Zinc, Lead, Tin Reach Highest Since 2015 on China Factory Data

This article by Joe Deaux and Agnieszka de Sousa for Bloomberg may be of interest to subscribers. Here is a section:

Zinc, lead and tin climbed to the highest in more than a year after China’s official factory gauge unexpectedly rose last month, signaling improved demand from the world’s top metal user.

The manufacturing purchasing managers index rose to 50.4 in August, near a two-year high, the statistics bureau said Thursday, up from July’s 49.9 and compared with the 49.8 median estimate of economists surveyed by Bloomberg. The pickup strengthens the case that China’s economic stabilization remains intact even as credit growth slows and the central bank refrains from cutting interest rates. Copper was little changed in New York as traders assessed the prospect of strikes at two mines in Chile, the biggest copper-producing nation.

“Metals largely post gains as elements of Chinese manufacturing data display some improvement,” Michael Turek, the head of base metals at BGC Partners Inc. in New York, said in an e-mail. “Continuing Chilean labor unrest could become more pertinent for copper.”

Positive factory output figures from China represent a welcome development for the industrial resources sector which has been plagued by fears that the Chinese economy is in serious decline. Perhaps better economic data is a reflection of the fact that continued government support in the form of loose monetary and fiscal stimulus are having the desired effect on demand.

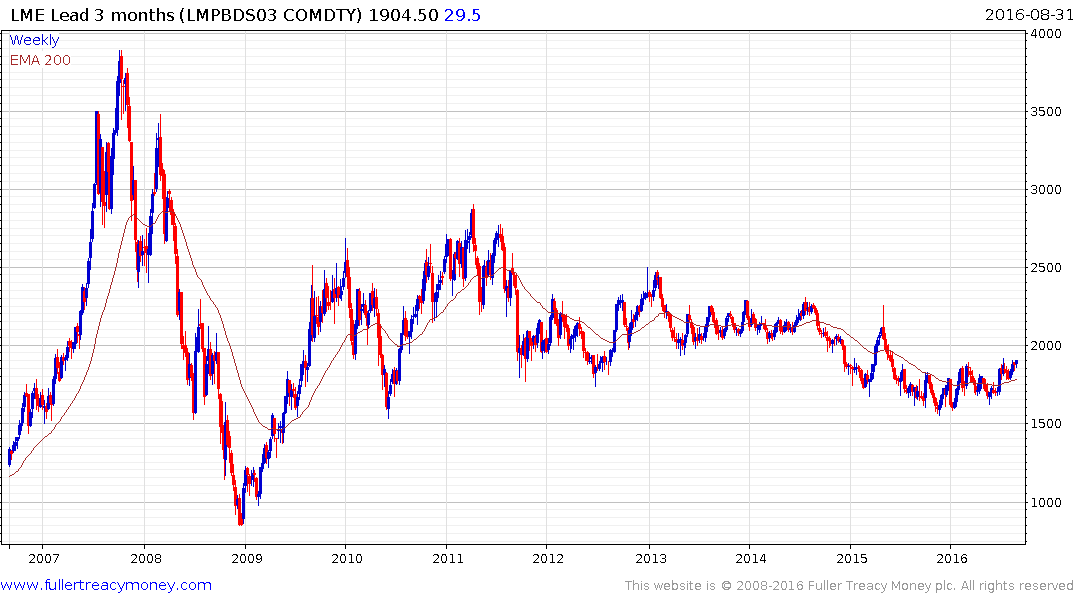

Lead moved to a new closing high today and exhibits an overall rounding characteristic consistent with accumulation.

Zinc has been rallying persistently since early this year and is now approaching the psychological $2400 level which has been area of resistance since 2010. A break in the progression of higher reaction lows would signal more than temporary resistance in this area.

Tin broke a two-year downtrend earlier this year, found support in the region of the trend mean from May and continues to extend its rebound.

Teck Resources has been rallying consistently higher since early this year and a break in the progression of higher reaction lows would be required to question momentum.

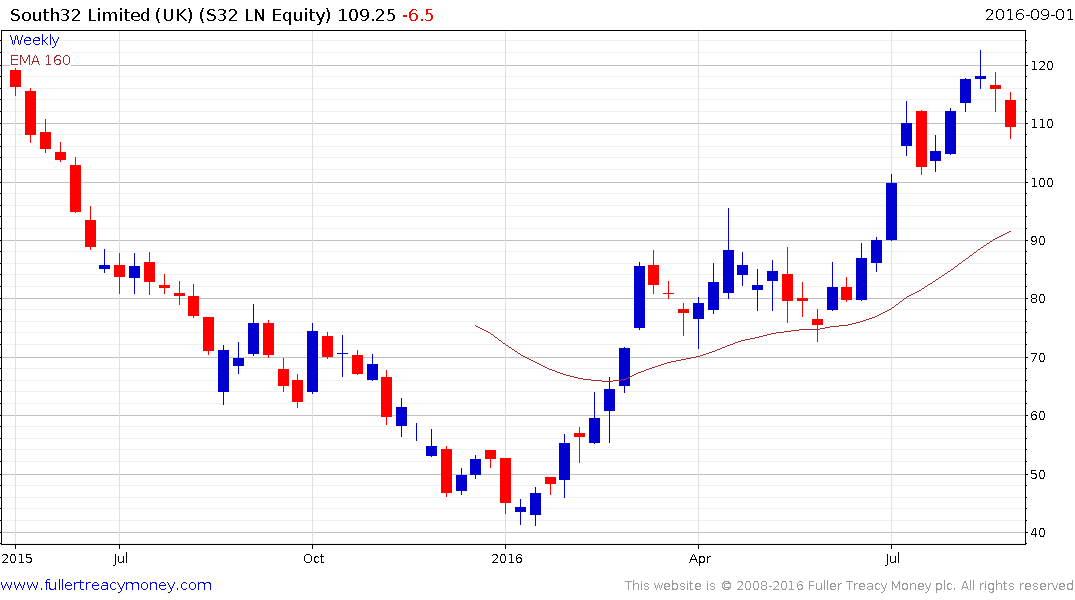

South32 has also been rallying since early this year and a sustained move below 100p would be required to question medium-term uptrend consistency.

Boliden is now unwinding a short-term oversold condition having encountered resistance near SEK200. A sustained move below the trend mean would be required to question the medium-term upward bias.