What is Quality?

This report by Michael Hunstad for Northern Trust may be of interest to subscribers. Here is a section:

Higher quality stocks—as identified by the Northern Trust Quality Score (NTQS) definition—tend to outperform lower quality stocks and do so with considerably less risk. This phenomenon is seen across domestic, international developed and emerging markets.

Unlike value or size, there is no single generally accepted definition of an equity quality factor. Although a wide range of attempts have been made to define quality, their ability to capture the quality phenomenon has been extremely varied.

Much of the difficulty in defining quality stems from the lack of a theoretical justification. Classic models such as CAPM suggest the quality phenomenon should not exist so we lack a practical framework with which to form a definition. However, these models make restrictive assumptions such as uniformity of investor risk posture.

On the other hand, our model of heterogeneity in investors’ views toward risk does a better job of explaining the quality phenomenon as well as the asymmetry of returns to quality during crises and recessions.

Heterogeneity of risk postures suggests risk-seeking investors drive up the price of lowquality/ high-risk stocks until their expected values are negative. Risk-averse investors gravitate toward low-risk stocks where positive expected values, i.e., positive risk premia, are an equilibrium condition.

With this guidance we can define quality as those features of a company that appeal to risk-averse investors – a definition that is inherently multidimensional and will vary by market segment.

With metrics encompassing multiple dimensions of quality, the NTQS has performed exceptionally well relative to other alternative definitions. Implementation of Northern Trust’s quality philosophy, while integrated into the consistent framework that underlies our active equity products, varies by strategy and market segment.

Tactically rotating in and out of quality is impractical since “junk rallies” are tied directly to macroeconomic cycles and are, hence, even more difficult to predict. Further, most of the return for holding low-quality names is concentrated into a few, relatively brief periods which are easily missed with factor rotation.

?The quality and low-volatility phenomenon are only partially related. While there is strong overlap between low quality and high-volatility stocks, there is only a weak relationship between high quality and low-volatility stocks. Thus, the two phenomena are fundamentally different.

Here is a link to the full report.

Quality is a poorly defined term, but is a characteristic investors tend to prize more than traders. When we created the Autonomies designation, it was with a view to finding companies that have grown into truly international businesses.

Today’s multinationals are in many respects globally mobile, not least in where they choose to pay taxes, but also in terms of where their respective processes are centred. As truly global companies their revenue is sourced internationally and is less focused on the country they originated in. Together with the fact that they generally have sound balance sheets and competent management structures, the Autonomies share a number of characteristics with “quality” companies.

One point from the above report that caught my attention was in the assumption that risk appetites represent a constant. When we look at the market from a behavioural perspective we come to realise that this is not the case. Investor perception of risk tends to be highest following a steep decline and lowest following a steep advance. How an asset has performed directly influences perceptions of risk and therefore investor behaviour.

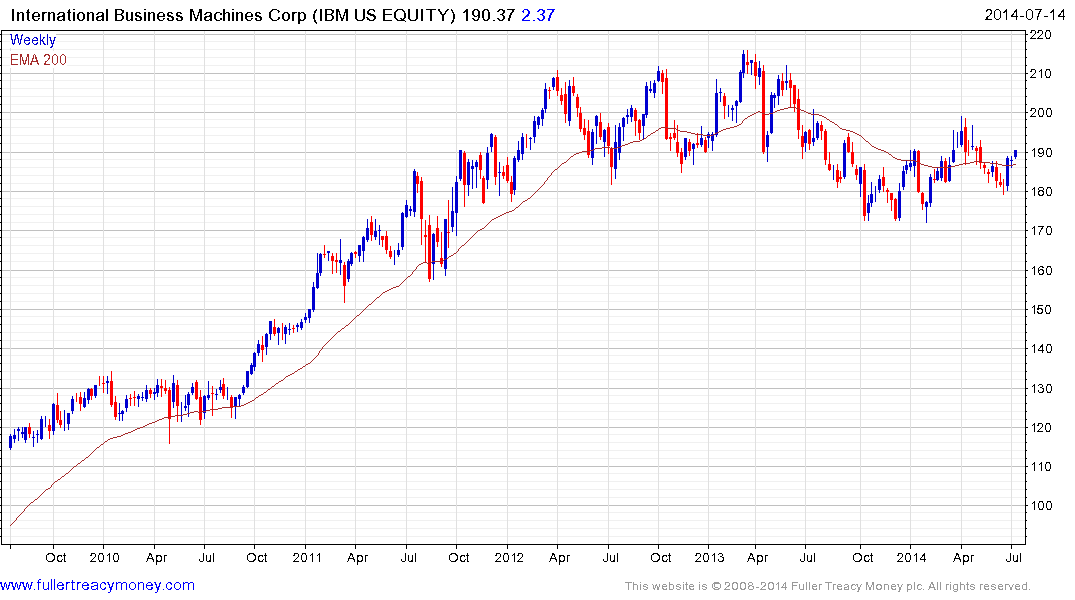

By many measures IBM is a quality company and yet the share has been ranging for near two years. Amazon eschews profits for market share. As a result its fundamentals are troublesome for conventional metrics. However, it has outperformed by a wide margin. Both are Autonomies but only one could be described using quality metrics.

Is it possible then for a relatively new high growth company to also be a quality company? Using fundamental data that rely on historic records the answer is probably no. However if we equate Autonomy-hood with quality for the purposes of this argument then we can answer in the affirmative.

Back to top