Zinc, nickel prices to move dramatically higher

This article by Dorothy Kosich for Mineweb may be of interest to subscribers. Here is a section:

“Firmer potash and sulphur prices and the beginning of a recovery in uranium also contributed to the gain,” she noted. “Spot uranium prices have increased to US$31 per pound in late August alongside stepped-up Chinese buying, after bottoming at a mere US$28 in June.

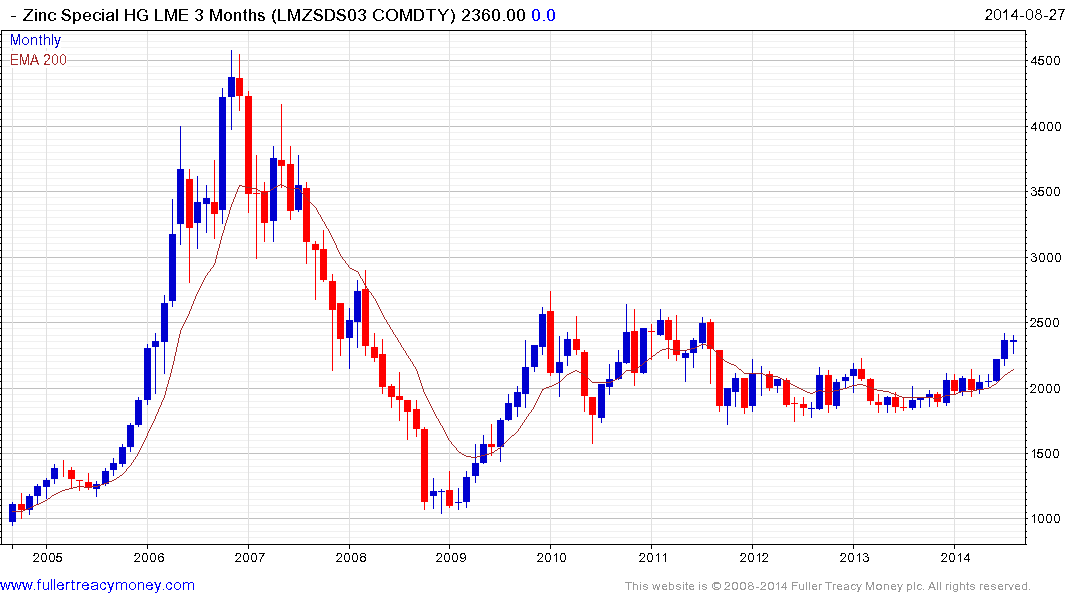

Meanwhile, Mohr observed that the base metals rally in July was led by zinc with prices remaining firm at US$1.07 in late August, which is normally a time of summer doldrums. “Commodity funds and investors have bid up zinc prices, anticipating tightening supplies over the next three-four years—with mine supplies not keeping the pace with demand growth,” she said.

The sharp pullbacks currently underway among the major iron-ore miners tend to obscure the fact that the Continuous Commodity Index found support this week in the region of the psychological 500 area. Additional upside follow through next week would suggest at least a reversionary rally back up towards the MA is underway.

Zinc is rallying towards the upper side of an almost five-year range.

Nickel has been consolidating this year’s earlier advance in what has been a relatively gradual process of mean reversion.

Aluminium continues to extend its three-month rally which has seen it break a three-year progression of lower rally highs.

While not represented in the majority of commodity indices uranium is also worthy of mention. It continues to extend its rebound and rallied yesterday to push back above the 200-day MA for the first time since 2011.

Against this background, stock picking in the resources sector, with a focus on companies that have exposure to particular metals is likely to be more productive than focusing on the mega-caps which are heavily exposed to the weak iron-ore price environment.

Canada listed Lundin Mining has pulled back to test the region of the 200-day MA where it will need to find support if the medium-term progression of higher reaction lows is to remain intact.

Sherritt International continues to steady in the region of the 200-day MA.

Australia listed Western Areas has paused following its powerful advance from late last year but a sustained move below the 200-day MA would be required to question medium-term recovery potential.

Back to top