Won Drops From 14-Month High as BOK Signals Room for More Easing

This article by Jung Park for Bloomberg may be of interest to subscribers. Here it is in full:

South Korea’s won fell from the strongest in more than a year after the Bank of Korea Governor signaled policy remains accomodative.

The dollar’s slide this week amid speculation U.S. borrowing costs will stay unchanged in 2016 has boosted emerging-market currencies. The Korean currency is the top performer in Asia this month after the Taiwanese dollar. The BOK held its interest rate at a record low as forecast by economists and Governor Lee Ju Yeol said the central bank “still has monetary, fiscal policy room.”

“Governor Lee’s comment that the BOK still has policy room reaffirmed its accommodative stance and the possibility of a rate cut in the near future,” said Chung Sung Yoon, a currency analyst at Hyundai Futures Corp. in Seoul. “The longer term direction will probably be determined by the policy stance of global central banks, particularly the U.S. and the Bank of Korea.”

The won dropped 0.5 percent to 1,099.72 per dollar at the 3:30 p.m. close of trading in Seoul. It snapped five days of gains that sent the currency to its strongest level since May 2015.

The currency’s level has become burdensome following the rally, Hyundai Futures’s Chung said, adding that speculations of a “government intervention” in the market “near 1,090 right before the close” on Wednesday fueled concerns over another one.

South Korean bonds were little changed, with yield on three-year note at 1.23 percent, and 10-year note at 1.40 percent.

The South Korean Won has been among the strongest currencies regionally so far this year but the Dollar has developed a short-term oversold condition and potential for a reversionary rally has increased.

For South Korean companies, competing with Chinese and Japanese manufacturers, cross rates may be an even more important consideration. The Japanese Yen has been trending higher against the Won for a year and a sustained move below trend mean would be required to question medium-term uptrend consistency.

Meanwhile the Won has been confined to range against the Yuan since 2000 and is now testing the upper boundary (shown inversely below)

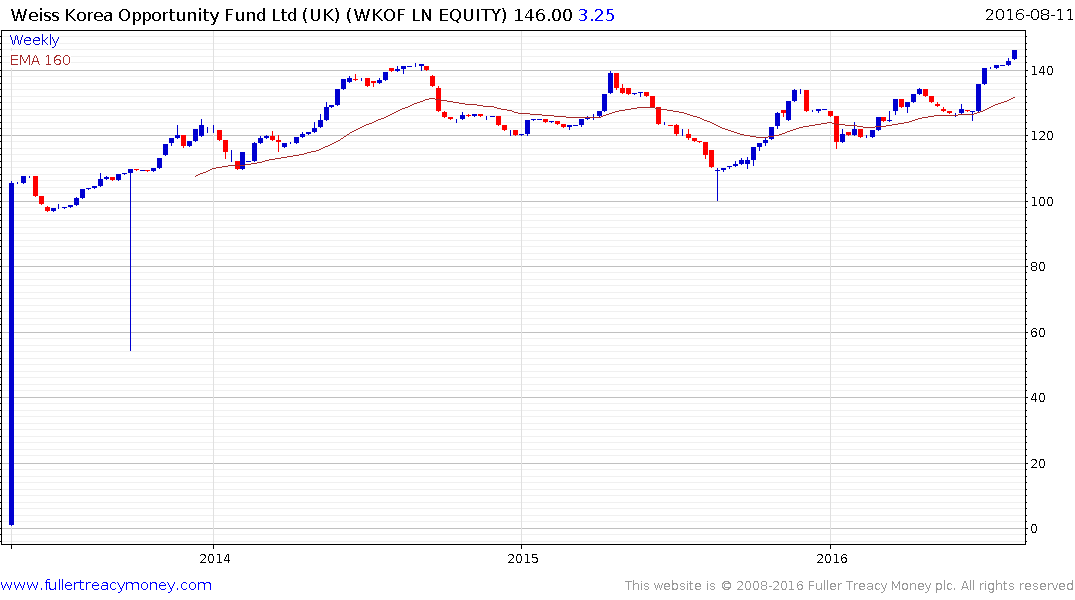

The UK listed, Pound denominated Weiss Korea Opportunity Fund trades at a 5.55% discount to NAV and broke out of a more than two-year range today to reassert medium-term demand dominance.

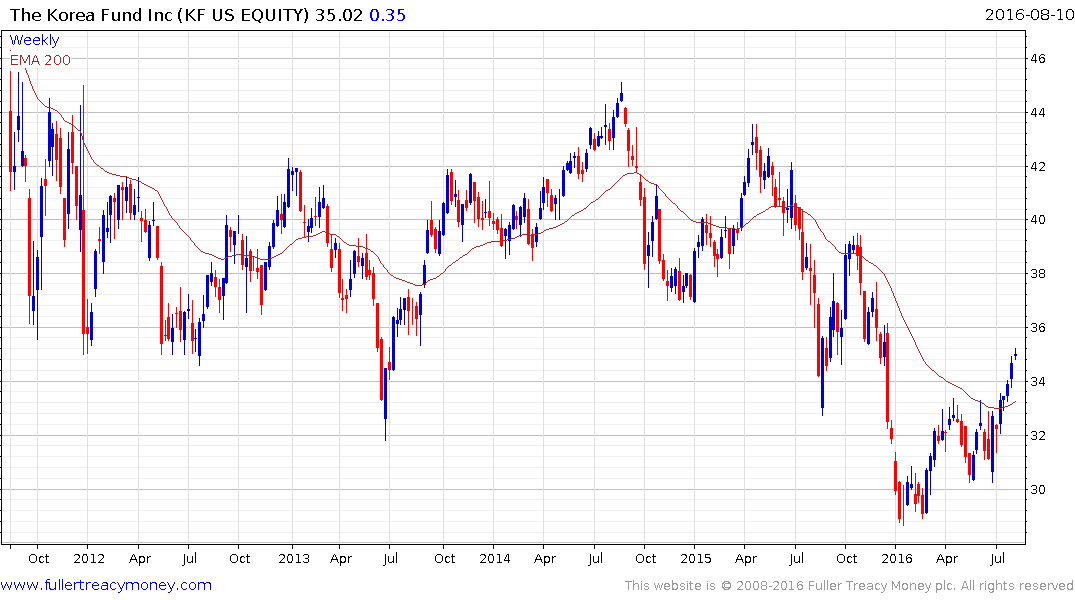

The US listed Dollar denominated Korea Fund trades at an 11.44% discount to NAV and is currently rallying from the lower side of a five-year range.