West Uses Russia's Central Bank Against Putin

This article from Bloomberg may be of interest to subscribers. Here is a section on where Russia’s gold is:

But here’s the rub: Most of Russia’s reserves are in institutions outside of the country. As my Bloomberg News colleagues have charted, 78% of that $630 billion is held in China, France, Japan, Germany, the U.S., the U.K. and elsewhere. And the West just told Russia that it plans to block its central bank’s access to those funds. Think about that. The West is attempting to disarm Russia by crippling its financial autonomy. It’s a move Putin may not have anticipated and should give him pause.

And

Bloomberg News estimates that in a worst-case scenario, Russia will retain access to only $230 billion of its $630 billion hoard. Does that give Putin enough firepower to continue waging financial warfare while he vandalizes and terrorizes Ukraine? Yes, it does, particularly as Russia continues to haul in revenue from oil and gas sales. But, at a minimum, it drastically shortens how long Putin can continue marauding without economic and political consequences at home.

The West, to use the collective term, is using the most powerful non-military weapon at its disposal. Depriving Russia of the financial architecture it relies on to conduct daily operations is a major step forward. I was wondering in Friday’s big picture video what it was going to take to get Europe to rally around the idea of cutting Russia out of SWIFT. It turns out it was just a matter of time.

Sanctioning the central bank and cutting the major banks out of SWIFT is a major first step towards disincentivising Vladimir Putin’s appetite for the invasion. The next vital step is cutting off the regime’s ability to earn fresh income from commodity sales. That’s a lot easier said than done and it will inevitably come with repercussions for economic growth; particularly in Europe. Banning repayments on foreign currency debt and exports of hard currency represent Russia’s initial counter volley against sanctions.

If there is even a hint of liquidity tightening becoming a problem in response to tit for tat sanctions, the world’s central banks will not hesitate to provide as much liquidity as is required. That may also come with greater control over how bond yields perform. Yield curve control in service to a war effort is not unusual and control over how banks making lending decisions is also a possibility.

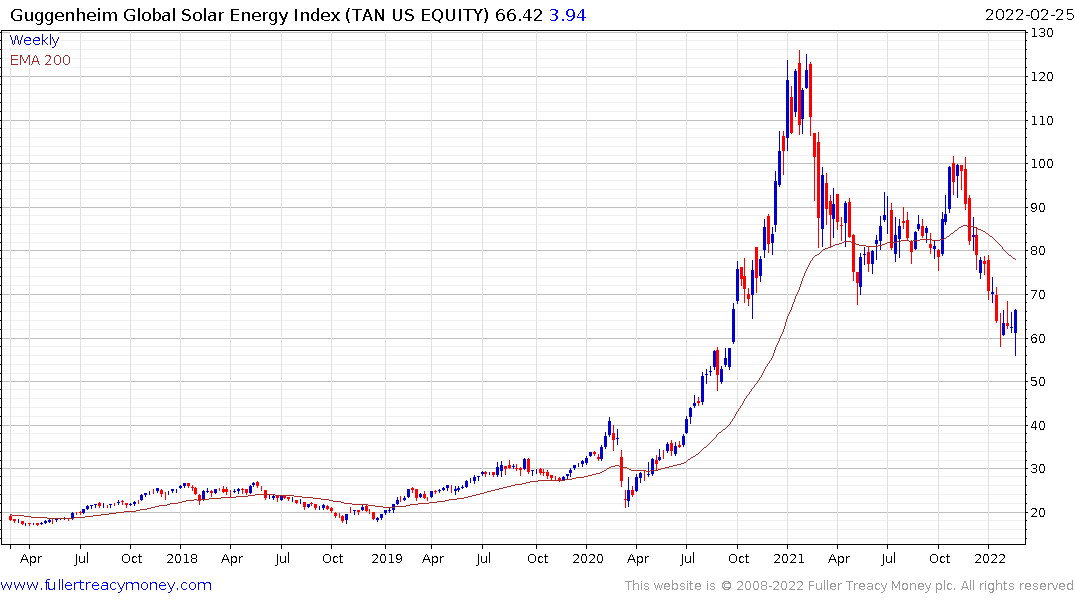

The rebound is solar, battery and electric vehicle stocks today suggests investors have concluded the renewables sector is likely to be a major beneficiary of efforts to disengage from reliance on Russia. Most renewables might be intermittent suppliers of electricity but offer the promise of energy independence which is invaluable in current circumstances.

Oil shares remain firm since an oil produced outside Russia now has a premium. That’s certainly thrown new impetus onto the negotiations with Iran.

BP pulled back sharply on the write down of its holding in Rosneft but rebounded intraday and from the region of the October peak and remains in a reasonably consistent uptrend.

BP pulled back sharply on the write down of its holding in Rosneft but rebounded intraday and from the region of the October peak and remains in a reasonably consistent uptrend.

Occidental Petroleum surged on a large buyback announcement.#

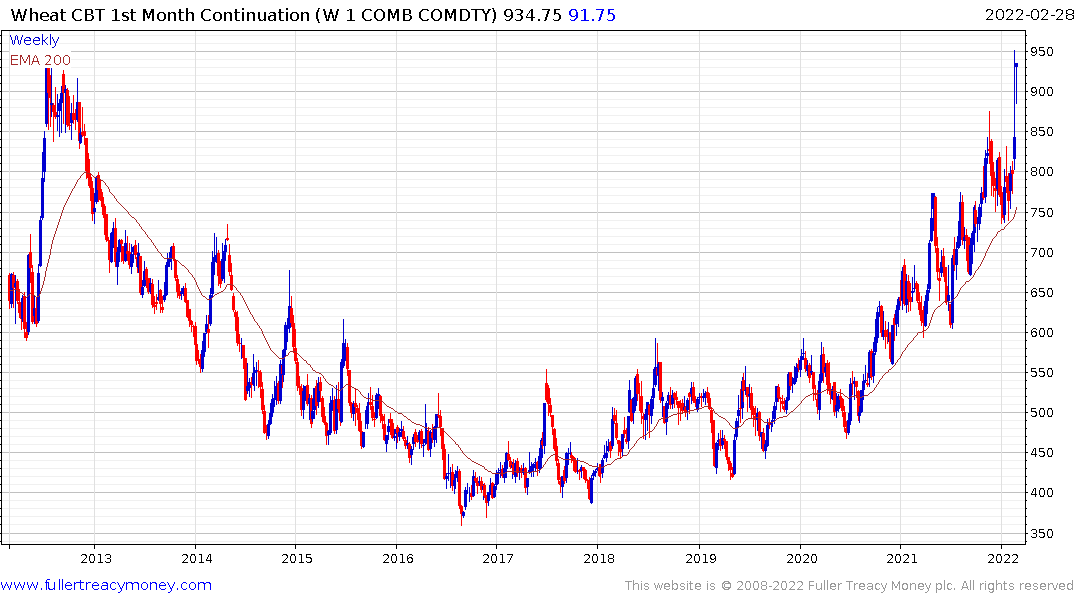

Wheat prices reversed Friday’s downward dynamic to retest the peak and the medium-term uptrend is still intact.

This report from Goldman Sachs with some discussion on the context for the war and its implications may also be of interst.

Back to top