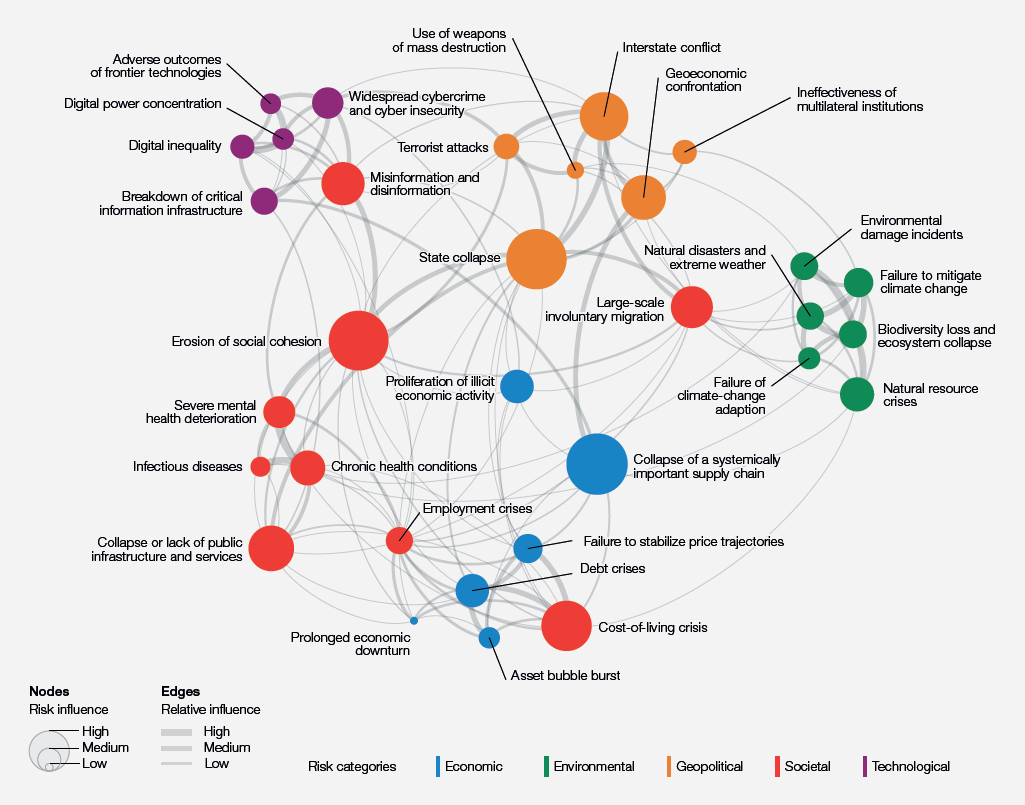

World Economic Forum Global Risk

This report goes to some lengths to highlight the worst possible outcome for the global economy but then goes on to say that fewer than half of participants are as gloomy as the report’s conclusions. Here is a section:

The report describes four potential futures centred around food, water and metals and mineral shortages, all of which could spark a humanitarian as well as an ecological crisis – from water wars and famines to continued overexploitation of ecological resources and a slowdown in climate mitigation and adaption. Given uncertain relationships between global risks, similar foresight exercises can help anticipate potential connections, directing preparedness measures towards minimizing the scale and scope of polycrises before they arise.

In the years to come, as continued, concurrent crises embed structural changes to the economic and geopolitical landscape, they accelerate the other risks that we face. More than four in five GRPS respondents anticipate consistent volatility over the next two years at a minimum, with multiple shocks accentuating divergent trajectories. However, respondents are generally more optimistic over the longer term. Just over one-half of respondents anticipate a negative outlook, and nearly one in five respondents predict limited volatility with relative – and potentially renewed – stability in the next 10 years.

Indeed, there is still a window to shape a more secure future through more effective preparedness. Addressing the erosion of trust in multilateral processes will enhance our collective ability to prevent and respond to emerging cross-border crises and strengthen the guardrails we have in place to address well-established risks. In addition, leveraging the interconnectivity between global risks can broaden the impact of risk mitigation activities – shoring up resilience in one area can have a multiplier effect on overall preparedness for other related risks. As a deteriorating economic outlook brings tougher trade-offs for governments facing competing social, environmental and security concerns, investment in resilience must focus on solutions that address multiple risks, such as funding of adaptation measures that come with climate mitigation co-benefits, or investment in areas that strengthen human capital and development.

Some of the risks described in this year’s report are close to a tipping point. This is the moment to act collectively, decisively and with a long-term lens to shape a pathway to a more positive, inclusive and stable world.

The worst case scenario seldom comes to pass. That’s an important point to remember when sentiment about the future is so bearish. So of the biggest challenges are with relation to how populations are distributed globally. That’s true because of migration within countries to the coasts and because the highest population growth countries are all in the emerging markets. These factors are stressing water resources. So is the fact that water infrastructure is hard to build and politically fraught so also hard to get paid for building it. In the end it comes down to governance.

Sustaining the welfare of the rising global population depends on the stability of the global supply chain. There is no question it has been damaged by the pandemic and the war and there have been knock-on effects in several countries with emerging debt issues. The degree of uncertainty around supply chains is certainly higher than over the last couple of decades. There is scope for it to get worse if the relationship between China and Russia with the rest of the world deteriorates further.

However, it is also worth remembering that many of the issues arising right now are because of governance and the drive to remake the global economy. That’s especially true where expansion of coal fired power stations is being impeded but alternatives for base load power are being impeded. https://www.bloomberg.com/opinion/articles/2023-01-23/desperate-to-be-a-ceo-here-s-the-worst-job-in-global-energy

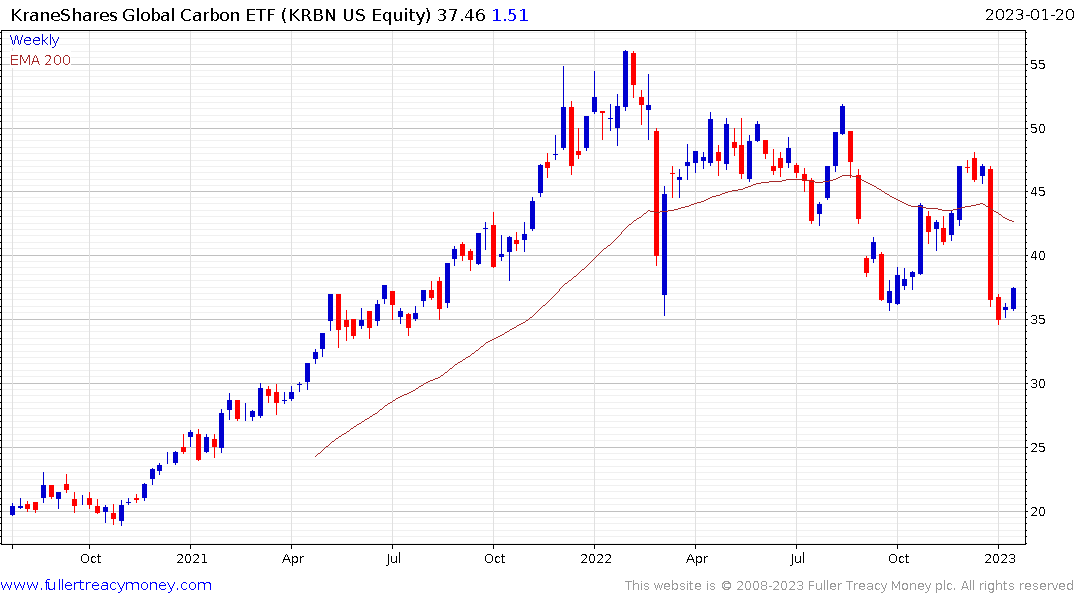

The introduction of carbon pricing has many merits but it is also an artificial construct and tax that delivers economic inefficiencies. Capitalist systems work best on a profit motivation. Interfering with that is a confusion for everyone.

The Kraneshares Global Carbon Strategy ETF is currently firming from the region of the 1000-day MA and prices for these credits are government sponsored so there is a limit to how low they can fall.

The Kraneshares Global Carbon Strategy ETF is currently firming from the region of the 1000-day MA and prices for these credits are government sponsored so there is a limit to how low they can fall.

With El Nino expected to make a return for the first time in several years in 2023, these topics are likely to gain increasing traction.

Back to top