Weekend Reading May 16th 2014

Thanks to a subscriber for this edition of Deutsche Bank’s Insights in 140 Words as well as a number of mostly academic reports. Here is a section:

Market extremes - The problem with historical comparisons when interpreting markets is they can be useless for a long time - until suddenly they explain everything. As the S&P 500 briefly touched 1900 this week its capitalisation overtook the annual output of the US economy. The ratio of market cap to output now lies squarely between 92 and 125 per cent, the cyclical peaks of 2000 and 2007 respectively. Those worrying about the current rally also point to Shiller’s cyclically adjusted price to earnings multiple at 25 times - well above the long-term average of 17. The trouble is that the last two times the CAPE crossed 25 (in 1996 and 2003) the bull market was just getting started and ran for another four years. Similar 'extreme but may go extremer' arguments exist for volatility, eurozone periphery sovereign yields, high-yield corporate bond spreads and more.

Here is a link to the full report.

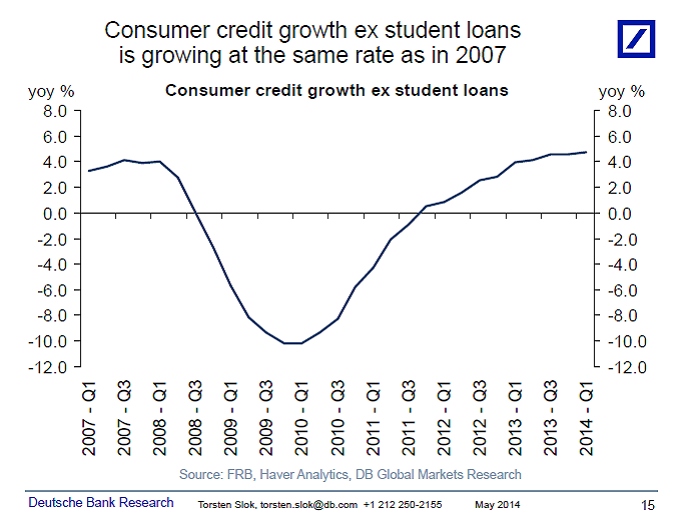

This graphic of consumer credit growth is particularly noteworthy since it is now back to where it was in 2007.

Fed: Can investors use momentum to beat the US Treasury market?

BIS: The Exit from Non-conventional monetary policy: What challenges?

Fed: When are equity investors paid to take risk?

IMF: Save havens, feedback loops, and shock propagation in global asset prices

ECB: The effect of G20 Summits on global financial markets

Fed: How Important Are Hedge Funds in a Crisis?

Fed: Forecasting Stock Market Crashes

How Do Financial Market Participants Process Central Bank News?

Fed: Inflation Expectations and the News

Heterogeneity and Unemployment Dynamics

IMF: Global Liquidity