Weekend Reading October 31st 2014

Thanks to a subscriber for this list of mostly academic reports which we can reasonably assume constitute at least some of the reading of decision makers.

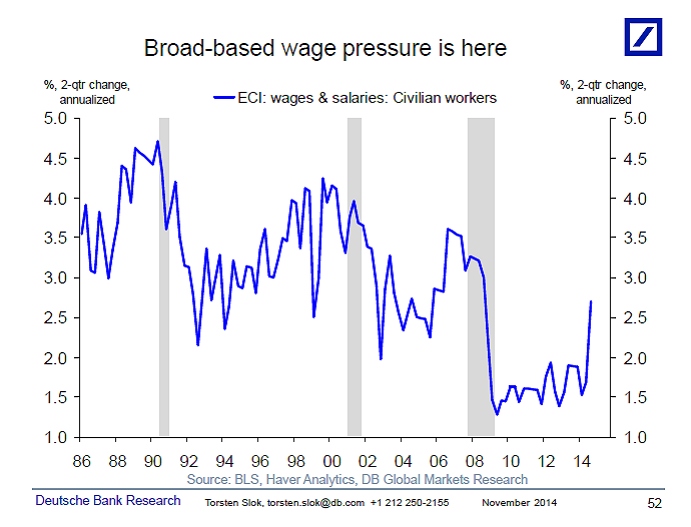

Is this the indicator that will finally turn Fed Policy?

Fixed income investors should be paying attention to the rising trend in wages because the FOMC will not be ignoring it. In other words, it is time to protect your portfolio against higher rates.

“Can Macroeconomists Get Rich Forecasting Exchange Rates?”

The results indicate that forecast combinations help to improve over benchmark trading strategies for the exchange rate against the US dollar and the British pound, although the excess return per unit of deviation is limited.

Fed: “The Impact of Missed Payments and Foreclosures on Credit Scores”

This paper debunks the common perception that “foreclosure will ruin your credit score.” Using individual-level data from a credit bureau matched with loan-level mortgage data, it is estimated that the very first missed mortgage payment leads to the biggest reduction in credit scores. The effects of subsequent loan impairments are increasingly muted. Post-delinquency foreclosures have only a minimal effect on credit scores. Moreover, credit scores improve substantially a year after borrowers experience 90-day delinquency or foreclosure. The data supports one possible explanation of this improvement: the absence of mortgage payments relaxes the borrowers’ budget constraint, allowing them to restore other forms of credit.

Fed: “Is the United States Poised for a Rebound in the Labor Force Participation Rate?”

The U.S. labor force participation rate has declined sharply since 2007—far faster than can be explained by demographic shifts in the population. This brief analyzes the re-entry probability for individuals who exit the labor force as well as the financial, demographic, and employment characteristics of these individuals. The vast majority of individuals younger than 45 years of age re-enter the labor market within four years of exiting; however, the re-entry rate drops substantially for 50– 54 year-olds and 55–59 year-olds. Those individuals who exit the labor market appear more marginally attached to the labor force, and they have less financial resources to sustain themselves during long periods of being out of work. There is also some evidence that intra-household labor market substitution occurs when the household head exits the labor market first.

BIS: “The impact of liquidity regulation on banks”

To the best of our knowledge, this is the first study to estimate the effect of liquidity regulation on bank balance sheets. It takes advantage of the fact that not all banks were made subject to tighter liquidity regulation by the UK Financial Services Authority (FSA) in 2010. Under this new regulation a subset of banks operating in the UK were required to hold a sufficient stock of high quality liquid assets (HQLA) to withstand two scenarios of stressed funding conditions. We find that banks adjusted both their asset and liability structures to meet tighter liquidity requirements. Banks increased the share of HQLA and funding from more stable UK non-financial deposits while reducing the share of short-term intra-financial loans and short-term wholesale funding. We do not find evidence that the tightening of liquidity regulation had an impact on the overall size of bank balance sheets or a detrimental impact on lending to the non-financial sector either through reduced lending supply or higher interest rates on loans. Overall, in response to tougher liquidity regulation, banks replaced claims on other financial institutions with cash, central bank reserves and government bonds - and so reduced the interconnectedness of the banking sector without affecting lending to the real economy.

OECD: “On the Effectiveness of Exchange Rate Interventions in Emerging Markets”

we find that on average intervention is effective in moving the real exchange rate in the desired direction, controlling for deviations from the equilibrium and short-term changes in fundamentals and global financial variables.

IMF: “Sovereign Debt Composition in Advanced Economies”

We examine how the composition of public debt, broken down by currency, maturity, holder profile and marketability, has responded to major debt accumulation and consolidation episodes during 1900-2011.

“The Relevance of International Spillovers and Asymmetric Effects in the Taylor Rule”

This paper provides evidence that both international spillovers, for instance international dependencies in the interest rate setting of central banks, and nonlinear reaction patterns can offer a more realistic specification of the Taylor rule in the main industrial countries.