What do quant strategists have to say about the decline in markets yesterday?

Thanks to a subscriber for this excerpt from Marko Kalanovic’s "Flash Crash, Flows and Investment Opportunities" at JPMorgan:

Here is a section from the note:

"In last week's note, we noted that volatility, at the time, was not sufficient to trigger systematic strategy de-risking. On Friday, the market dropped ~2% on a day when bonds were down ~40bps. The move on Friday was helped by market makers' hedging of option positions (as gamma positions turned from long to short midday). Friday's move, on its own, was significant as it pushed realized volatility higher, which is a signal for many volatility targeting strategies to de-risk. Anecdotally, broad knowledge about the risk of systematic selling kept many investors fearful and waiting on the sidelines (both in equity and volatility markets). Midday today, short-term momentum turned negative (1M S&P 500 price return), resulting in selling from trend-following strategies. Further outflows resulted from index option gamma hedging, covering of short volatility trades, and volatility targeting strategies. These technical flows, in the absence of fundamental buyers, resulted in a flash crash at ~3:10pm today. At one point, the Dow was down more than 6%, and later partially recovered. After-hours, the VIX reached 38 and futures more than doubled-it is not clear at this point how this will reflect on various short volatility products (e.g., some volatility ETPs traded down over 50% after hours).

Today's large increase of market volatility will clearly contribute to further outflows from systematic strategies in the days ahead (volatility targeting, risk parity, CTAs, short volatility). The total amount of these outflows may add to ~$100bn, as things stand. However, we want to point out the massive divergence between strong market fundamentals and equity price action over the past few days. The large market decline over the past few days will likely draw fundamental investors and even trigger pension fund rebalances (those that rebalance on weight thresholds). We also want to highlight a strong probability of policy makers stepping in to calm the market.

Rapid sell-offs, such as the one today, can also be followed by market bounce backs as liquidity gets exhausted by programmatic selling. With next year P/E on the S&P 500 now below 16, further positive impacts of tax reform and stabilization of bond yields (e.g., note the current record level of CFTC bond short positions), we think that the ongoing market sell-off ultimately presents a buying opportunity."

Credit Suisse is redeeming its short volatility (VelocityShares Daily Inverse VIX Short-Term ETN – XIV) not least because its indicative value was around 20% of the closing price in afterhours trading. ETN are not ETFs. They are perhaps best compared to swap contracts but often contain covenants allowing the issuer to close the trade at times when it is in their interest such as yesterday.

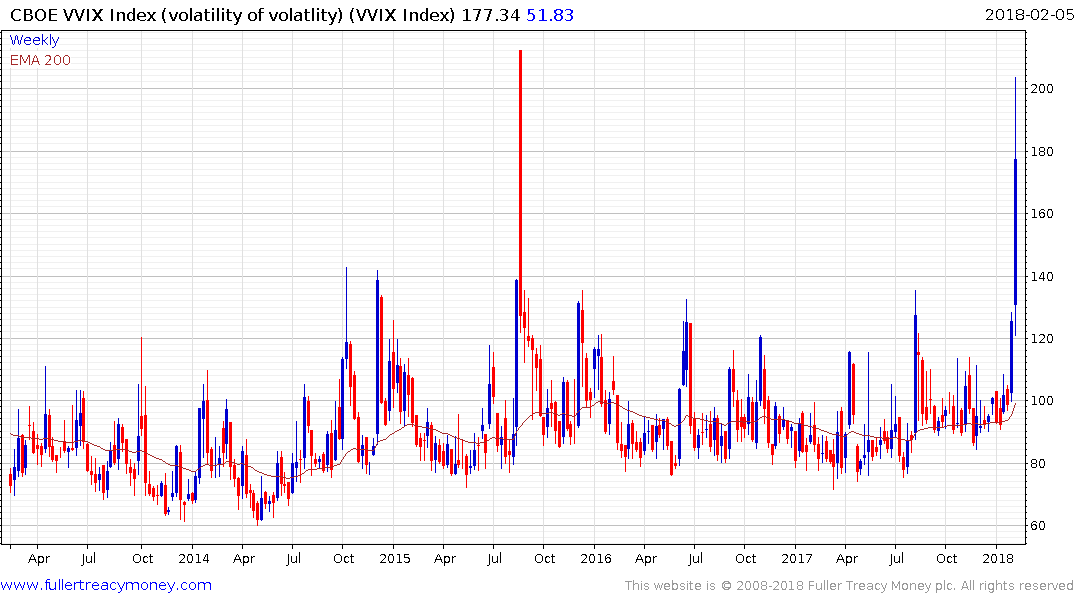

This liquidation of short volatility ETNs resulted in a spike higher for volatility and it continued into the afterhours market. However, with the closure of these funds it removes a potent source of additional demand for long VIX exposure since the short covering will be reduced. Importantly the Volatility of the VIX fell today as evidence of David’s long-held maxim that “a crisis has to be seen to be getting worse for it to continue to have as strong an influence on markets”.

At present the messy unwind of short volatility trades appears to be in hand. However, the damage to sentiment is real and suggests a peak of at least near-term significance. Even in the flash crash of 2010 the market rallied subsequently but ranged in a volatile manner for six months before surmounting the previous peak. It is not at all beyond the bounds of possibility that we see something similar on this occasion and particularly for shares that continue to sport wide overextensions relative to their respective trend means.