Won Falls for Second Day on Concern Economy Slowing, Fed Outlook

This article by Justina Lee for Bloomberg may be of interest to subscribers. Here is a section:

Official data due Thursday will show South Korea’s gross domestic product expanded 2.3 percent from a year earlier in the April-June period, the least in nine quarters, according to a Bloomberg survey. The central bank has lowered its key interest rate by 50 basis points this year to spur growth. In the U.S., Federal Reserve Chair Janet Yellen indicated last week that policy makers are on track to raising borrowing costs in 2015.

The Federal Open Market Committee will next meet on July 29.

“Heading into the FOMC, I think the market continues to look for indications of a hike this year,” said Irene Cheung, a currency strategist at Australia & New Zealand Banking Group Ltd. in Singapore. In South Korea, “we are not putting in another rate cut in the forecast table, but we feel that, between hiking and easing, the bias is still toward easing,” she said.

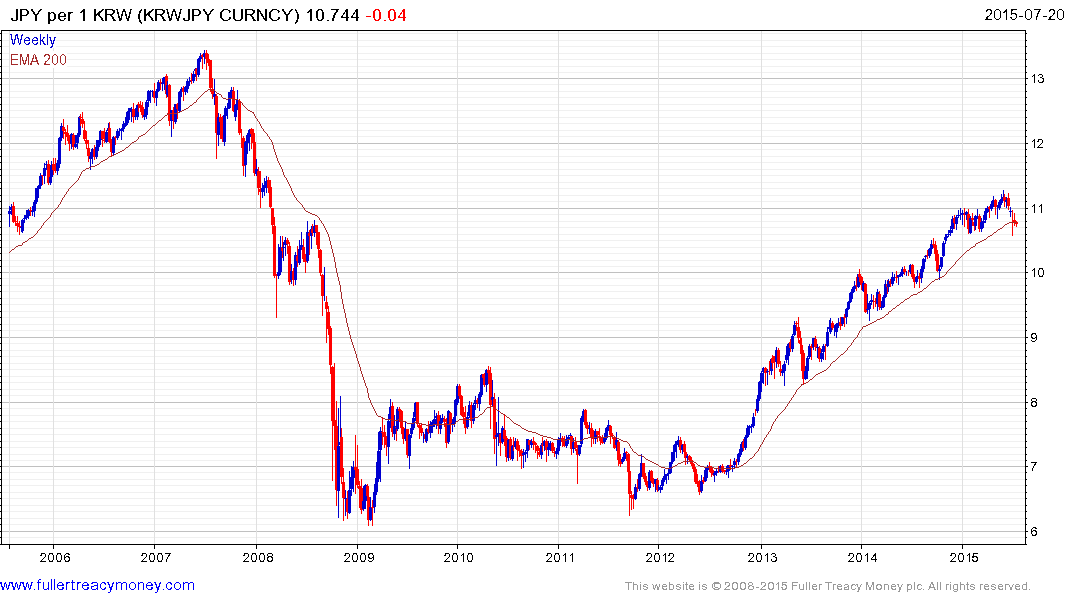

While the majority of commentary focuses on what effect the Fed’s eventual rate hike will have on other currencies, the actions of the Bank of Japan are of greater important to South Korea. Both countries compete in many of the same markets for consumer goods and South Korea benefitted enormously from the strength of the Yen in the aftermath of the credit crisis.

That ended in 2012 and the Won has jumped 65% against the Yen since. It is currently testing the region of the 200-day MA but a sustained move below 10.5 would be required to question medium-term uptrend consistency.

The US Dollar has base formation characteristics against the Won and a sustained move above KRW1200 would confirm a return to demand dominance beyond the short term.

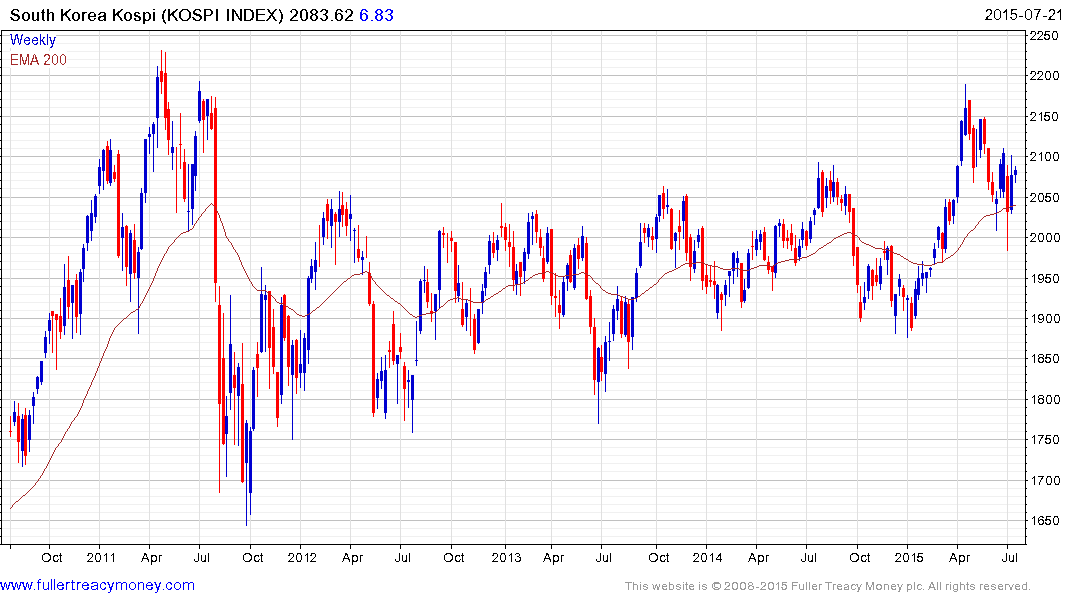

The Kospi Index tested its 2011 peak in April and has pulled back to the upper side of the lengthy trading range. It needs to hold the 2000 level if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

The US Dollar denominated iShares Korea ETF highlights the impact the Won has had on returns for foreign investors.

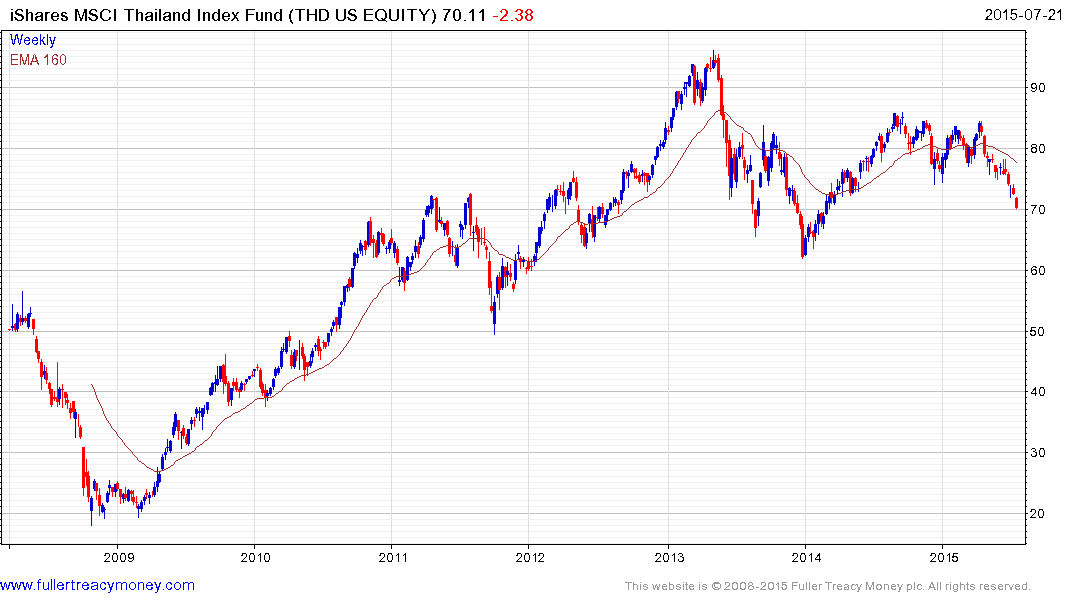

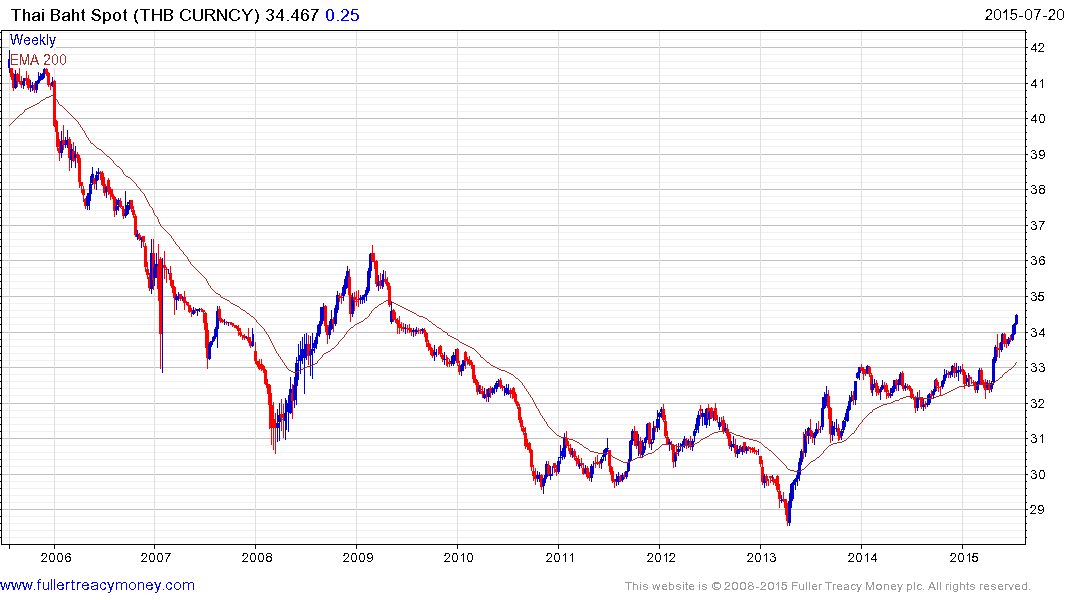

While the role of the Yen is not as important to Thailand, the weakness of the Baht has taken a toll on the stock market as foreign investors retreat. The Baht is somewhat oversold in the short term but there is no sign yet that the selling pressure has eased.

Meanwhile the SET Index has medium-term top formation characteristics in nominal terms and the iShares MSCI Thailand ETF has a similar pattern.