World-Beating Currency Has RenCap Double-Checking Its Math

This article by Christine Jenkins for Bloomberg may be of interest to subscribers. Here is a section:

Colombia’s currency is the world’s top performer in the early days of 2018, and Renaissance Capital is forecasting more gains ahead for what it sees as one of the best bets in emerging markets.

The peso has rallied 3 percent this month following a lackluster 2017 that left it almost unchanged and toward the bottom of the pack for developing-nation currencies. It closed at 2,887 per dollar Thursday, its strongest level since May, amid gains in oil, the country’s biggest export. The peso slipped 0.4 percent Friday to 2,899 per dollar as of 9:28 a.m. in New York.

Even so it’s almost 40 percent undervalued in a real effective exchange rate model, according to Charles Robertson, the global chief economist at RenCap in London, who said the dramatic difference had him double-checking his worksheets.

The Colombian Peso almost halved in value between the middle of 2014 and early 2016 as the value of the legitimate commodities it exports collapsed in value. The continued strength in oil prices coupled with synchronized global economic expansion suggests the outlook for Latin America’s commodity producers is improving.

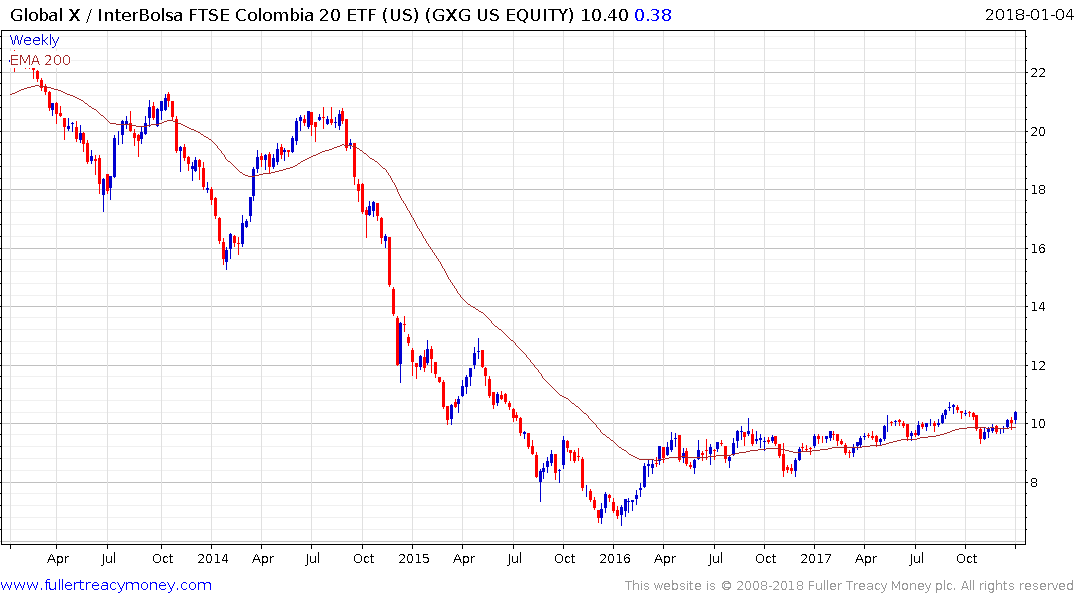

The Peso rallied from the its lows in 2016 but has spent much of the last 18 months ranging in a first step above the Type-2 bottom. A sustained move to new highs would confirm a return to medium-term demand dominance.

The Global X / InterBolsa FTSE Colombia 20 ETF (GXG) has been ranging mostly below $10 since 2016 but has held a progression of higher reaction lows and a successful breakout is now looking more likely than not.