Zinc turning bull?

This article by Kip Keen for Bloomberg may be of interest to subscribers. Here is a section:

She responds, “Glencore’s cuts do matter.”

To give perspective, she puts the zinc cut in copper terms. “Another way I have been explaining the impact of these cuts is that if this were announced in the copper market, it would be equivalent to 1 million tonnes of mine supply, which would be a very big cut from a copper miner.”

So, with a sizeable cut to zinc output in mind, Fung now forecasts a market that looks set to get tight – finally some might add.

“We were forecasting a 74kt surplus next year (pre-Glencore cuts) assuming 2.8% demand growth,” she writes in an email. “If we assume zero growth, it’s about 400kt that we remove from the demand side of the equation. But Glencore’s cuts more than offset this assumption, so at worst (assuming zero-growth is worst case) we still have a tight market next year, which should be positive for prices, given how far they’ve fallen in response to demand concerns this year.”

Already near-delivery prices have jumped from the mid-70 cent range to over 80 cents.

There has been a lot of loose talk about the inevitability of a deflationary outcome which the falling price of oil has contributed to. However we have been at pains to point out in the audio commentaries that there is the world of difference between deflation and disinflation. After all commodity prices went up a lot and have subsequently come done a lot not least due to supply factors.

Demand growth has disappointed the overly ambitious forecasts of the last decade but that does not mean demand is now contracting. The global population continues to expand and rising standards of living in major population centres mean the demand trend is likely to remain positive. Commodity prices are much more heavily influenced by supply which is why Glencore’s decision to curtail zinc production is meaningful.

The LME Metals Index has found at least near-term support in the region of 2350 and a mean reversionary rally is underway. It will need to sustain a move above the 200-day MA and find support above the recent lows on a pullback to signal a return to demand dominance beyond the short term.

Among the individual commodities nickel is bouncing from the psychological $10,000 level which was also an area of support in 2008.

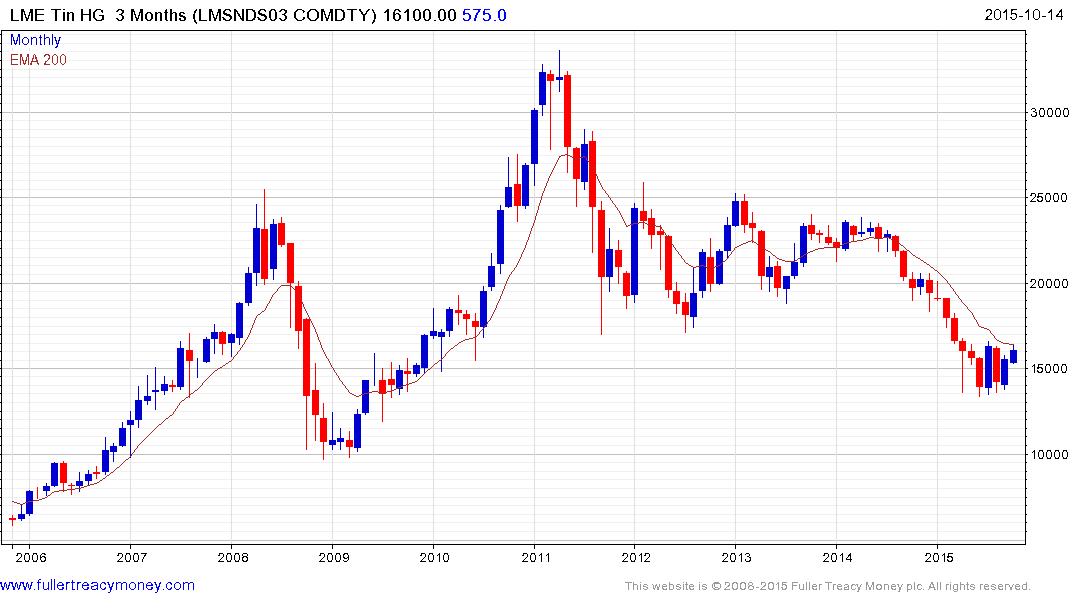

Tin has now completed a reversion to the mean and a sustained move above $16,500 would represent base formation completion.

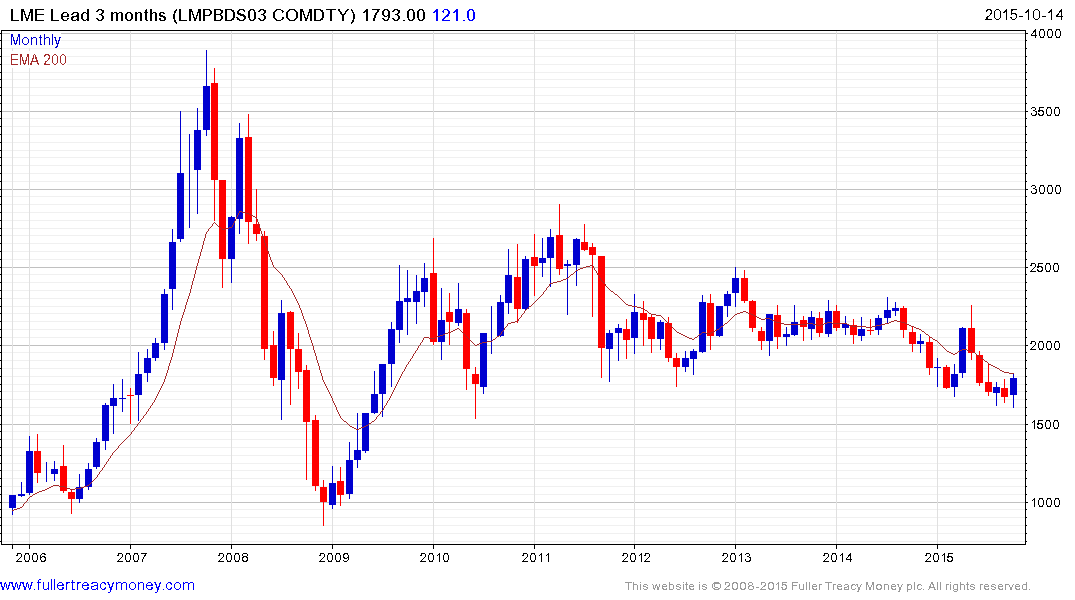

Lead posted a large upward weekly key reversal last week and has improved on that performance somewhat this week.

Low energy prices have taken encouraged aluminium production but it posted an upside weekly key reversal in late August and found support above $1500 last week. A sustained move below that level would be required to question potential for an additional reversionary rally.

Zinc has accelerated lower to test the psychological $1500 level and bounced on the Glencore news to break the five-month progression of lower rally highs. There is room for some consolidation but a sustained move below $1700 would be required to question the change of trend.

.png)

Copper has held a progression of lower rally highs since its 2011 peak but found near-term support in late August and rallied from above that low last week. A reversionary rally remains in evidence but a sustained move above the trend mean will be required to break the medium-term downtrend.

In the above charts I’ve used 10-year timeframes to illustrate just how long prices have been falling.

A number of these declines are looking mature following lengthy bear markets and while it is not yet clear that demand has returned to medium-term dominance, this is not the time to becoming more bearish.

The FTSE 350 Mining Index bounced three weeks ago from the region of its 2008 low and a reversionary rally remains in evidence. This is a natural area one might expect steadying and it will need to hold the low on the first significant pullback to demonstrate support coming back in at progressively higher levels.

The relative weakness of the mining and energy sectors has acted as a headwind for the FTSE-100 but the four largest miners now represent less than 5% of the Index. It bounced today from the region of the upper side of its short-term range and a sustained move below 6200 would be required to question medium-term scope for continued upside.