Why Central Banks Like Canada's Are Finding It Hard to Get Home

This article by Theophilos Argitis for Bloomberg may be of interest to subscribers. Here is a section:

Poloz counters by pointing out that the leverage already out there makes tightening risky too. Plus, he sees potential long-term benefits from frontloading demand.

Exports and investment remain below pre-crisis levels as a share of the economy, leaving Canada reliant on consumption and housing. Wage gains are smaller than in the past. The number of new firms being created, an important metric for Poloz, is lackluster. What if Canada’s economy is on the cusp of an investment boom that may not be detectable yet, and companies are holding back because they lack confidence? Productivity typically picks up late in the business cycle, and policy makers shouldn’t get in the way of that by removing stimulus too quickly.

Yet, if the purpose of low rates has been to nurse the economy back to normal, then the ability to raise them should be the ultimate gauge of health.

With the jobless rate at four-decade lows, and underlying inflation back near the 2 percent target, there were signs that the economy was nearing its capacity -- which is why Poloz began to hike.

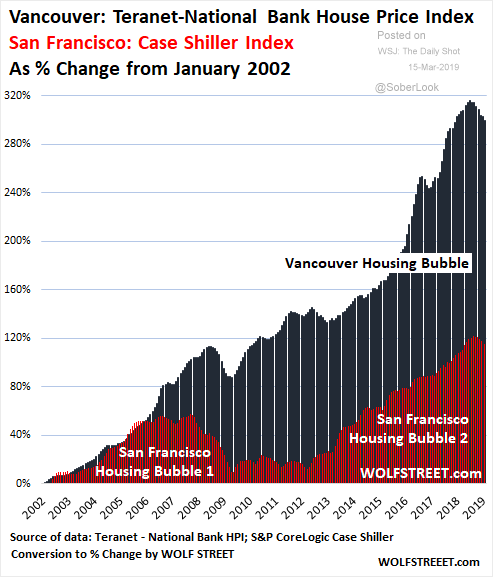

The dilemma facing the Bank of Canada is similar to that facing the Reserve Bank of Australia and the Bank of England for that matter. They are all facing into housing markets that are expensive by any measure and household sectors that are very sensitive to interest rates.

Bond yields compressing suggest investors see no room for further rate hikes, rather the opposite and if central banks are not sensitive to that message their stock markets are at risk of reacting violently.

The twin impacts of the Royal Commission’s findings and the housing slowdown continue to weigh on Australia’s banks which paused in the region of the trend mean this week.

Meanwhile Canada’s financials remain above the most resilient among the G7 and currently represent about a third of the TSX Index. The sector is being led higher by Brookfield Asset Management which just broke out to new all-time highs following the acquisition of Howard Marks’ Oaktree Capital.