Weekly Digest: return of the toaster

Thanks to a subscriber for this lighthearted note on monetary policy by John Wyn-Evans at Investec. Here is a section:

I apologise to those of you with long memories, but I suspect many will have forgotten, and there are also a lot of new readers. I’m sure you have all encountered on holiday or a business trip one of those “conveyor belt” toasters. Almost invariably you load up the bread and it reappears, what feels like an interminable period later, in much the same state – just a piece of cold bread. Repeating the process produces the same result, so you turn the heat up a notch, which leaves the bread lightly tanned, but still not toasted. By now, getting rather agitated, not to mention the impatient queue growing behind, you turn the dial to “max” and send the bread on another voyage. By the time smoke starts to billow from the machine, the bread is too far in to retrieve, and it is not unknown for it actually to be on fire by the time it emerges.

AndThe Federal Reserve has already reached for the fire extinguisher, having raised interest rates five times and also started to reverse its QE. But that is no match for the central banks of Europe and Japan who still want their toast properly browned. The aggregate global central bank balance sheet is still growing, and will continue to do so for the rest of 2018 on current projections, even if at a slower rate than historically. It is this endless tide of liquidity that promises (threatens?) the possibility of a euphoric “melt-up” in equity markets. While we might all profit, it would, in all probability, leave equities worryingly overvalued and vulnerable to a sharp reversal.

Here is a link to the full report.

Here is a section from the report.

I apologise to those of you with long memories, but I suspect many will have forgotten, and there are also a lot of new readers. I’m sure you have all encountered on holiday or a business trip one of those “conveyor belt” toasters. Almost invariably you load up the bread and it reappears, what feels like an interminable period later, in much the same state – just a piece of cold bread. Repeating the process produces the same result, so you turn the heat up a notch, which leaves the bread lightly tanned, but still not toasted. By now, getting rather agitated, not to mention the impatient queue growing behind, you turn the dial to “max” and send the bread on another voyage. By the time smoke starts to billow from the machine, the bread is too far in to retrieve, and it is not unknown for it actually to be on fire by the time it emerges.

And

The Federal Reserve has already reached for the fire extinguisher, having raised interest rates five times and also started to reverse its QE. But that is no match for the central banks of Europe and Japan who still want their toast properly browned. The aggregate global central bank balance sheet is still growing, and will continue to do so for the rest of 2018 on current projections, even if at a slower rate than historically. It is this endless tide of liquidity that promises (threatens?) the possibility of a euphoric “melt-up” in equity markets. While we might all profit, it would, in all probability, leave equities worryingly overvalued and vulnerable to a sharp reversal.

The total assets accumulated on the balance sheets of the Federal Reserve, ECB, BoJ and PBoC, when redenominated to US Dollar’s stand at $20.5 trillion. That’s an increase of $500 billion since December.

A refrain in the subscriber’s audio & video over the last few years is that capital is both global and mobile. Central bank printing in one location flows out in the world in search of the most attractive opportunities to capture yield, capital and currency market appreciation. When we think of the fact that the advance off the 2009 lows was liquidity fuelled we don’t have to look far for where that liquidity came from.

At the same time, we have to consider that the market is a discounting mechanism. The Fed has raised rates, the UK reversed it cut after the Brexit vote and Canada raised in December. Eurozone inflation is not above target but the ECB is increasingly intimating that it will have completed a tapering operation by September. Concurrently Japan has been among the greatest contributors of liquidity and is increasingly close to achieving its inflation goals. There is the real possibility that 2018 will see a meaningful peak in the total assets held on central bank balance sheets. That will remove a source of demand from the stock market.

While not an animating factor in the pullback seen this week, the fact the USA is now adopting large deficit spending measures is introducing additional supply into the market at just the same time central banks are beginning to buy fewer bonds. With wage growth finally picking up amid record low unemployment, this has the makings of a supply elasticity meets shrinking demand environment which is sharply bearish for the bond market.

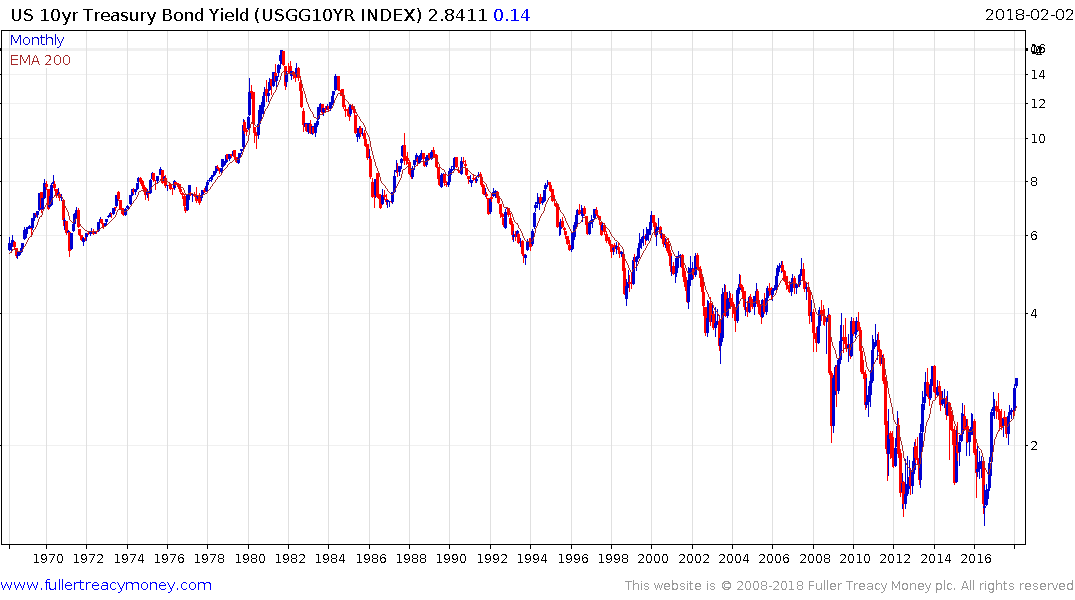

10-year Treasury yields are rallying towards the 3% level which offered support during the taper tantrum in 2013. That’s an important level for the market because a sustained move above it would signal a change to the dynamic of the market. Yields have been in a base formation since 2011 and 3% is the top of that base.

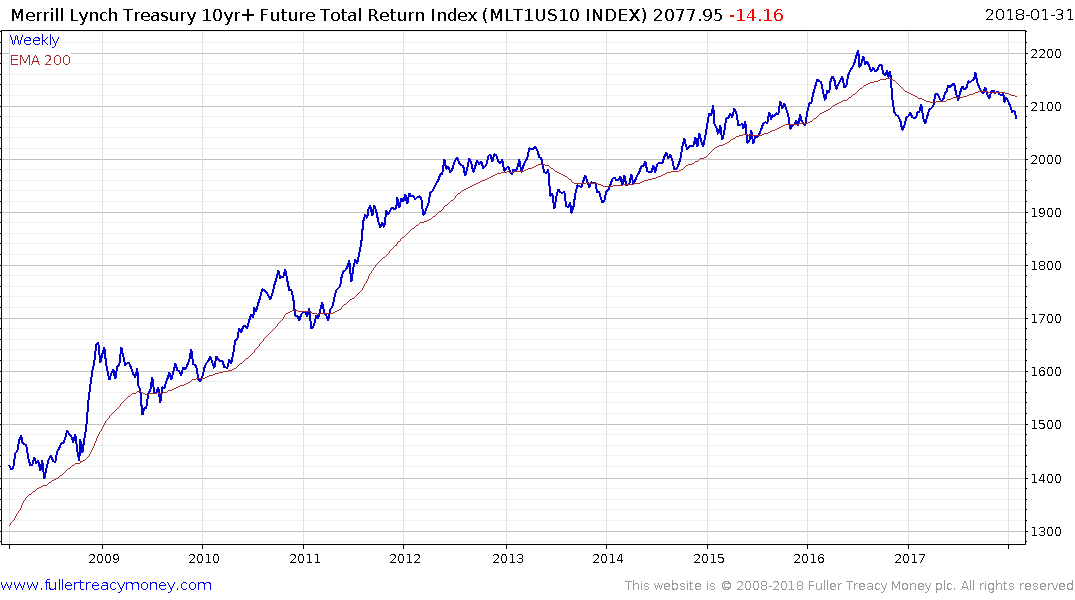

The Merrill Lynch 10yr+ Treasuries Total Return Index has evolving Type-3 top formation characteristics. A sustained move below 2050 would complete the top formation and signal the beginning of a secular downtrend.

It’s when interest rates rise that investors begin to focus on valuations and the expected return on assets at given prices. The pullback following accelerations we are now seeing on stock markets is an initial sign of some profit taking as these factors are assess by investors.

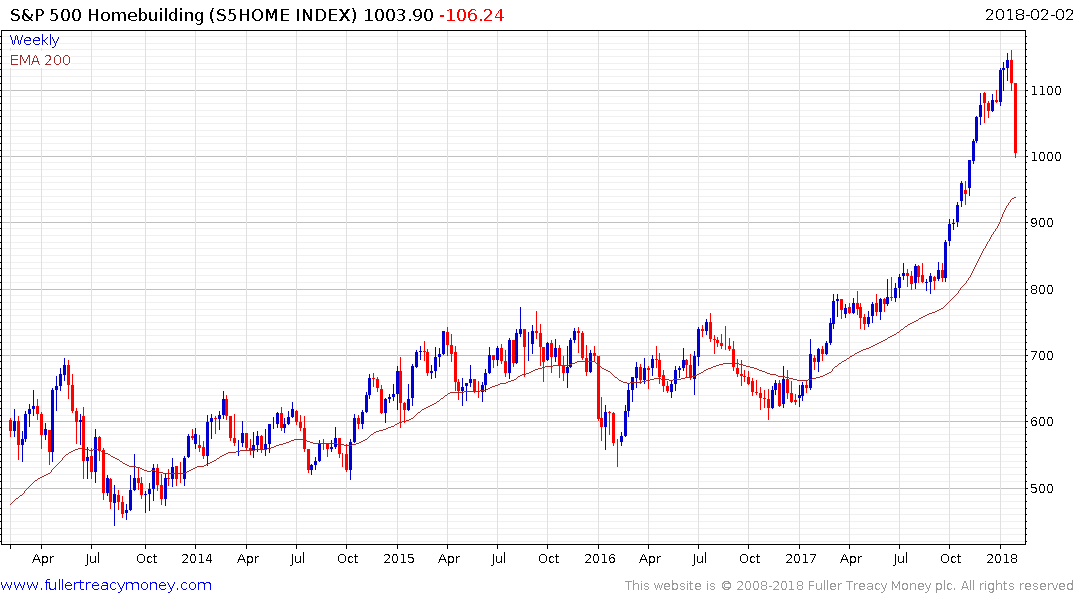

The Homebuilding sector for example is heavily exposed to rising interest rates and pulled back sharply this week to follow through on last week’s key reversal.