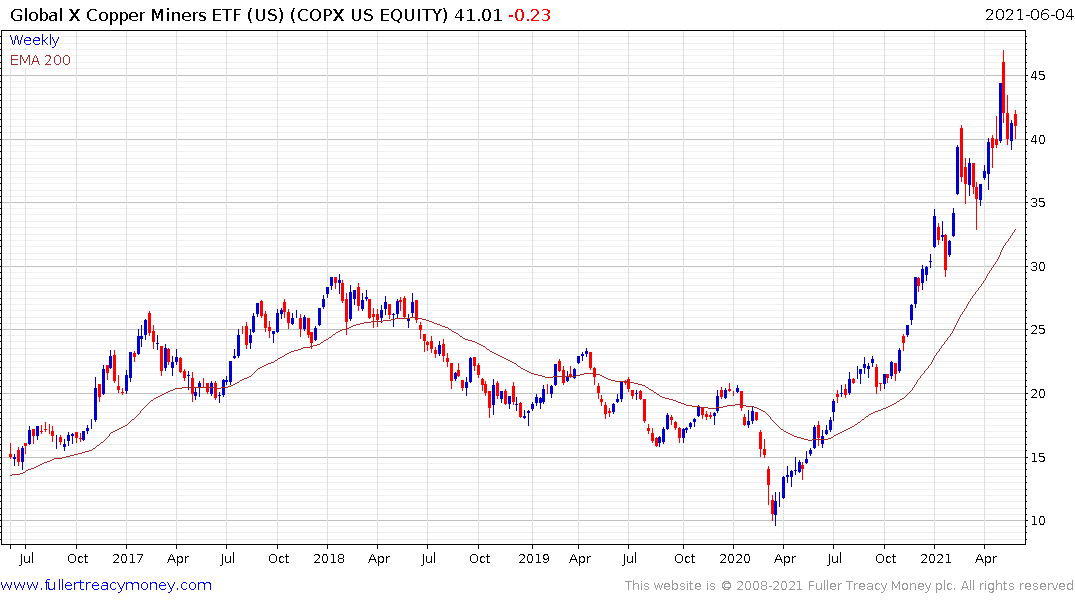

Today copper is the supply inelasticity meets rising demand bull market story. Renewable energy, motors, turbines, charging stations and industry need copper. Building new mines to meet rising demand is a very lengthy process. Commodities are volatile but as long as political tailwinds for renewable energy persist the trend will be higher.

The Copper Miners ETF also remains on an upward trajectory overall.

The Baltic Dry Index has been easing back over the last month and the big question will be in how well the breakout from the base formation holds.

The Baltic Dry Index has been easing back over the last month and the big question will be in how well the breakout from the base formation holds.

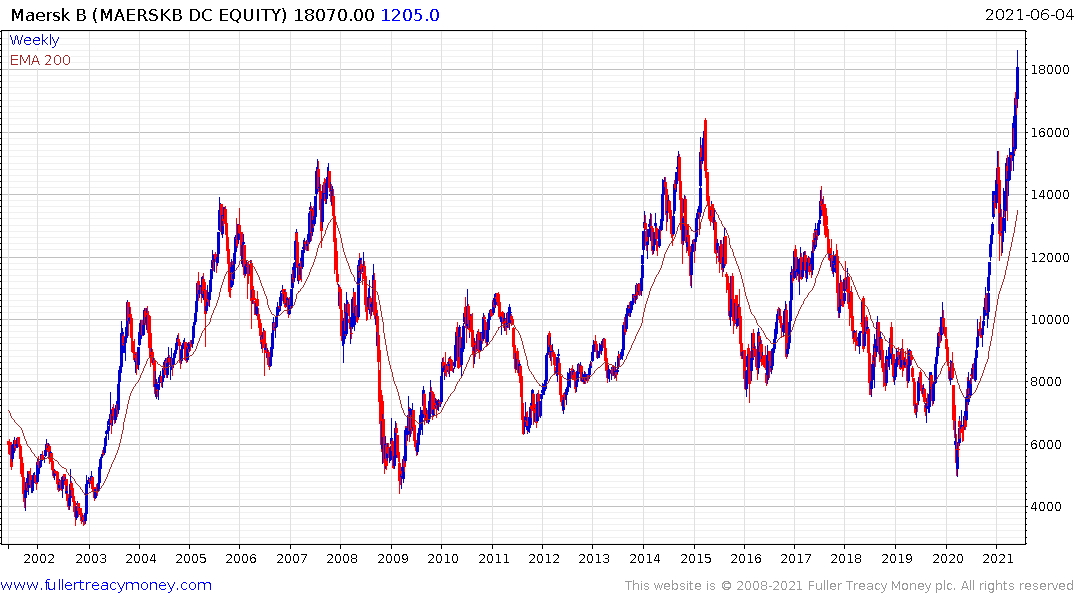

Maersk broke higher over the last month.

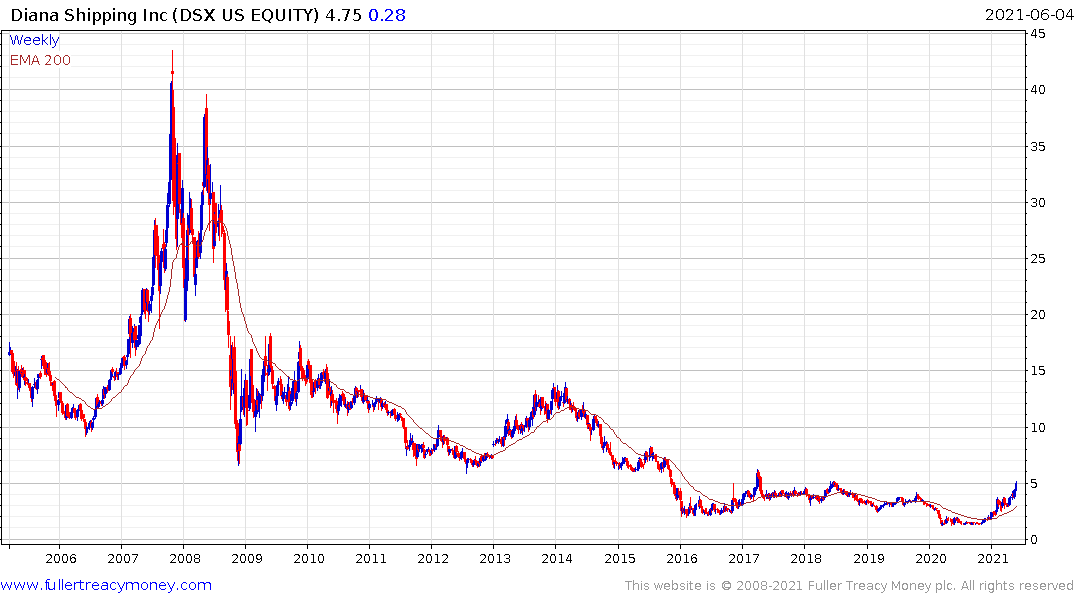

Diana Shipping rallied over the last month to retest the upper side of its base formation.

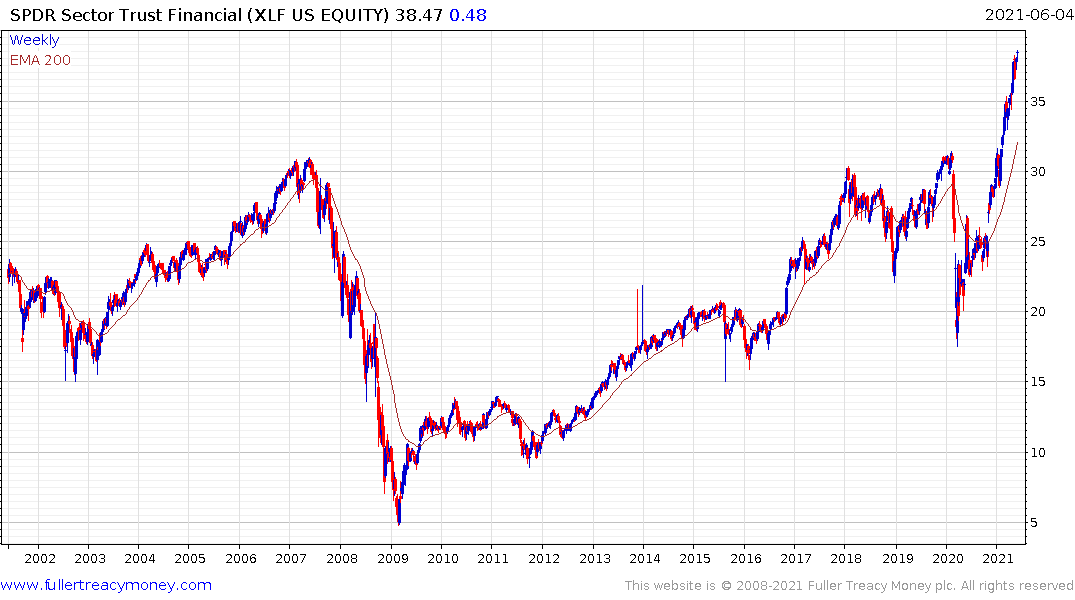

The tone of questioning this week when bankers were questioned by Congress focused on environmentalism and redistribution and less on financial risks. That represents a sign that the banking sector is no longer the villain in the eyes of consumers and politicians. That increases potential for buy backs to restart and dividends to increase. The Financial Sector SPDR continues to extend the breakout from its 14-year base formation. The tone of the Congressional interrogation was a mark of just how much the conversation has turned in favour of social justice movement.

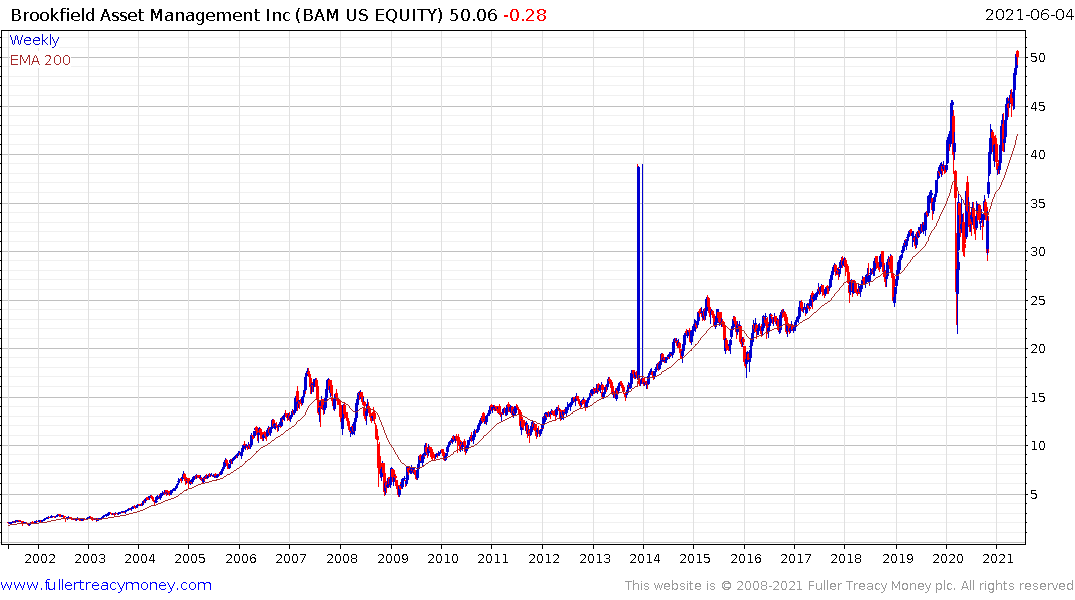

Demand for hard assets is not limited to precious metals. Many billionaires are displaying outsized interest in acquiring productive land and trophy properties. Brookfield Asset Management deploys a private equity model to acquiring income producing properties. The share remains in a clear uptrend.

If gold is the ultimate safe haven insurance policy, bitcoin is the ultimate risk asset. One of the primary lessons from the Chart Seminar is the biggest bull markets produce the most consistent trends. That has been particularly true of bitcoin, which peaked in April and remains in a corrective phase. T0he loss of consistency began in March with the failed upside break and progressed from there. At the time of writing there is no evidence the correction is over.

Countries are increasingly keen to deploy digital currencies because they would provide additional information on the velocity of money and additional avenues for money printing. The war on cash continues to escalate and the increased vigour behind efforts to create global minimum taxes will only further support the argument. That’s not good for other cryptocurrencies since governments tend to be jealous of their privilege.

The enduring challenge of Heisenberg’s Uncertainty Principle, as it applies to markets, is the less we know about a given strategy, the better it works. As popularity rises, the once uncorrelated asset becomes highly correlated. That was true of illiquid assets in 2008 and it is equally true today and particularly so for bitcoin. In other words, assets are uncorrelated because they are less well known. As soon as everyone knows they are uncorrelated that statement is no longer true.

Carbon taxes may ultimately become a challenge for bitcoin but they weigh on all emitters. That may pressure shares but be positive for commodity prices by raising production costs. They are equally a tailwind for the renewable energy sector.

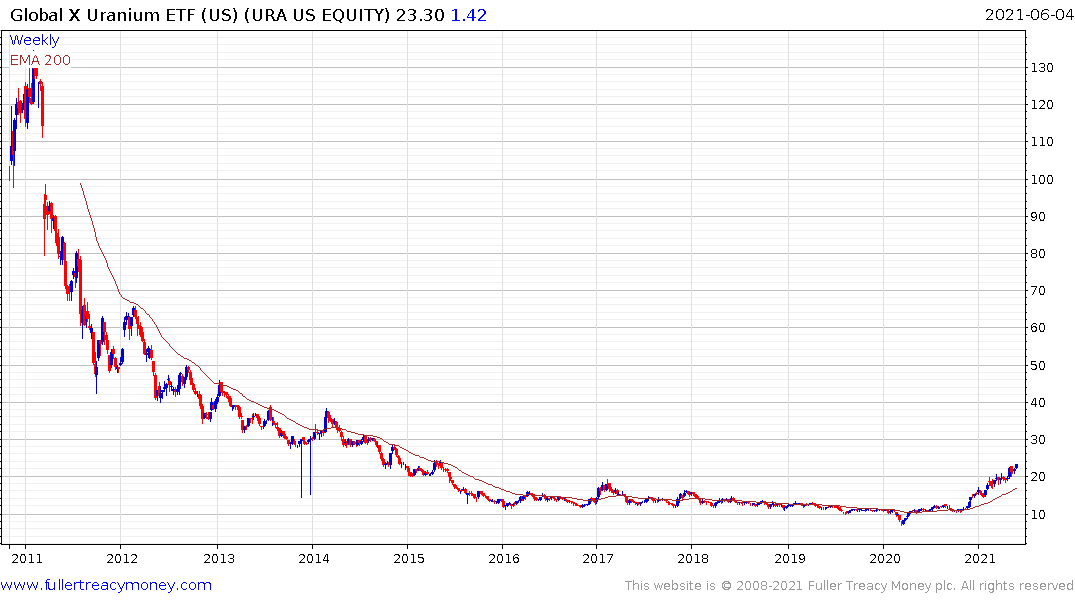

The Global X Uranium ETF remains on a recovery trajectory.

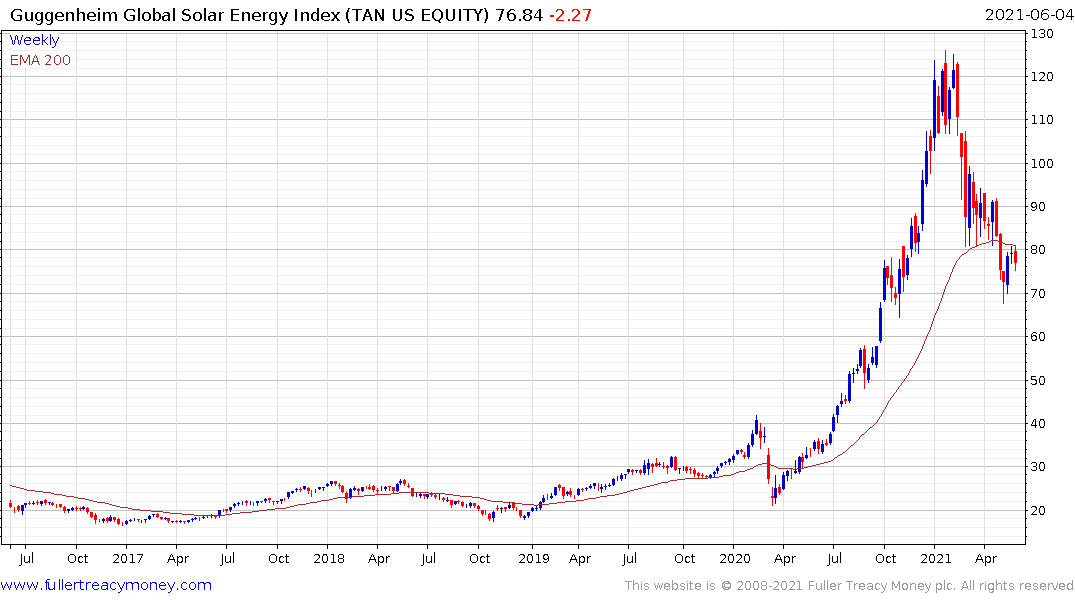

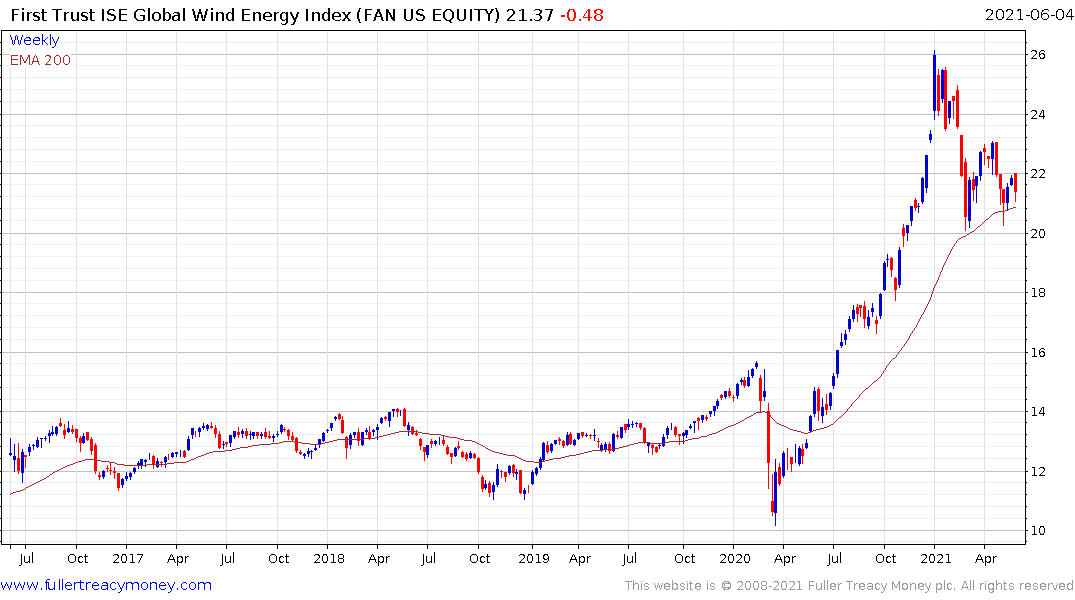

The challenge for many renewable stocks is they have adopted subscription business models where they absorb upfront costs. That means they are very interest rate sensitive. They are heavily influenced by Treasury yields as a result. That is truer of the solar sector than it is of the wind sector which accounts for the divergence in performance.

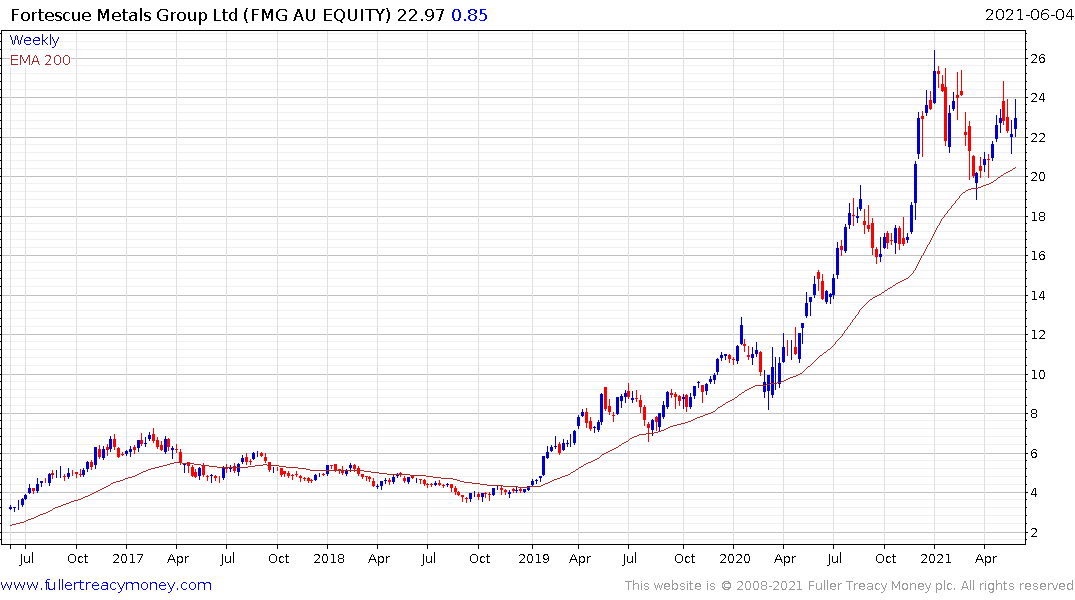

Fortescue Metals has embraced the green hydrogen theme and remains in a consistent uptrend.

The cannabis sector remains on a secular growth trajectory and the pandemic will only have bolstered the trend of licentiousness. The Alternative Harvest ETF continues to pause in the region of the trend mean.

This month I did not see the relevance of reviewing lead indicators of future recessions because none are relevant. We remain in a bull environment with extremely loose financial conditions and monetary officials appear nonplussed at the prospect of significant inflation. Bond yields are not surging higher and in fact look more likely to contract in the near term. That continues to represent a tailwind for most assets.

The big takeaways are that the trend of ex-US outperformance is growing. While most trends are still reasonably consistent there is clear evidence of hedging exposure to the USA. If the Dollar breaks down, as appears likely, that will spur a significant additional trend of migration away from Wall Street. Sometimes the secret to success is in avoiding the worst performer instead of focusing on finding the best performer.

It seems to me that wishing companies like Apple or Amazon will quickly attain market caps in the order of $2 or $3 trillion is wasted while most other global assets continue to enjoy the base effect. The FANGs were invaluable components of portfolios over the last 12 years but I doubt that will still be true over the coming decade.

If we position ourselves as the judges at an international beauty contest, the prettiest contestants are more earthy than ethereal.

Back to top