Work From Home And The Office Real Estate Apocalypse

This report from the NBER may be of interest to subscribers. Here is a section:

We study the impact of remote work on the commercial office sector. We document large shifts in lease revenues, office occupancy, lease renewal rates, lease durations, and market rents as firms shifted to remote work in the wake of the Covid-19 pandemic. We show that the pandemic has had large effects on both current and expected future cash flows for office buildings. Remote work also changes the risk premium on office real estate. We revalue the stock of New York City commercial office buildings taking into account pandemic-induced cash flow and discount rate effects. We find a 45% decline in office values in 2020 and 39% in the longer-run, the latter representing a $453 billion value destruction. Higher quality office buildings were somewhat buffered against these trends due to a flight to quality, while lower quality office buildings see much more dramatic swings. These valuation changes have repercussions for local public finances and financial sector stability.

San Francisco commercial real estate occupancy is below 40% while New York and Los Angeles are just higher than that figure. This is a looming issue for the owners of vacant properties, many of whom are pension funds and other private investors.

I’ve been working from home since 2007. In that time I had the privilege of spending every day with my children in their formative years. I refused the post of editor in chief of a significant financial publication because nothing could compensate me for the joy I was experiencing in being so close to my family.

I’ll freely admit working from home is not for everyone, but there is a significant number of people who will never wish to work in an office again. That’s quite apart from the fact motivated workers are much more productive assets, regardless of where they do their jobs.

This social and societal change is a black swan event for the commercial real estate market. When leases expire, buildings will be handed back and new leases will be significantly lower. Pensions are heavily exposed to alternative assets and commercial property is a big part of that. That suggest REITs are a very risky portion of the market.

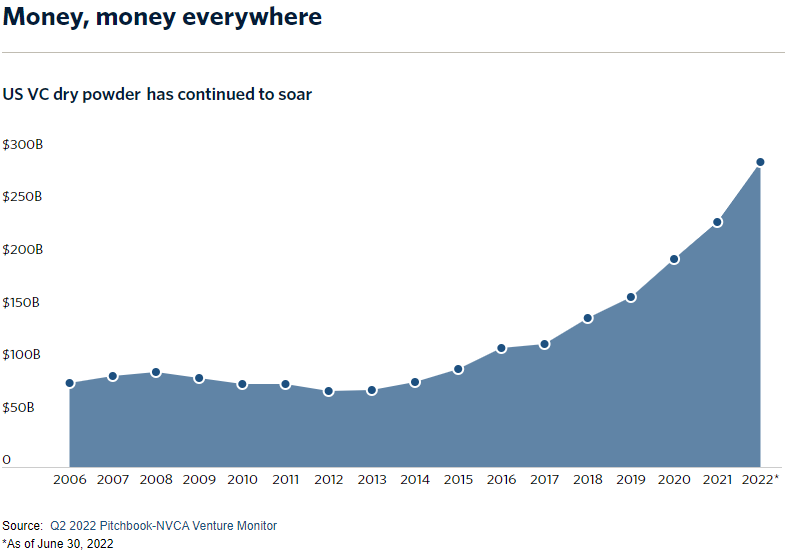

This article from Pitchbook discussing the estimate of how much dry powder is outstanding may also be of interest. The first thing about the chart is it massively understates the other estimates of dry powder I’ve seen. $300 billion is a lot of money but it is well shy of the $1.4 trillion quoted by McKinsey in their April 2021 report.

The belief that there is a wall of cash sitting on the sidelines waiting to jump in is one of the most pervasive in markets today. Private equity’s trillions, trillions sitting in repo and the Fed’s inevitable pivot are used as justification to buy the dip. This will be true eventually but at present there is still entirely too much money chasing returns in speculative assets. This story of how banks lost $600 million on the Citrix leveraged buyout is a cautionary tale.

Pre-empting the Fed when inflation is high and unemployment still low is likely to be counterproductive.

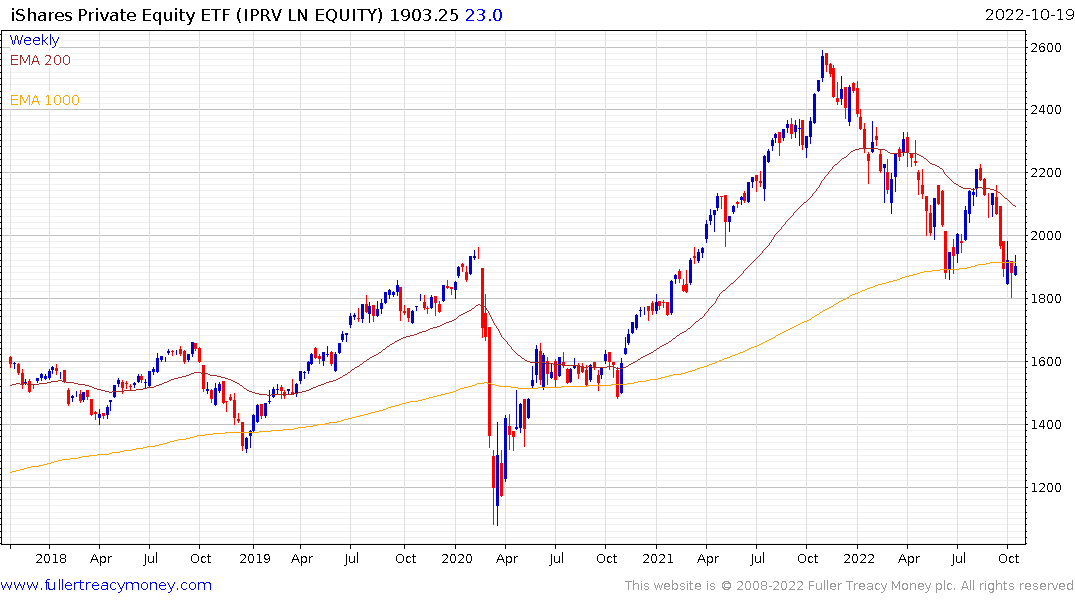

The iShares Private Equity ETF is back in the region of the 1000-day MA, like many of the large cap Wall Street companies.

The iShares Private Equity ETF is back in the region of the 1000-day MA, like many of the large cap Wall Street companies.

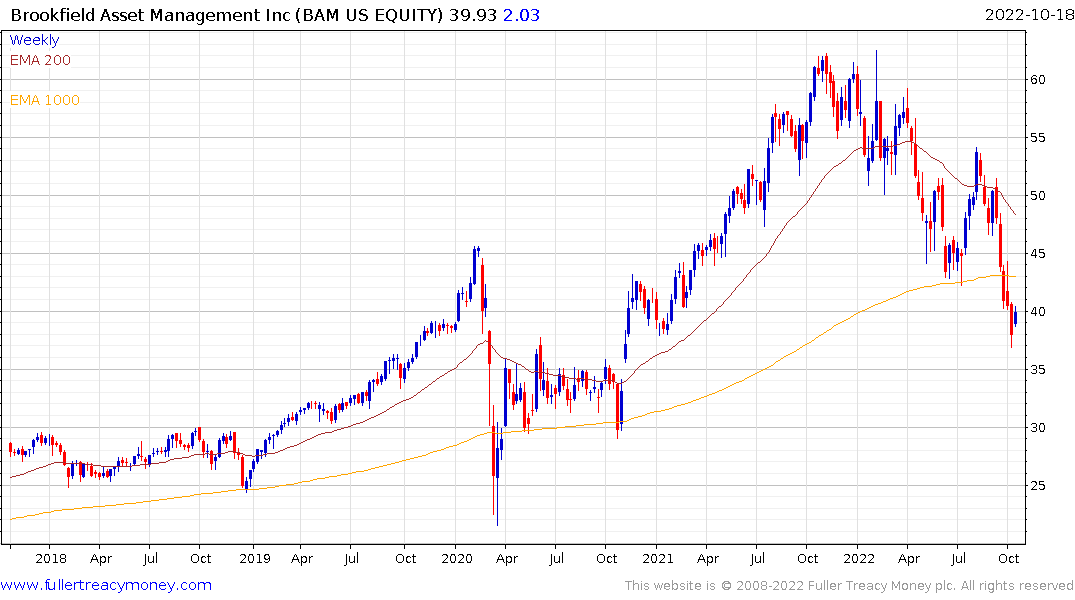

Meanwhile Brookfield Asset Management, one of the most respected asset allocators in the sector is accelerating lower. I do wonder if this is another example of the Canadian curse. It seems like every time a Canadian company is successful enough to dominate its sector on a global basis, it marks a top. Nortel Networks, Palm, Blackberry and Shopify all made headlines for being the best in the world just before their success peaked. Every institutional investor I know speaks in deferential terms about Brookfield but the company’s empire is based on commercial property.