Yen Drop to 1998 Low Plausible as Abe Goes to Polls

This article by Kevin Buckland, Rachel Evans and Liz Capo McCormick for Bloomberg may be of interest to subscribers. Here is a section:

Strategists are seeing more weakness in the yen on bets Prime Minister Shinzo Abe will do whatever it takes to haul the economy out of recession after government and Bank of Japan stimulus sent the currency down 14 percent since June.

“Once you start to push on the dam, there’s enough pressure and it starts to break, you can create these explosive moves in terms of the water cascading lower,” Sebastien Galy, a senior currency strategist at SocGen in New York, said yesterday by phone. “It can get uncontrolled and some of the moves that we’ve seen in the yen don’t seem to be normal moves in the sense that they’re very aggressive.”Abe’s call this week for a snap election fed into the growing bearish sentiment for the yen, as did his decision to delay a sales tax increase needed to rein in the world’s biggest debt burden. The yen already tumbled 27 percent since he took office in December 2012, fueled by government largess, a determination to help exporters, and central bank bond-buying that’s driven inflation above sovereign yields.

The sales tax hike that has just been delayed was originally designed to bolster government finances amid a concerted attempt to initiate asset price inflation. Postponing it a short-term tailwind for the economy, but removes an argument for Yen strength by putting Japan’s high debt to GDP ratio back on the radar of international traders.

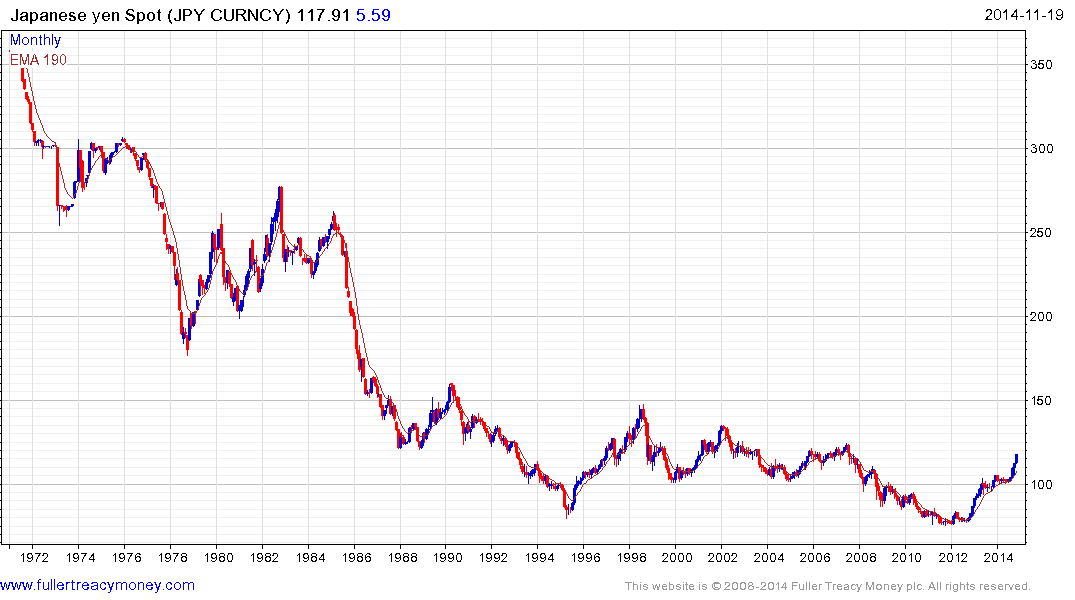

The 1998 low was near ¥150 to the Dollar. Considering the 20-year downtrend has been broken, that does not look like an overly ambitious medium-term target. We will nevertheless be guided by the price action. The Dollar has surged higher over the last four weeks and is closing in on the psychological ¥120 level. Some consolidation in that area is a possibility but a clear downward dynamic, similar to that posted at the early 2013 peak, would be required to check momentum beyond a brief pause.

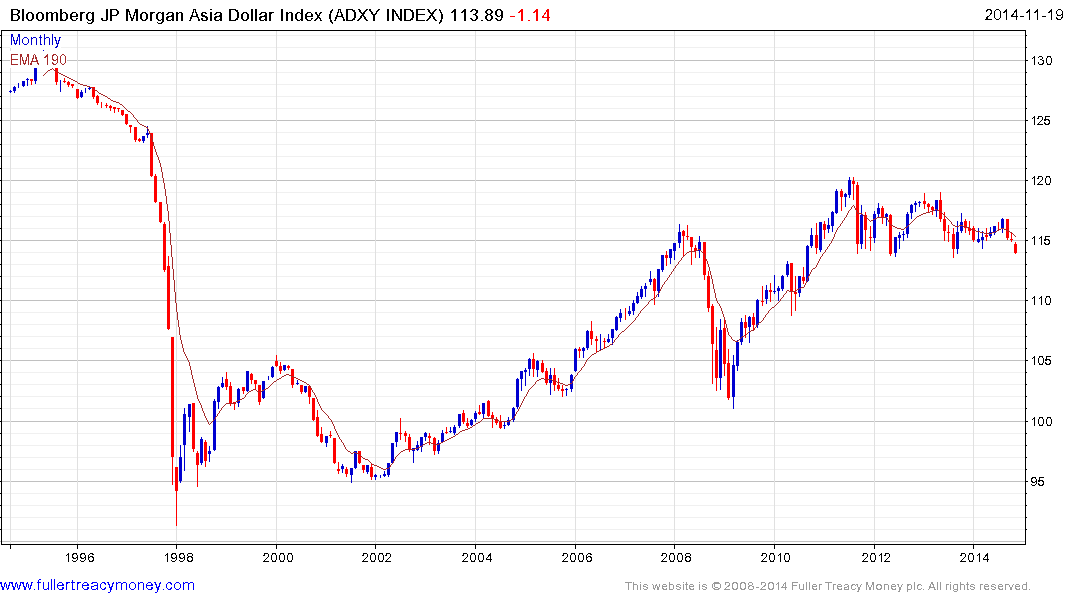

As a major centre of gravity in the region, the Yen’s weakness is putting pressure on its regional competitors to remove support for their respective currencies. The Asia Dollar Index is now testing the lower side of a more than three-year range and a clear upward dynamic will be required to signal a return to demand dominance in this area.

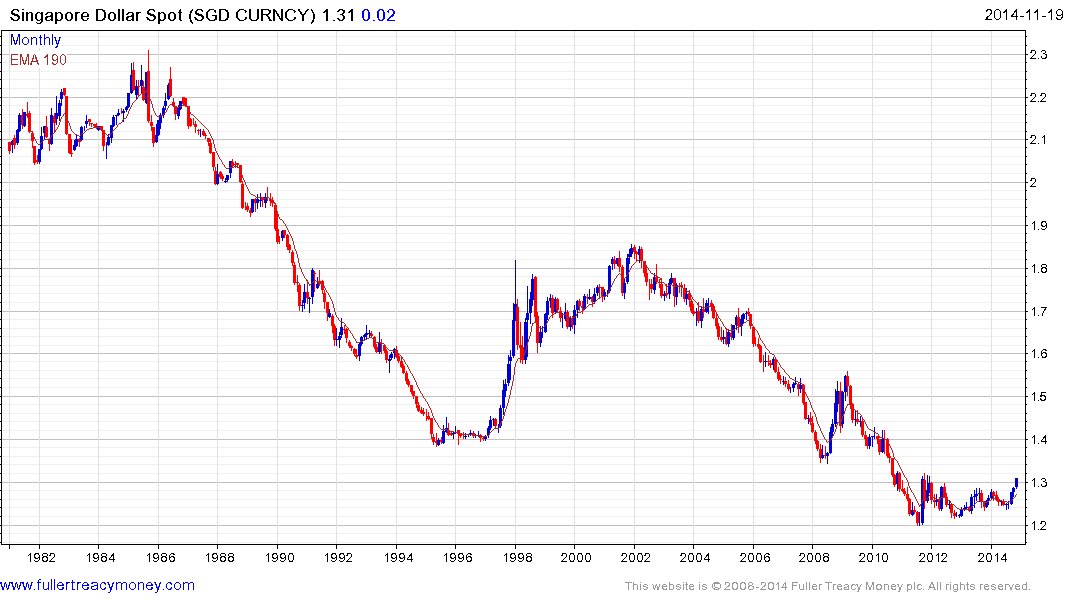

To take a specific example, the Dollar hit a new three-year high today against the Singapore Dollar, Additional follow through would represent medium-term base formation completion and the conclusive end of a decade long decline.

Back to top