World's Cheapest Currency Has Goldman and BlueBay on Its Side

This article by Constantine Courcoulas for Bloomberg may be of interest to subscribers. Here is a section:

Appetite for lira assets remains strong among foreign investors chasing higher returns. The currency is the highest yielding among major liquid emerging markets, and when adjusted for volatility pays almost twice as much as the runner up, the Mexican peso.

Offshore funds bought a net $5.4 billion worth of local currency government bonds this year, the most for the period since 2013. They also bought a net $3 billion of the nation’s stocks, helping fuel a 40 percent rally that pushed the benchmark stock index to a record high.

Expectations that inflation will slow as the central bank holds funding costs at near a six-year high are fueling interest in the nation’s debt and helping the currency too, said Werner Gey van Pittius, the London-based co-head of emerging-market debt at Investec Asset Management Ltd.

“The central bank is doing the right thing,” he said. “We are positive on lira.”

The Turkish Lira is the latest in a string of emerging market currencies to accelerate to historic lows over the last few years. However, while the Brazil Real, South African Rand or Indonesian Rupiah collapsed because of the decline in commodity prices for the Turkish Lira it has been about the dictatorial aspirations of its President.

Nevertheless, with overnight interest rates at 12.5% even that risk is proving attractive for investors, particularly in a generally low interest rate environment elsewhere. The Lira has unwound its oversold condition relative to the trend mean, since its low in January, and strengthened through TRY3.5 this week. A sustained move back above that level would be required to question the Lira’s near-term potential for outperformance.

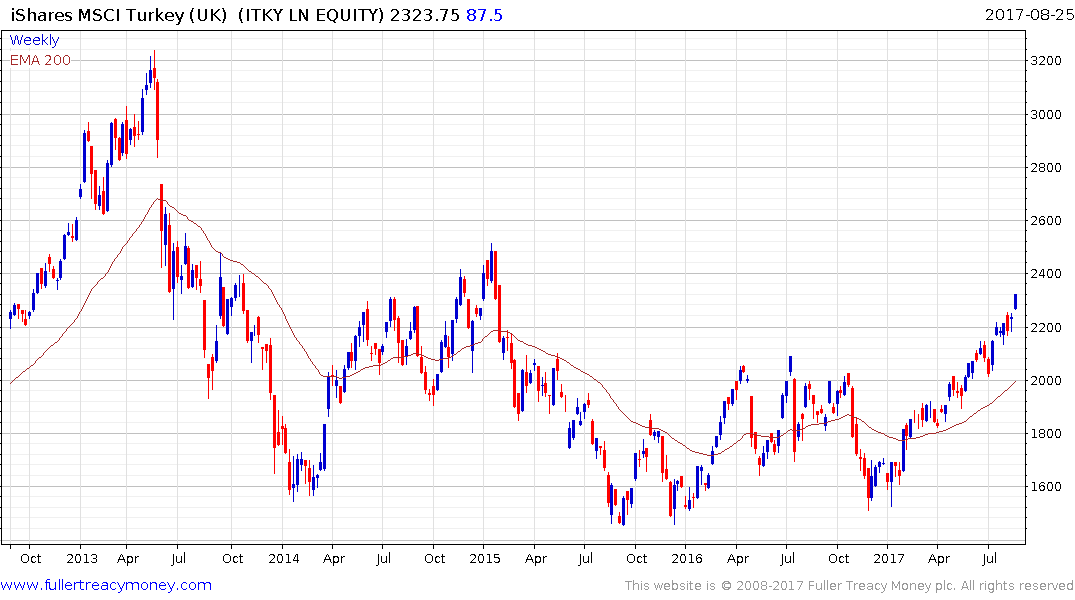

The National 100 Index broke out of a four-year range in April and continues to extend the advance. While increasingly overextended relative to the trend mean, a sustained move below it would be required to question potential for additional upside.

The UK listed iShares Turkey ETF found support near 1500p in January and has rallied over the last couple of months to break the medium-term progression of lower rally highs.