Yellen to chair financial stability council meeting as bank worries persist

This note from MarketWatch may be of interest. Here is a section:

Treasury Secretary Janet Yellen will convene a meeting of the Financial Stability Oversight Council Friday.

FSOC comprises the heads of the nation's top financial regulators, and was created in the wake of the 2008 financial crisis to enable the government to coordinate efforts at combating systemic risks to the U.S. economy.

The announcement comes amid concerns over the health of the banking sector following the recent failures of Silicon Valley Bank and Signature Bank.

The uncertainty is being felt overseas as well with shares of Germany's Deutsche Bank (DBK.XE) slumping as its credit default swaps widened.

Financial sector equities (XLF) were under pressure Friday, ranking as the worst performing sector in the S&P 500 in morning trade.

The Plunge Protection Team is convening so the monetary and fiscal authorities are fully aware of the $1.7 trillion in unrealised losses in the US banking sector. The simple fact is anyone who bought long-dated bonds between 2019 and 2022 is sitting on fat losses.

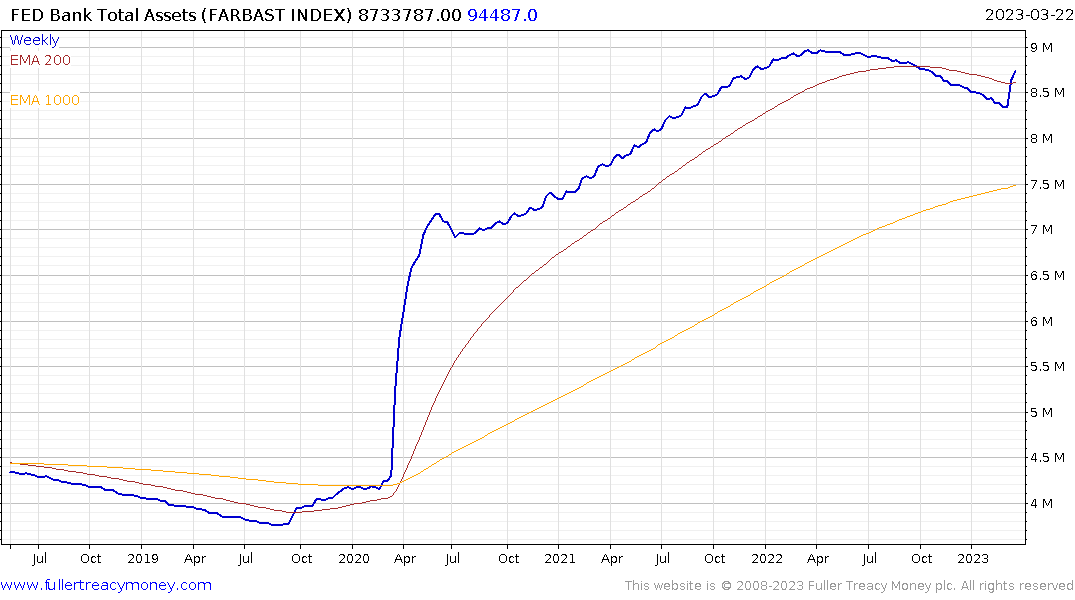

Banks cannot sell those bonds without accepting a mark-to-market loss which is why the Fed set up the at-par buying program two weeks ago. So far demand from the Bank Term Funding Program has been muted. The total figure is up from $11.9 billion to $53.7 billion this week but that is a fraction of the totals outstanding.

The discount window has been much more popular as a source of funding because it is short-term money at market rates. The underappreciated factor is many bonds were bought above par. That’s another side effect of low interest rates. Low coupons mean bonds have greater convexity (interest rate sensitivity).

The only way to allay fears and quell depositor flight is for regulators to fully back deposits at all banks for an extended period. That of course raises significant moral hazard issues because government back stops only enhance the temptation to step further out on the risk curve.

Discussions about the reimposition of the Glass-Seagal Act continue to escalate but are unlikely to succeed given the scale of the banking sector and its lobbying power. By far the most likely scenario is this crisis will lead to a further iteration of the crony capitalist system that has prevailed since the financial crisis where the rich continue to be bailed out at the expense of the public purse.

Expectations for significant market intervention are the primary reason tech stocks are outperforming even as banks hit new lows. The underperformance of the banking sector cannot simply be ignored. As liquidity providers this weakness is a lead indicator for trouble in the wider economy and is further confirmation a recession is inevitable.

Back to top