Weekly Warm-up: More Stimulus May Mean Less for Markets

Thanks to a subscriber for this report from Mike Wilson at Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

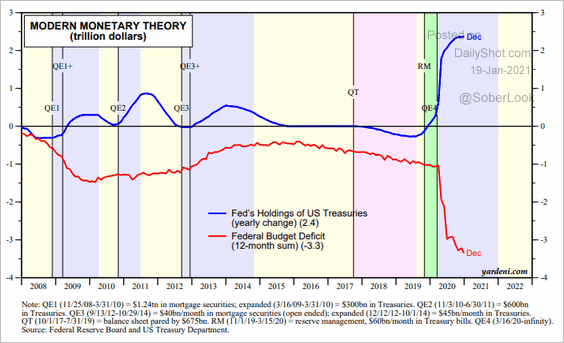

With such excess, it seems straightforward how inflation is likely to surprise on the upside once this money starts going into the economy, rather than investments. Yet, we continue to hear many clients push back on this idea with the consensus still arguing lower for longer on long term interest rates. The argument now is that whatever inflation we get this year as demand exceeds supply will prove to be transient and/or temporary. This will allow the Fed to keep its guidance on rates and current asset purchases unchanged. Another way of thinking about it is that there is still quite a bit of skepticism about the Fed's ability to reach its goal of above trend inflation for any sustainable period of time. Ironically, it's exactly this complacency around policy that should allow inflation to surprise on the upside.

Having said that, 10-year inflation breakevens have moved meaningfully higher and currently sit above2% for the first time in over two years, a time when the economy was growing about 2 percentage points lower than what we are forecasting for 2021. The disconnect is with nominal and real 10 year yields, not breakevens, and that is the biggest risk and opportunity for equity investors in our view. Equity markets seem to agree with stocks levered to inflation and higher back end rates outperforming significantly since the lows last March and especially since the announcement of vaccines in early November. Additional stimulus recently passed and proposed on the back of what is now a Democratically controlled Congress has simply turbocharged the trends we have been favoring — i.e. small caps, cyclicals, commodities and rate plays.

When looking at the equity markets relative to rates specifically, we can see that a wide divergence has opened up. Using our cyclical/defensive ratio, it's very clear that equity markets are trading ahead of rates markets, as they normally do (Exhibit 5). However the spread has become so wide, something has to give — either cyclicals need to go through a period of underperformance or rates need to catch up in a hurry. We have been in the latter camp and while rates have finally started to move higher, it's happening more slowly than we expected which may be the best outcome for stocks more broadly as we will discuss later.

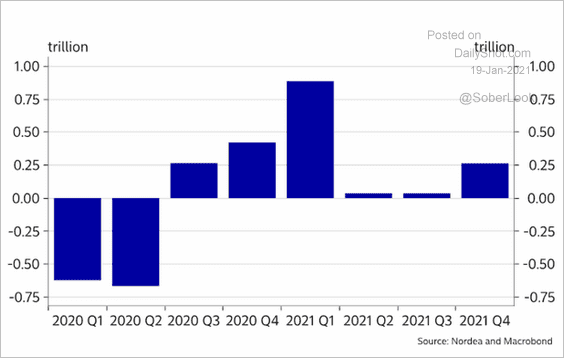

The US government expects to issue about $1 trillion more bonds than the Fed currently expects to buy in 2021. Without a clear move to boost the amounts committed to the bond buying program yields will inevitably rise. It’s a simple supply and demand argument. Of course, no one really believes the Fed will fail in its commitment to provide assistance while unemployment is well above trend.

The timing of these transitions will probably be influenced by the performance of the stock market. Risk appetite is still riding high and as long as that is the case the Fed is unlikely to act in a big way.

As inflationary pressures mount, led by commodities and big-ticket items likes homes and cars, central banks everywhere are getting what they desired. They are likely to ensure interest rates stay below inflation for years to come.

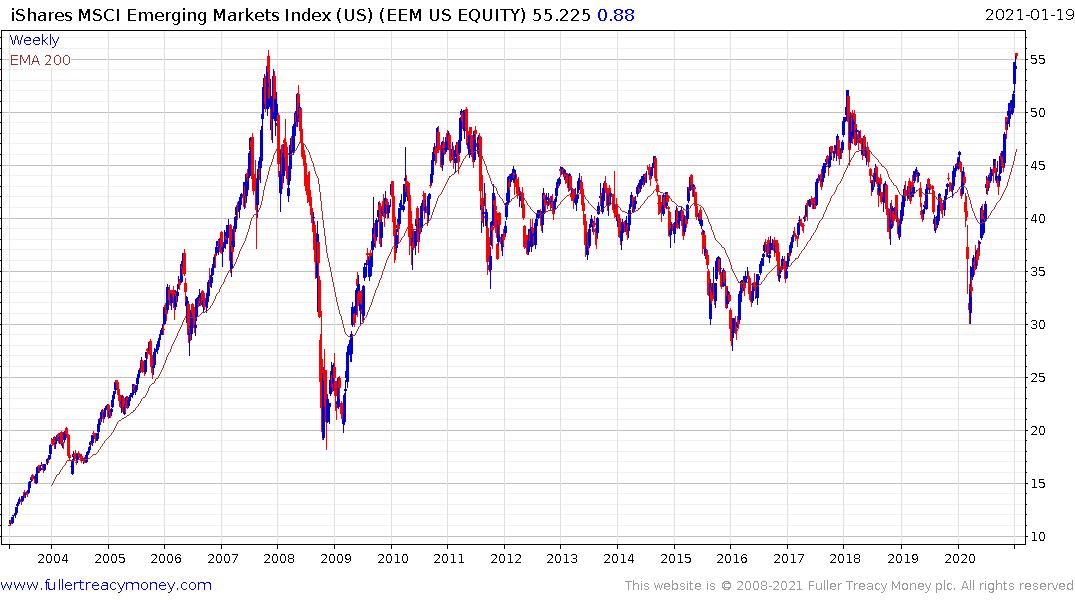

That’s putting downward pressure on the Dollar but more broadly raises the prospect of more aggressive competitive currency devaluation. That’s positive for emerging markets over all and particularly those markets that came through the pandemic in robust form.

The MSCI Emerging Markets Index is on the cusp of completing a long-term base formation.

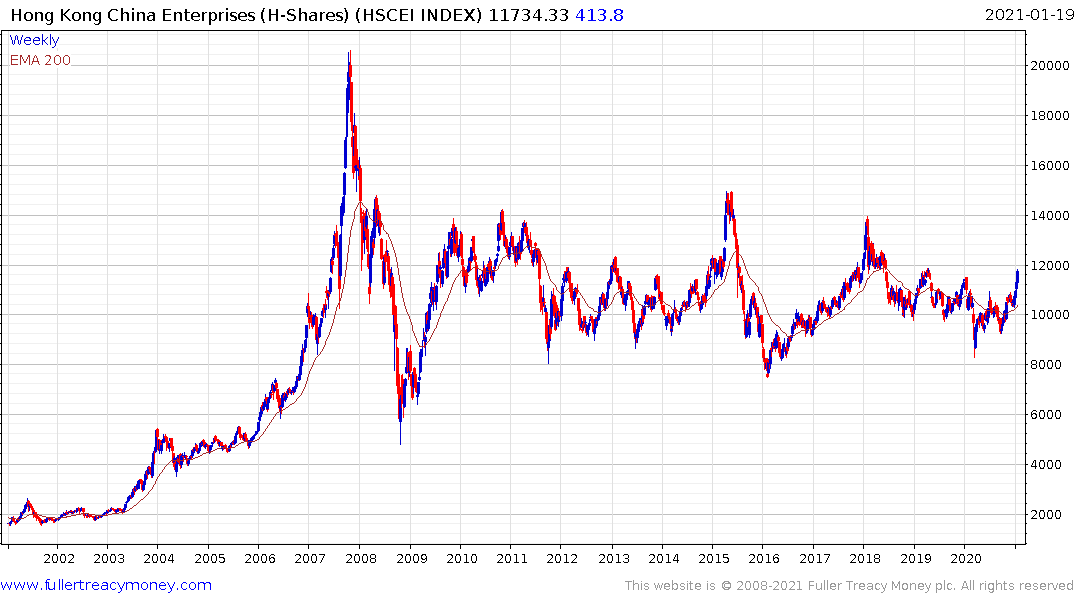

The Hang Seng China Enterprises Index rallied last week to break a three-year downtrend and is improving on that performance this week.

The China Fund Inc has a long record of paying special dividends and continues to extend its uptrend.

The Wisdomtree India Earnings Fund is now also breaking out of a decade-long base.