Who Wins, Who Loses From MiFID II Shakeup?: QuickTake Scorecard

This article by Suzy Waite, Sarah Jones and Trista Kelley for Bloomberg may be of interest to subscribers. Here is a section:

Losers

RESEARCH ANALYSTS. Those that aren’t ranked in the top three or four in their sector could be axed from trading floors.

McKinsey & Co. expects banks to cut about $1.2 billion of spending in the area. INVESTOR RETURNS? Fewer analysts means less research, which means some fund managers may have to shrink the universe of companies they invest in. Missed opportunities could potentially limit returns, while less oversight could impact decision-making.

BOUTIQUE INVESTMENT BANKS. Independent research firms will see new competition once banks roll out their new offerings. MiFID II may also trigger a price war in execution, which could see bulge-bracket investment banks drive boutiques out of equities trading.

STOCK EXCHANGES. Bourses such as Euronext NV and Deutsche Boerse AG could also lose out. Even if regulators close the pricing loophole that currently give SIs an advantage, bank-run platforms may still be more attractive as banks roll out increasingly competitive stock-trading options, such as low execution prices and larger “risk trades” to lure business.

SMALL-TO-MEDIUM-SIZED ENTERPRISES. Smaller companies are expected to see less coverage from research analysts, potentially reducing their shareholder base. That could make it hard for investors to price the shares and make stocks more illiquid. London-based Toscafund Asset Management, which invests in U.K. small caps, wrote a letter to 30 such companies urging them to pay for research on their own stocks.

MIFID II comes into effect in the New Year and will represent a considerable challenge for large numbers of people in the financial sector but most especially those in the small to mid-sized sector that benefitted from soft dollar arrangements with their clients. The effect of the rule changes is akin to taxing benefits in kind and will result in fewer analysts covering companies and a narrowing in the breadth of opinion available to institutional investors. This article from the Financial Times dated September 15th includes a number of helpful graphics on who is likely to be most affected.

This article focusing on some of the repercussions of the reduction in the deduction of state and local taxes may also be of interest. Here is a section:

Banks are seeing a wave of inquiries from customers in high-tax states rushing during the final days of the year to prepay 2018 property levies before a cap on deductions for state and local taxes comes into effect. One option: tapping home-equity lines or securities-backed loans to lessen the pain of a lump-sum outlay.

Lenders including Bank of America Corp. and SunTrust Banks Inc. aren’t introducing specific products to solve the last-minute problem but are pointing clients to the credit they already have. Counties in several states are scrambling to produce 2018 bills for individuals after officials in New York and New Jersey ordered local governments to accept prepayment of property taxes.

It is our view that we are in the latter stages of a medium-term cyclical bull market while also being in the early stages of a secular bull market. The introduction of enhanced regulation and less analyst coverage suggests there will be better opportunities for those willing to do their own research. At the same time the prevalence of ETFs and the growth of what I regard as earnings agnostic investing means fewer people are concerned with individual stock recommendations. This situation will eventually cause a problem for markets because index investing overlooks problems evolving in all but the largest shares in a basket of securities. However, it could be years before the full extent of these changes plays out.

Concurrently one of the unintended consequences of the US tax code will be to ensure that wealthy people with significant assets will likely take on more debt, often against their assets, in an attempt to minimize their tax liability. These developments suggest a situation could evolve over the coming years where the stock market is even more dependent on the financial well-being of consumers while simultaneously being less informed about the condition of the wider market.

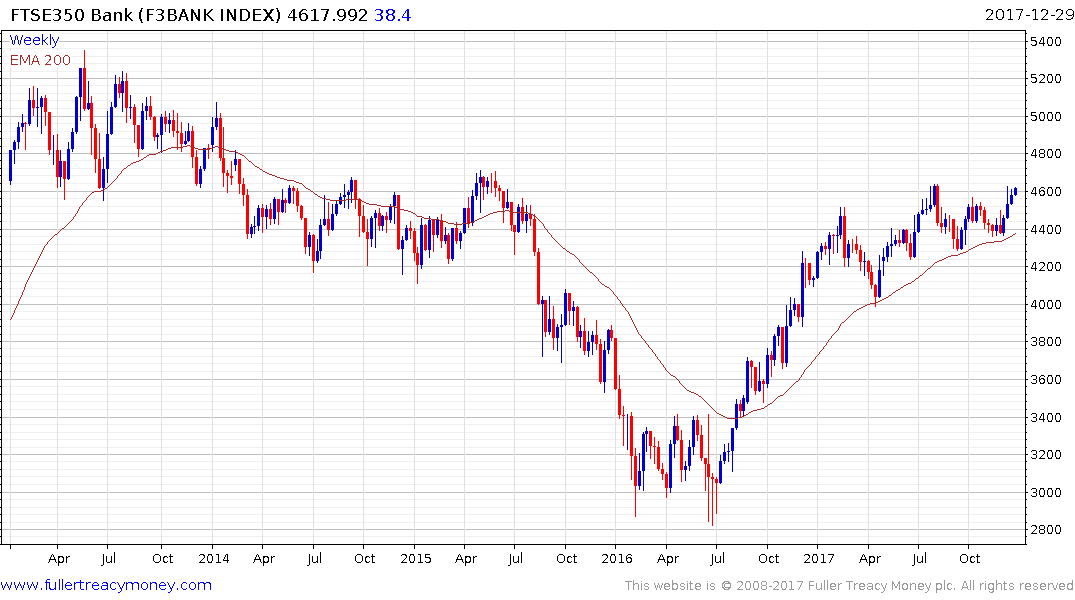

Meanwhile the FTSE-350 Banks Index is firming from the region of the trend mean and a sustained move below it would be required to question potential for addition medium-term upside.