Brazil Takes Steps to Transact in Yuan as China Ties Grow

This article from Bloomberg may be of interest to subscribers. Here is a section:

The announcement came during a Brazil-China business forum in Beijing on Wednesday in which government officials and company executives from both sides discussed trade and investment opportunities. Much of Brazil’s agricultural and mineral products are shipped to the Asian nation.

Brazilian President Luiz Inacio Lula da Silva was due to be in China for an official state visit this week, but was forced to postpone after he was hospitalized with pneumonia.

China and Brazil also agreed to settle trade in their own currencies, without the need of an intermediary currency like the US dollar, according to a statement from the Brazilian Trade and Investment Promotion Agency. The expectation is to reduce the costs of commercial transactions with the direct exchange between Brazilian reais and yuan.

Tatiana Rosito, Brazil’s Secretary of International Affairs at the Finance Ministry, says the goal is to boost liquidity of the Chinese currency, giving options to investors and traders.

“It’s not a game changer in relation to the impact on short-term trade, but it has the potential to expand transactions and familiarize agents” with transactions in yuan, she said in a telephone interview.

The entire global financial sector is built on trust. It is logical for countries trading with one another to accept their respective currencies in exchange for goods and services. The reason it is not commonplace is because currencies are volatile and bilateral relationships have no fallback if one of the party’s proves unreliable.

The SWIFT system has been the default fall back in the post-World War II era. Even when North Korea banks were banned from using it, the process was deliberative and grounded in ensuring confidence in the system.

Shutting Russia out of SWIFT and deploying financial weapons as a means of damaging the economy forced everyone to consider what would happen to them if they fall out of the USA’s good graces. Russia and Iran have signed bilateral trade arrangements but no one pays that much attention. Brazil accepting Renminbi for its metal, agriculture and energy exports is a more momentous event.

China is doing everything it can to be a reliable trade partner. That includes refusing to oversupply currency in response to the pandemic, casting the crusade against domestic big tech as antitrust and ensuring the country’s bonds are well underpinned.

The big looming question is whether Saudi Arabia will choose to accept Renminbi for its oil. Afterall China is it is biggest customer. The looming recomposition of the Brent Crude benchmark to include West Texas Intermediate supplies is a potential wrinkle in that plan. It provides the USA with greater control over the global oil benchmark. How significant that is remains to be seen.

The Dollar Index tends to move in a close to seven-year cycles with pauses at the major turning points.

Down

1969 to 1978 – 9 years

1985 to 1992 – 7 years

1991/2 to 1998 – 7ish years

Up

1978 to 1985 – 7 years.

1995 to 1991/2 – 7ish years after a three-year interval of ranging.

2014 to late 2022 – 8 years after a five-year interval of ranging.

If the secular trend is lower until 2030 that brings several long-term concerns highly relevant. The first is the inadequacy of the USA’s discussion about fiscal concerns. There are simply too many untouchable topics of conversation in the budget. That makes closing the deficit a major headache. Health care and pensions spending is going to increase markedly over the next decade and there is no plan for how to pay for it.

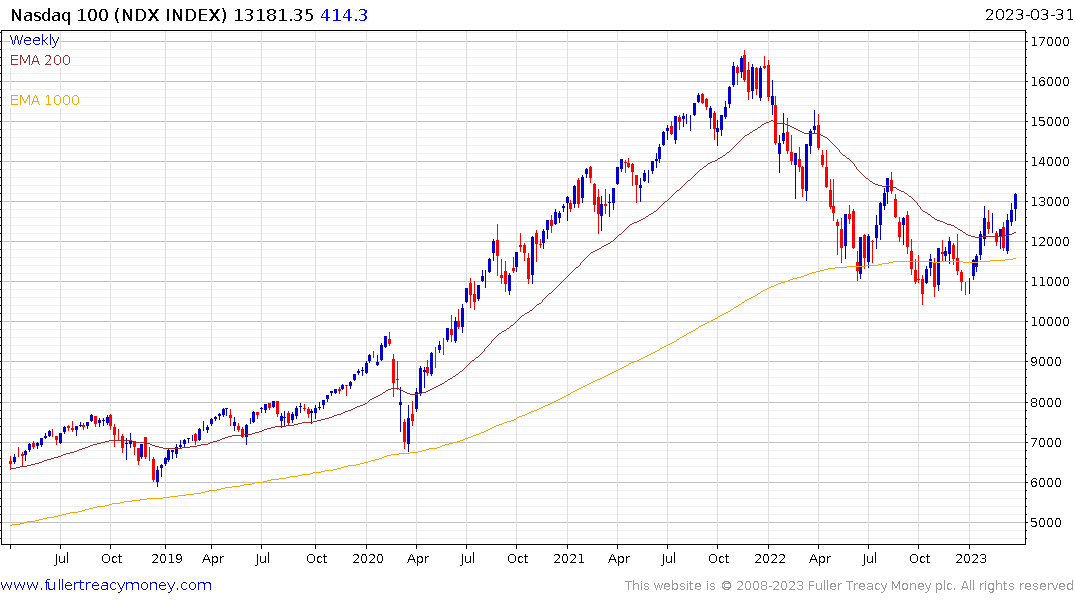

The unfolding debt issues in the banking sector are a reflection of the stress the system is coming under as a result of the current hiking cycle. The stock market is rebounding at present because traders have concluded the financial sector pressure is now high enough to force the Fed to relent. With inflation still way above trend, that’s bad news for the Dollar because of the risk of inflation staying at an elevated level for a prolonged period.

The big counter argument at present is the Federal Reserve’s interest rate hiking policy is as much about supporting the Dollar as it is about getting on top of inflation. The US needs to a stable currency if it is going to encourage foreigners to fund the deficit by buying Treasury bonds.

The Dollar’s cycle argues against that point. The more likely scenario is the Dollar trends lower. That suggest bonds yield compression will be limited to a reversion towards the 1000-day MA and the export sector will thrive in the stock market.

US 10-year yields are rolling over at present so that is also implying the threat of deflation is beginning to our weigh inflation. I remain of the view a recession is more likely than not and the greatest risk of a stock market drawdown occurs when the yield curve trends higher into positive territory following an inversion.

While gold is pausing at present, the medium-term outlook is for significantly higher levels in the event the Dollar trends lower.