Why the Case Is Building for Stevens to Relent on RBA Rate Cut

This article by Ian McDonald for Bloomberg may be of interest to subscribers. Here is a section:

Declining mining investment is a drag on growth that hasn’t been significantly offset by a pick up elsewhere in the economy apart from construction. Australian companies forecast A$86.3 billion ($71 billion) of such investment in the year through June, a drop of 17 percent from the same estimate a year earlier. Low interest rates have yet to ignite what Stevens calls the necessary animal spirits that drive firms to invest.

“The broadening of the non-mining recovery beyond housing and construction has been disappointingly slow,” Australia & New Zealand Banking Group Ltd. Chief Economist Warren Hogan said in a research note Jan. 15. “Weaker growth and lower inflation in 2015 will provide the RBA with a reason and the scope to take the cash rate down 50 basis points to 2 percent over the first half of the year.”

Canada’s interest rate cut, following a long hiatus, highlights the stress commodity exporters are under. Considering Australia and Canada export many of the same commodities the RBA may now be more likely to make additional cuts to the base rate.

The Australian Dollar has been reasonably steady over the last six weeks as it ranged above 80¢. However, today’s downward dynamic has increased the possibility that the medium-term downtrend will be reasserted.

The weakness of the Aussie Dollar and speculation that the RBA may be about to cut rates has acted as a tailwind for the ASX which continues to rebound from the October and December lows.

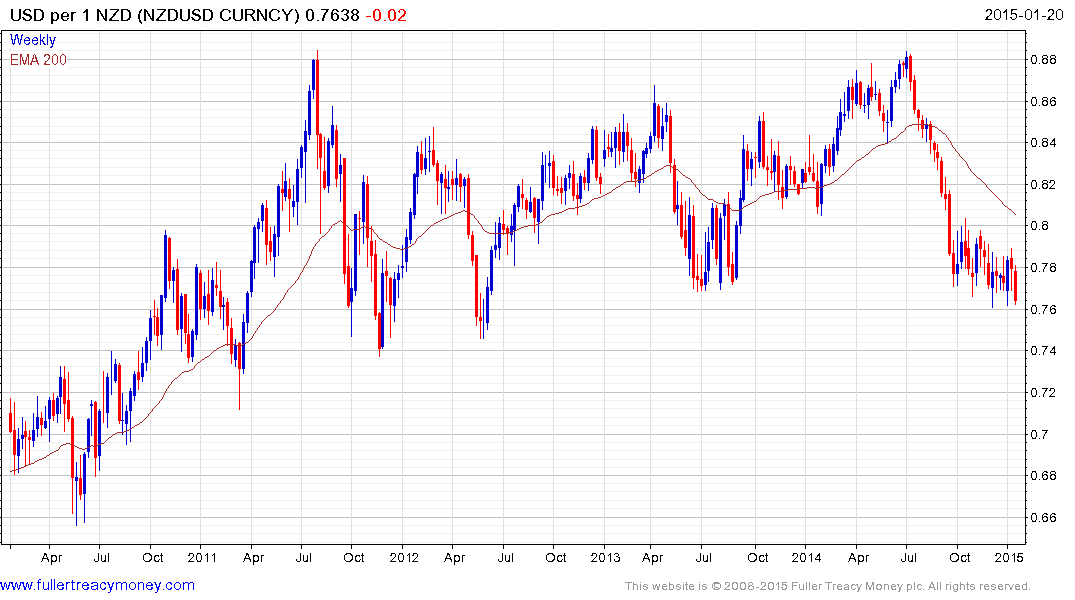

The New Zealand Dollar hit a new reaction low today and potential for an additional decline below 75¢ has increased.

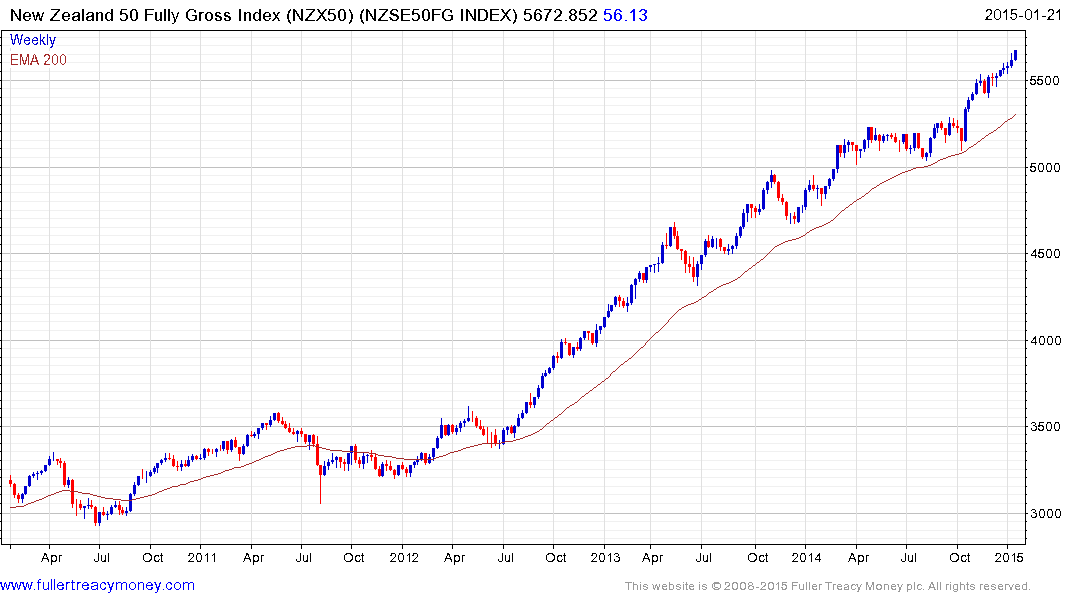

The New Zealand 50 Fully Gross Index’s performance has been flattered by the weakness of the Kiwi Dollar. From the perspective of a domestic investor the prospect of continued loose monetary policy should act to support the stock market.