Yuan Pares Record Rally as Goldman Says Now's the Time to Sell

This article from Bloomberg News may be of interest to subscribers. Here is a section:

The offshore yuan is sinking because there is some recovery in the dollar, perhaps the unwinding of short-yuan positions has mostly been done, and it’s closing the gap with the onshore currency,” said Roy Teo, senior currency strategist at ABN Amro Bank NV in Singapore. The yuan is likely to weaken this year as capital outflows continue and the U.S.

Federal Reserve increases interest rates, Teo said.China’s central bank raised its daily reference rate by 0.92 percent to 6.8668 per dollar on Friday, following a 1 percent drop in a gauge of the greenback’s strength overnight.

The offshore yuan was trading 0.8 percent weaker at 6.8457 per dollar as of 5:23 p.m. in Hong Kong, paring its weekly gain to 1.9 percent, the most in data going back to 2010. The onshore rate slumped 0.6 percent. Friday’s fixing was weaker than Mizuho Bank Ltd.’s prediction of 6.8447 and Australia & New Zealand Banking Group Ltd.’s estimate of 6.8456.

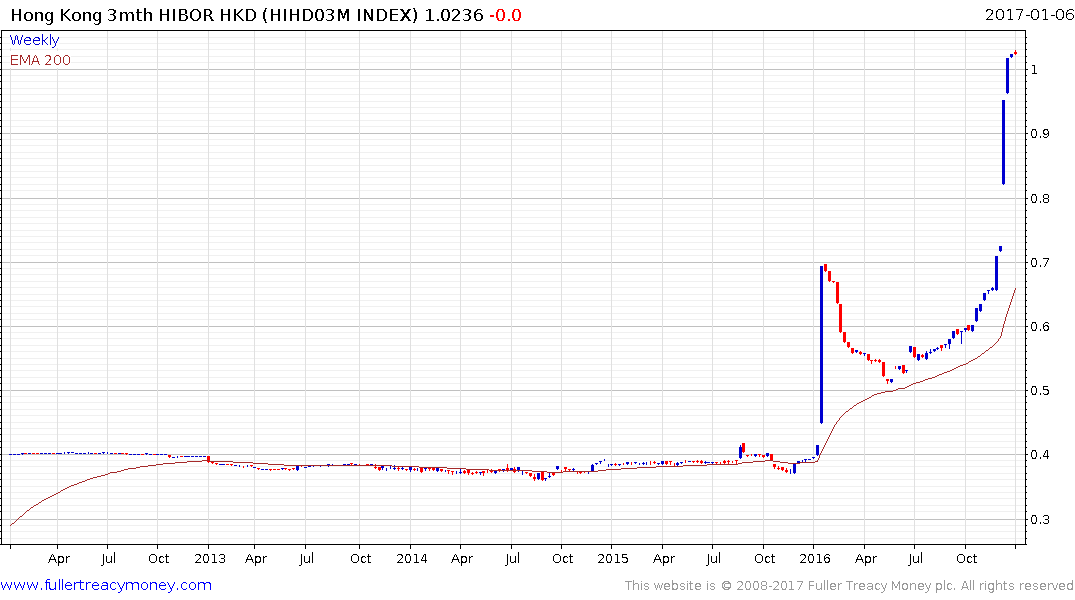

The three-month yuan interbank rate in Hong Kong, known as Hibor, surged to a record high, while the overnight rate jumped 23 percentage points to 61 percent, the highest since last January’s cash crunch. Rising interbank rates can make some short positions prohibitively expensive.

The Chinese administration has attempted to squeeze short sellers in much the same way it did a year ago when it believed perceptions of the Yuan as a one way bet were too prevalent. That does not mean the Chinese don’t want, or perhaps more importantly need, a weaker currency. They do but they want it to weaken in a measured manner.

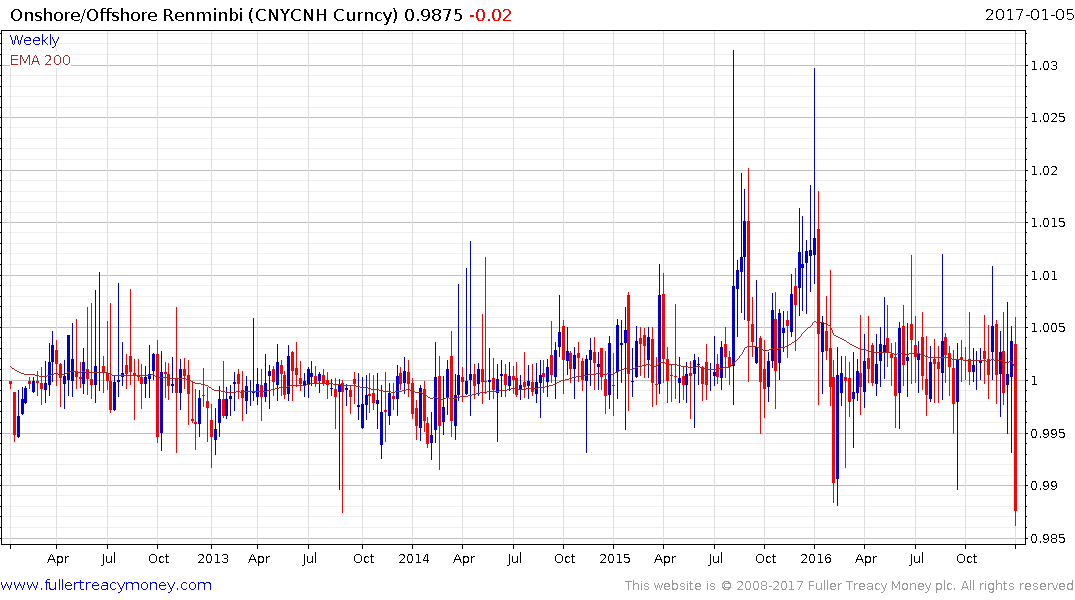

The Offshore/Onshore Cross rate is currently testing the lower side of the trading band which has prevailed since 2011 but will need to sustain a move back above CNH99 to confirm support in this area. Considering the lesson traders learnt from the experience last year they will probably see this strengthening of the Yuan as an opportune time to reopen shorts. If the Chinese administration wishes to re-educate them it will need to step in with more aggressive action. However since it does not want a strong currency, merely a slower rate of decline, there is a value proposition in how much it is willing to spend to support the Yuan beyond the short term.

3-month HIBOR short up last January on the first attempt to chasten short sellers. The coincidence of a Fed rate hike shortly before that event will not be lost on investors just as the Fed’s move late last year put additional upward pressure on Hong Kong interbank rates. With a pegged currency Fed rates hikes will be passed on to Hong Kong borrowers in a matter of fact manner. That has the potential to create a shortage of Dollars as investors attempt to capture the enhanced yield on offer which is why HIBOR is a useful tool for Chinese government actions to pressure short sellers.

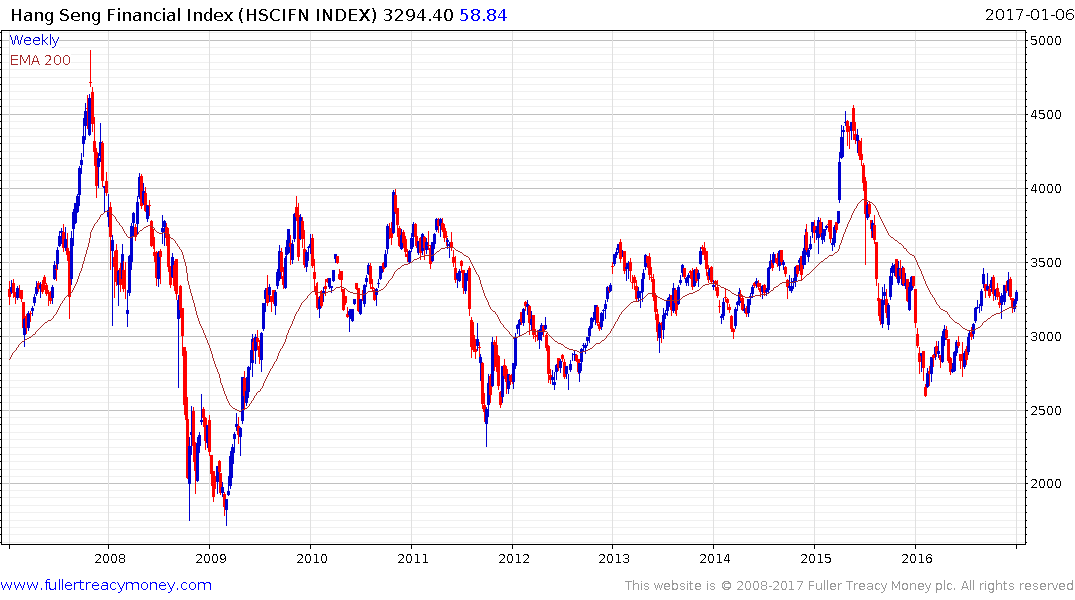

ICBC (12.3%), China Construction Bank (12.28%), HSBC (8.9%), Agriculture Bank (7.9%) and Bank of China (7.7%) are the five largest banks listed on the Hang Seng Financials Index by market cap. The Index has been confined to a long volatile range since 2008 but is currently bouncing from the lower boundary in line with a return to outperformance of global banking sectors. It found support in the region of the trend mean last week and improved on that performance this week. A sustained move below 3200 would be required to question medium-term potential for additional higher to lateral ranging.

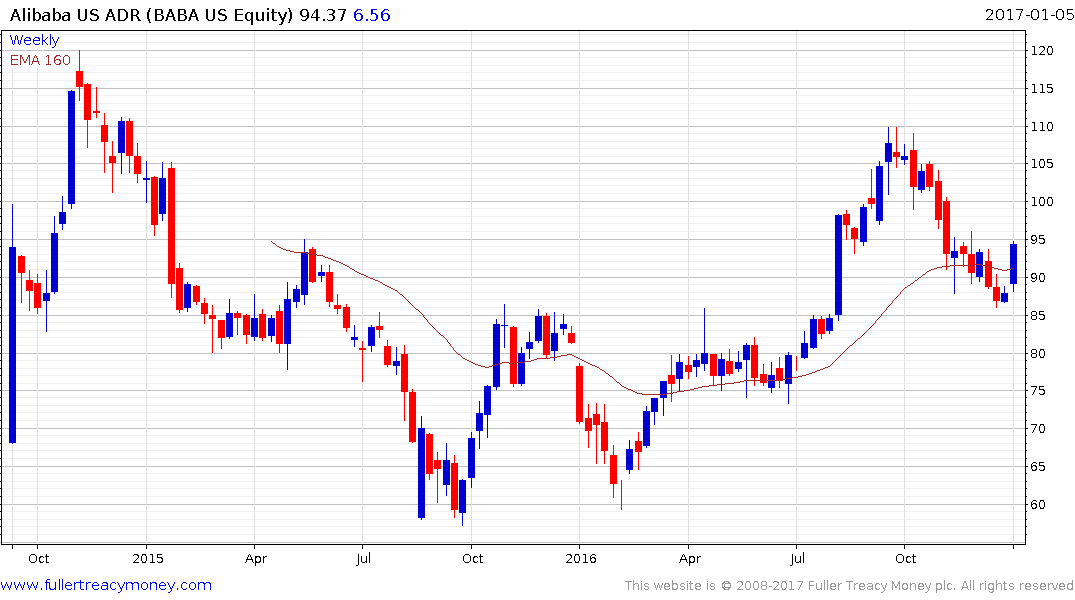

Elsewhere in the new economy portion of the Chinese market both Alibaba and Tencent Holdings are worthy of mention. They both bounced from the region of their respective trend means this week.

Baidu which has been confined to a triangular trading pattern since 2015 is currently bouncing from the lower boundary and continues to hold a progression of higher reaction lows.

The clear bounce in major Chinese shares highlights the fact that China is a big country with a lot of moving parts and it seldom pays to draw black and white conclusions based on for example the performance of the currency.

Back to top