Yuan Surges Most in a Year as Fed Eases Capital Outflows Concern

This article from Bloomberg news may be of interest to subscribers. Here is a section:

China’s capital outflows concern may be tempered after the Fed’s comments, and the PBOC will likely become more flexible as worries about a weaker yuan ease, Tommy Xie, a Singapore-based economist at Oversea-Chinese Banking Corp., said in an interview.

China is in talks with the International Monetary Fund to include the yuan in the institution’s basket of reserve currencies, PBOC Deputy Governor Yi Gang said in Beijing on March 12. The currency will decline 0.22 percent the rest of this year to 6.21 a dollar at the end of 2015, according to the median estimate in a Bloomberg survey.

“The fundamentals are still bullish for the yuan with the government’s plan to make it a reserve currency,” said Scotiabank’s Tihanyi. The PBOC fixings also send a “strong signal” that the authorities favor a stable currency, he said.

The Renminbi can be viewed from a number of different perspectives. For some it represents how much of an advantage China has gained from devaluing its currency more than twenty years ago. For others it represents the challenges experienced by manufacturers as its value has increased over the last decade. For still others its stability is a totem for the increasingly vital role China plays in the global economy.

The Chinese authorities have made clear they want to make the Renminbi as international as possible. Opening up the financial markets, encouraging competition, insisting on the currency being used as a medium of international trade and other measures are all designed to achieve this goal. As the largest energy importer, the benefit of sourcing supply denominated in one’s domestic currency is obvious but for that goal to be reached the currency will have to be globally fungible which is not the case just yet.

This week’s strengthening of the Renminbi suggests that while the CNY6 area probably represents a medium-term peak, the weakening that has been evident over the last year is likely to remain a measured process.

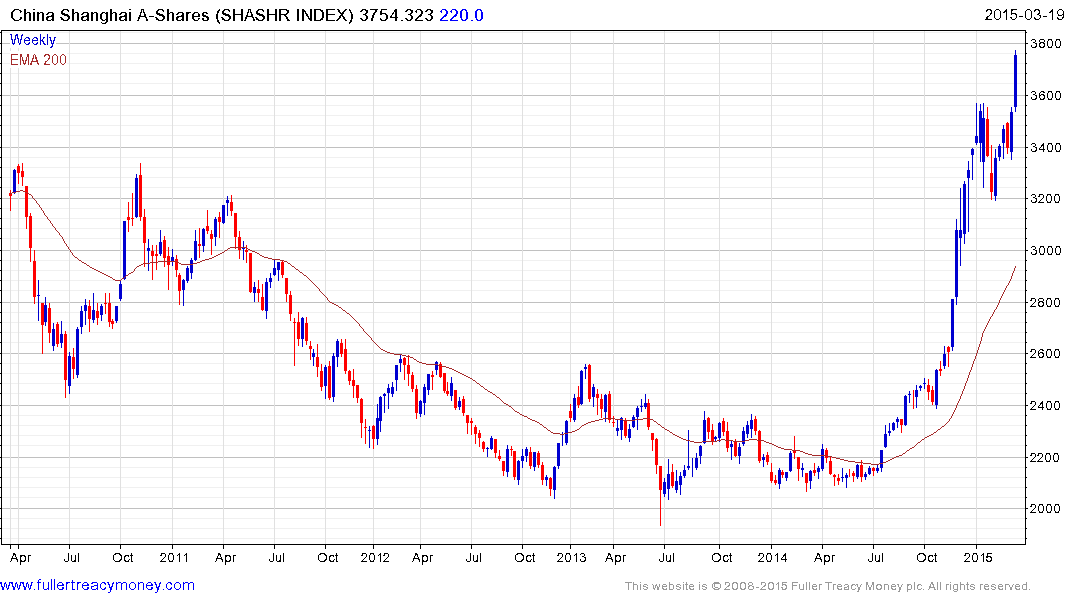

Against a global background where currency volatility has increased substantially the relative stability of the Chinese currency represents a tailwind for the domestic stock market which continues to extend the breakout from its two-month range.

Back to top