Falling oil prices and the implications for asset quality

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Our country bank analysts have studied the financing of the local energy production chain in 12 Asian markets and in this report evaluate the risks arising from sharply falling global oil prices. For the oil production countries, namely Australia, Malaysia and China, bank lending is primarily extended to the state-owned or globally established MNCs engaging in E&P (Exploration and Production), with some of them engaging in diversified energy businesses; for example, gas, that can help offset part of the losses from falling oil prices. In Australia, banks have set aside economic overlays (3-6% of the exposure) to buffer against potential risks from the worsening asset quality of the mining and energy sectors.

Impact for banks financing refinery businesses and overseas projects

While the refinery businesses of the major oil importing countries (India and Thailand) should benefit from falling global oil prices, the banks have less than 1% of loans pledged to the related industries, implying limited positive earnings impact. For Asian banks, such as Japanese banks, that have financed overseas projects, the borrowers are primarily strong companies with limited default risks.Indian, Indonesian and Chinese banks historically the best performers

Since 2006, we identified four periods of global oil prices falling by an average of 46% within six months and we observed that global equity indices have been negatively affected, with MSCI Asia-ex JP financial index underperforming the S&P Index by 2%, but outperforming the global MSCI EM index by 4.7%. The best performers were India (+19%), Indonesia (+8%) and China (+4%), while HSBC (-14.5%), Standard Chartered (-21%) and Korean banks (-16%) were the worst. This order of performance is consistent with our preference among Asian financials based on our fundamental analysis.

Here is a link to the full report.

A number of Asian markets have been subject to some quite extreme volatility over the last couple of weeks as the impact of meaningfully low oil prices have shaken the status quo.

The Indian market is a major beneficiary of lower energy prices. The Nifty has pulled back to test the 8000 level and the progression of higher reaction lows evident since February. It bounced today and a sustained move below the 200-day MA would be required to question the consistency of the medium-term uptrend.

Malaysia has experienced one of the more aggressive sell-offs and the Index has at least paused in its decline over the last two days. Potential for a reversionary rally has increased but there has been substantial damage done to the integrity of the medium-term uptrend. A period of consolidation is likely needed before one could conclude demand has returned to dominance.

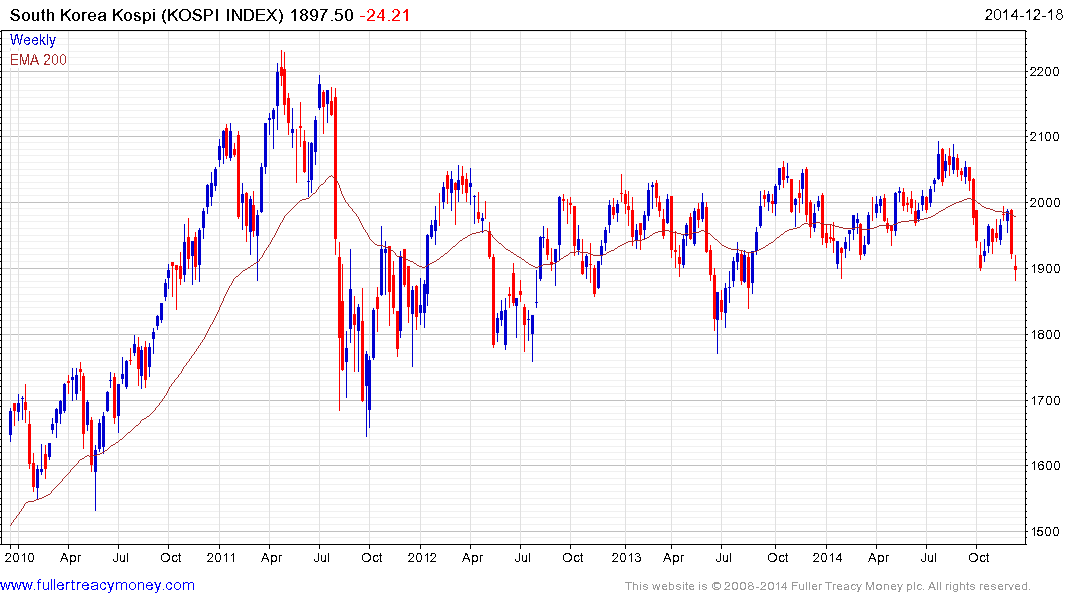

South Korea has returned to test the lower side of this year’s range and has at least paused. Considering the commonality evident across the region, potential for a bounce is increasing.

Thailand is rebounding strongly from this week’s steep decline. It is swiftly approaching the lower side of the overhead trading range and will need to hold the December 15th low on the next pullback to demonstrate a return to demand dominance beyond short covering.