Woman given one year to live is now cancer-free after experimental treatment

This article from the Independent may be of interest to subscribers. Here is a section:

When she found out the cancer had spread to her lungs, chest bone and lymph nodes, she was given one year to live.

David spent the following six months undergoing chemotherapy, and had a mastectomy in April 2018. This was followed by 15 cycles of radiotherapy which cleared her of cancer.

However, the cancer returned in October 2019 when scans showed multiple lesions throughout David’s body.

David then decided to take part in a clinical trial where she was given experimental medicine combined with immunotherapy drug Atezolizumab, which she has injected every three weeks.

After two years on the trial, the mother-of-two has been declared cancer-free once again.

Roche acquired Genentech in 2009. Atezolizumab is the fruition of that merger and continues to make its way through clinical trials.

Immuno-oncology went through a significant bull market in 2016/17 as the promise of curing cancer looked realizable for the first time. The difficulty of creating a one-size-fits-all solution resulted in much of the enthusiasm being squeezed out of the sector. Nevertheless, the results are impressive even if the scalability is not a panacea.

Over the last year the majority of shares have sold off aggressively but are now showing early signs of bottoming.

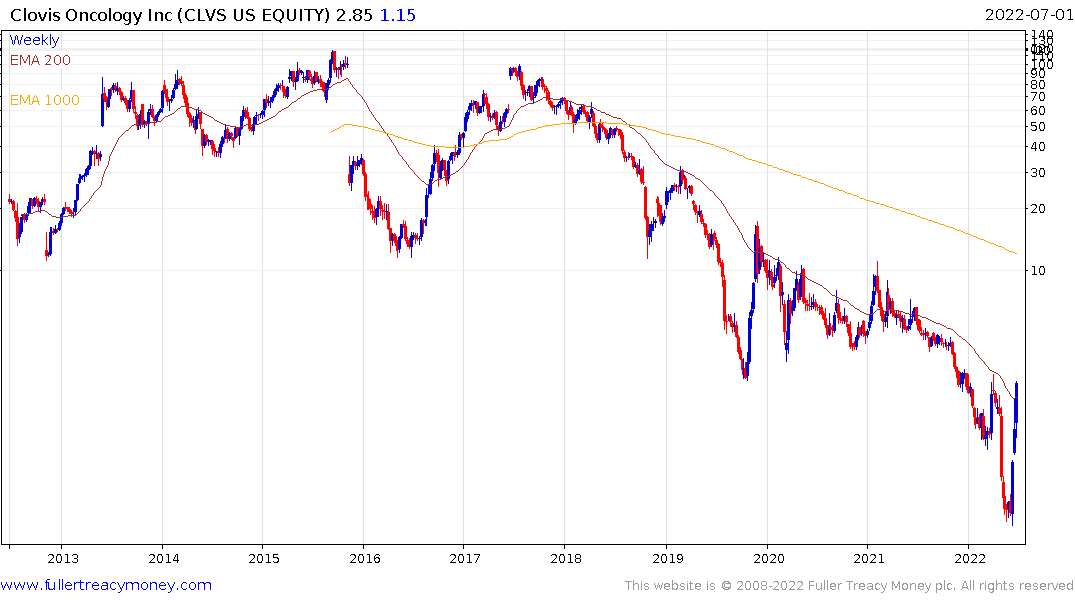

For example, Clovis Oncology lost 99% of its value before rebounding over the last couple of weeks.

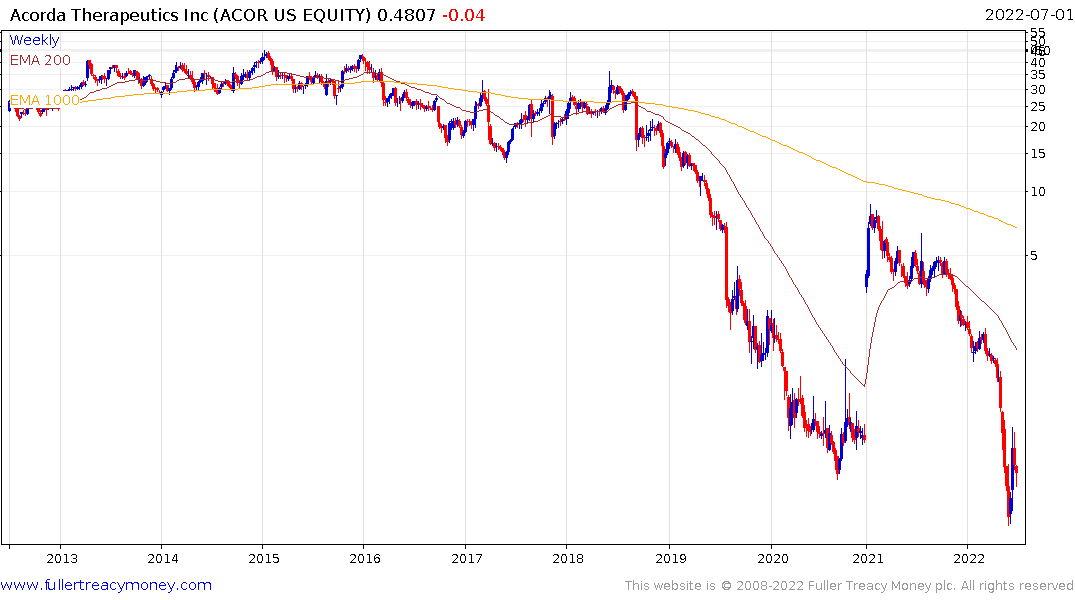

Acorda Therapeutics has also rebounded following an accelerated decline.

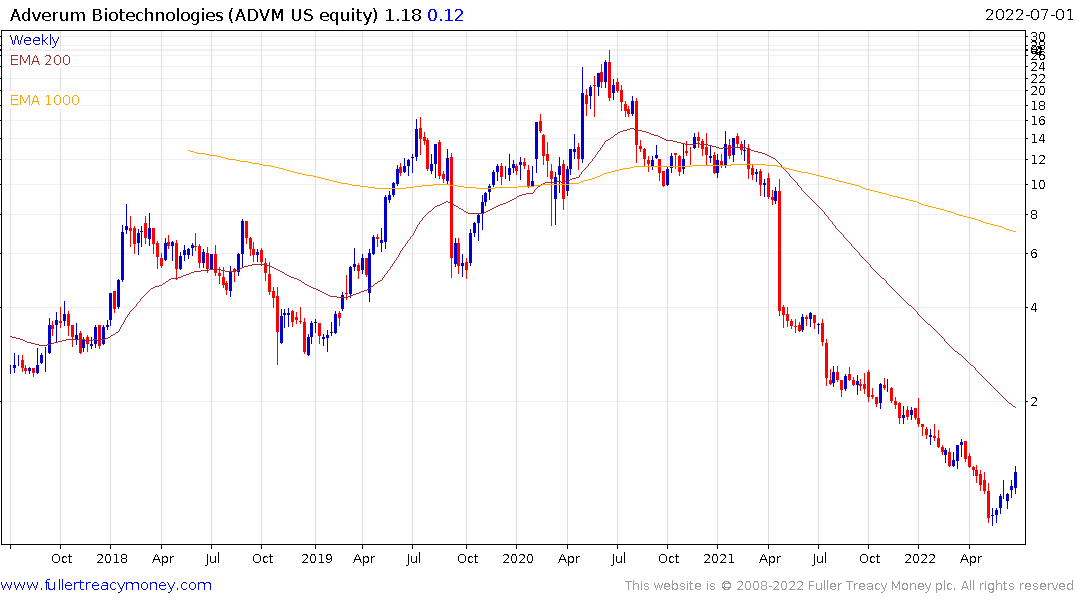

Adverum Biotechnologies is up for six consecutive weeks.

Amicus has rebounded impressively from the region of the 2020 lows.

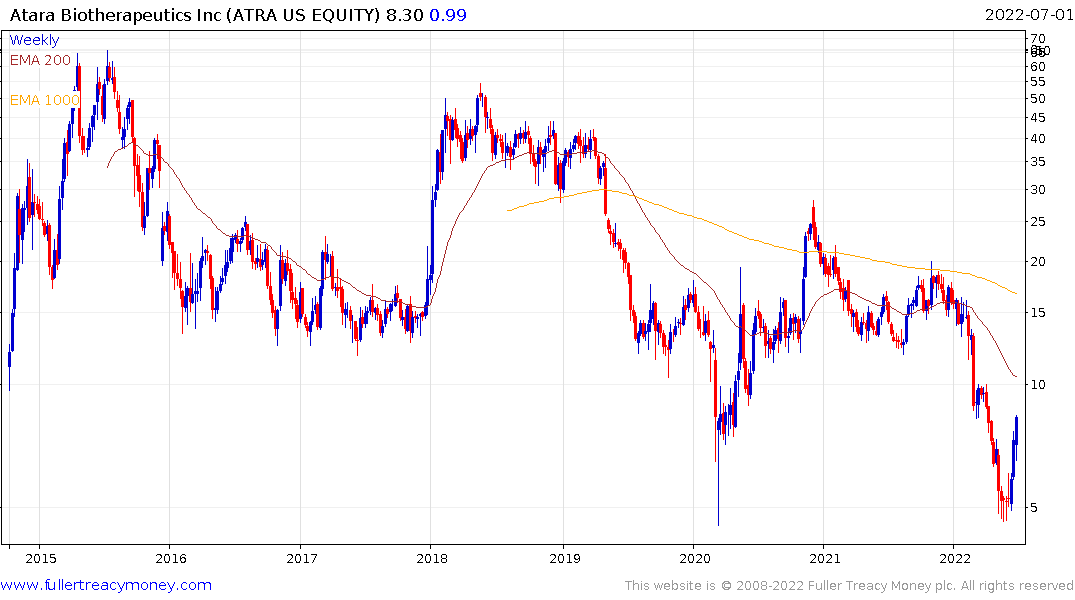

Atara Biotherapeutics has a similar pattern.

Atara Biotherapeutics has a similar pattern.

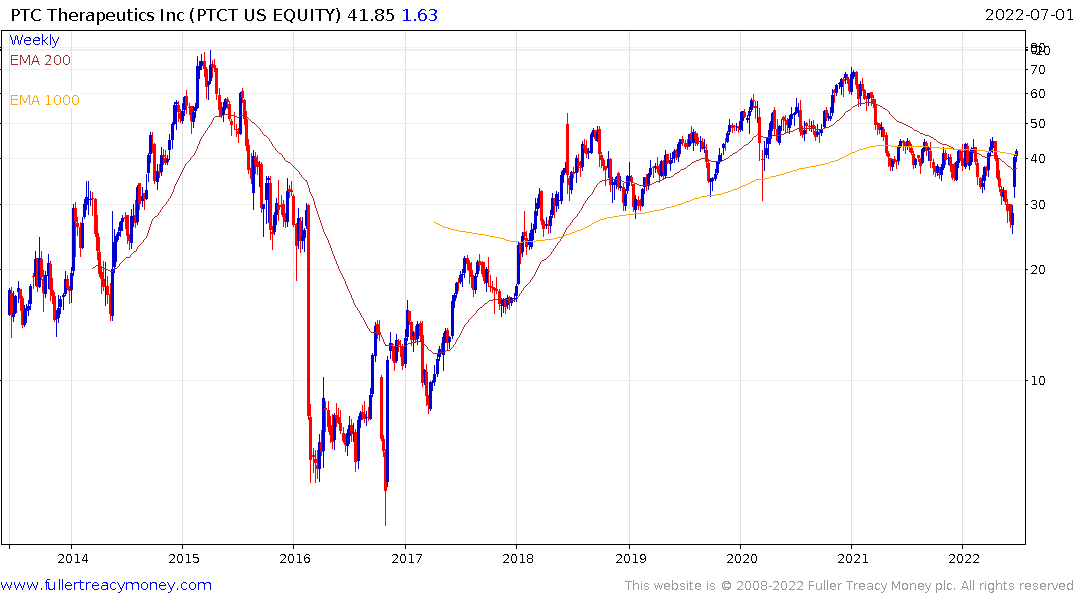

PTC Therapeutics is also rebounding impressively.

PTC Therapeutics is also rebounding impressively.

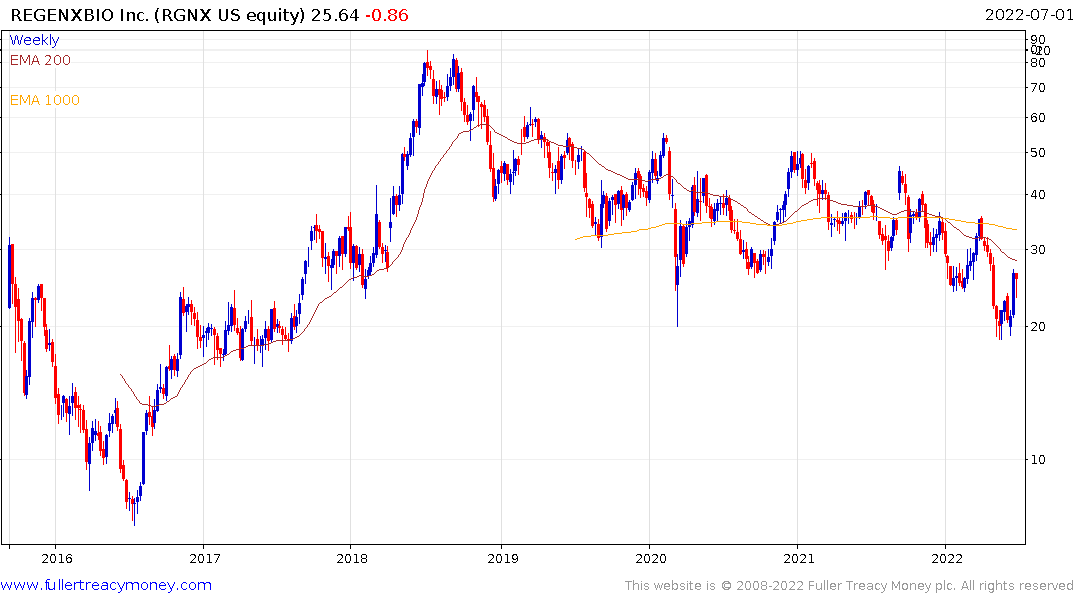

Regenxbio has also rebounded impressively.

Regenxbio has also rebounded impressively.

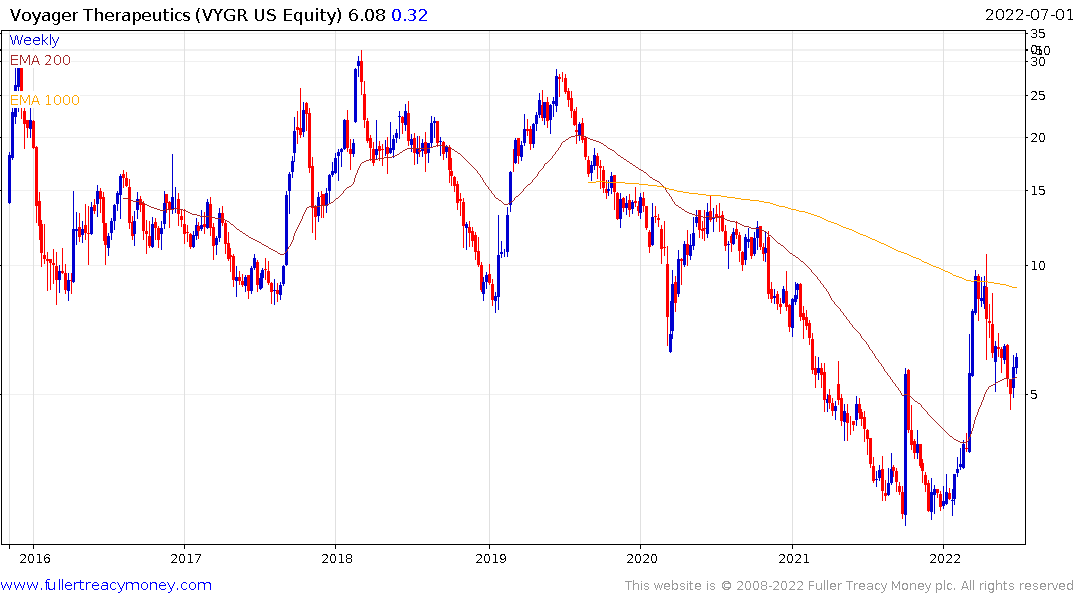

Voyager Therapeutics is now bouncing from the region of the 200-day MA.

Voyager Therapeutics is now bouncing from the region of the 200-day MA.

Australia’s Imugene is rebounding from the region of the 1000-day MA and is now challenging the steep sequence of lower rally highs.

The Loncar Cancer Immunotherapy ETF began life investing in small caps but as it accumulated assets has focused more on the larger companies. It is rebounding from a deep short-term oversold condition.

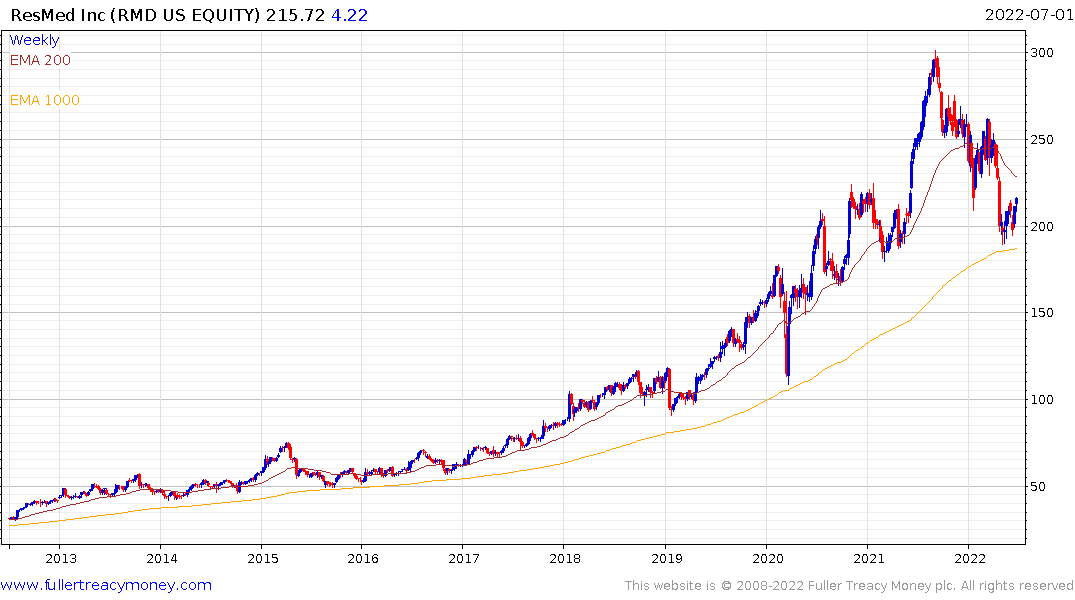

Resmed is firming from the region of the 1000-day MA.

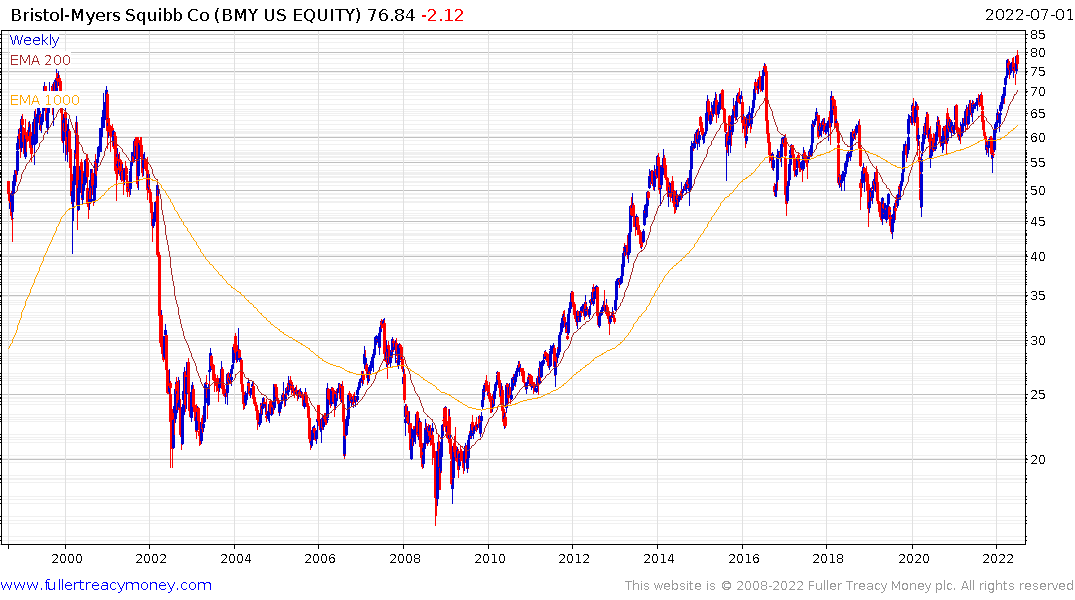

Bristol Myers Squibb is attempting to hold the breakout to new all-time highs following a six-year range in the region of the 1999 peak.