Your money market fund has changed

This article by Darla Mercado for CNBC may be of interest to subscribers. Here is a section:

All of that changed in September 2008, when Lehman Brothers filed for bankruptcy. The Reserve Primary Fund, a large money market fund, held Lehman bonds.

In turn, institutional investors pulled billions of dollars from the fund, knocking its share price from the supposedly steady $1 to 97 cents on Sept. 16, 2008. It had "broken the buck."

That crisis spurred new rules from the SEC, aimed at protecting smaller investors from large redemptions.

Two key reforms came about: One would require so-called prime institutional money market funds (generally used by large investors) to have a floating net asset value rather than a fixed $1 share price.

The other creates liquidity fees and "redemption gates," which are temporary halts on withdrawals to certain money market funds.

Highlighting the clear difference in risk between government and corporate commercial paper is at the root of these changes to the structure of money market funds. That is likely to be a net positive overall but it represents a change to the status quo and therefore an uncertainty.

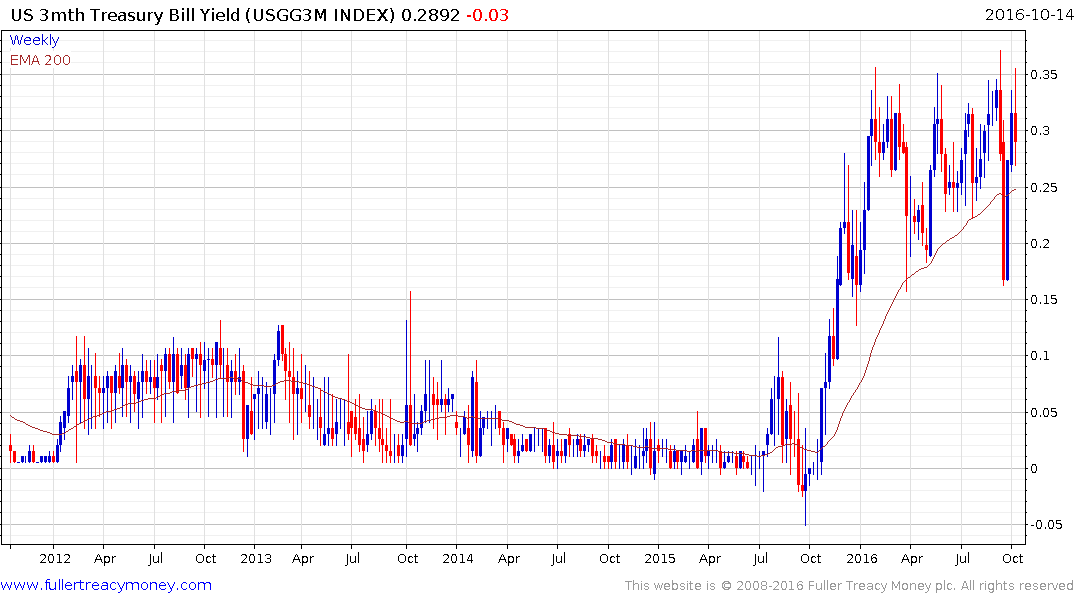

US 3-month yields have been subject to quite acute volatility over the last month; ranging between just above 15 and 35 basis points. At an absolute level of 29 basis points, the rate is not pricing in a rate hike this year. However, with increased demand for the security of government paper because of this change it is questionable how much yields will rally until there is a clear signal rates are going to rise imminently.

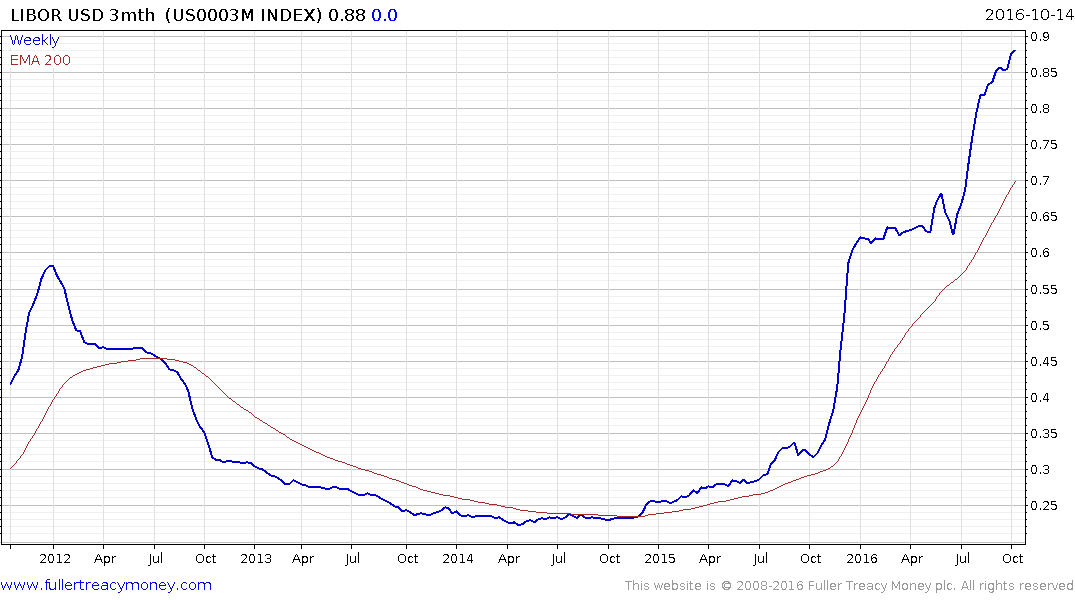

At the other end of the spectrum LIBOR rates have been pricing in the additional risk investors take on by investing in short-term corporate paper when the potential for a bailout has been removed. The 3-month rate remains on an upward trajectory and it is worth remembering that a great deal of debt from commercial paper to ARM mortgages are tied to LIBOR rates so this advance is likely to have repercussions.