Weekend Reading April 24th 2015

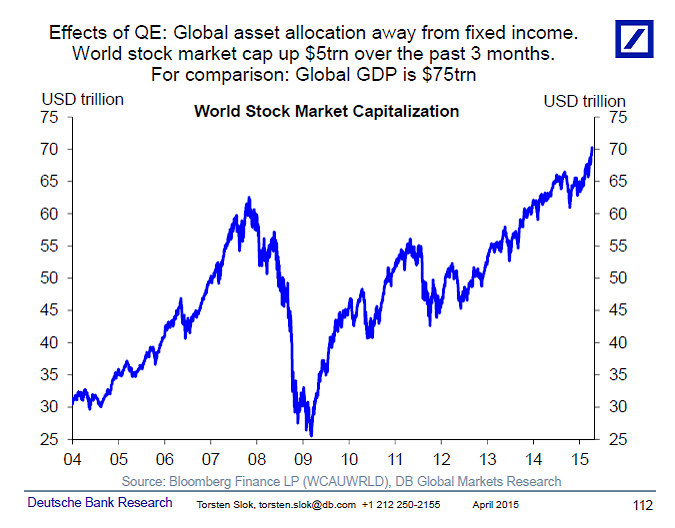

People say that “The Fed can never raise rates because higher rates in the US will push the dollar up, which will hold back US growth and inflation”. It is correct that the dollar has appreciated substantially since last summer. But over the same period oil prices have declined, US interest rates are lower, and over the past three months global stock markets have increased by $5trn, see chart below. In other words, next time someone wants to talk to you about the negative effects of the rising dollar please ask them how the negative effect from the dollar compares with the positive effects of lower oil prices, lower interest rates, and higher stock prices. Bottom line: There is more going on than the rise in the dollar and I think the consensus is underestimating the positive impact of the ongoing rise in global stock markets on global growth.

Our GEP this week covers a topic that comes up in all our client conversations at the moment. It is a must-read for both fixed income and equity investors.

GEP: Declining liquidity: The markets and the Fed

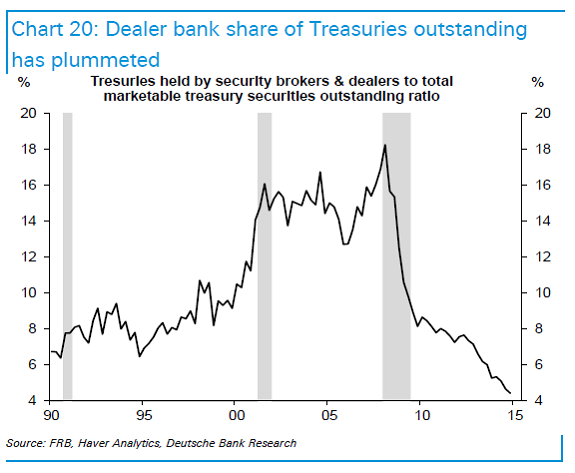

What would lower liquidity mean for the real economy? By amplifying the market response to fundamental shocks, lower liquidity can lead to higher rates or wider spreads and more volatility, which will adversely affect economic activity. However, it is difficult to measure the quantitative importance of this effect. Using a vector autoregression we do not find a significant impact of lower Treasury market liquidity on industrial production or employment. But the lack of evidence for this link should not be taken as evidence that market liquidity does not matter for the real economy.

- Although lower liquidity has not translated into broad market impairment so far, liquid markets could quickly turn illiquid in response to a shift in Fed policy or some other shock, which could amplify any adverse market response. As such, we do not think the Fed can ignore potential issues with market illiquidity simply because they are difficult to quantify. But we also acknowledge that it would be difficult to re-calibrate a policy in response to a factor whose impact on the real economy is unknown. Just as the Fed monitors financial stability developments but does not yet factor them directly into monetary policy decisions, we expect they will do much the same with market liquidity developments unless and until they become evidently more problematic.

-----------------------------------------------

Rogoff: “Debt supercycle, not secular stagnation”

Weak, post-Crisis growth has been blamed on secular stagnation. This column argues that the ‘financial crisis/debt supercycle’ view provides a more accurate and useful framework for understanding what has transpired and what is likely to come next. The difference matters. Unlike secular stagnation, a debt supercycle is not forever. After deleveraging and borrowing headwinds subside, expected growth trends might prove higher than simple extrapolations of recent performance might suggest.

Fed: “A Measure of Price Pressures”

This price pressure measure would provide policymakers and markets with a quantitative assessment of the probability that average inflation over the next 12 months will be higher than the Fed’s long-term inflation target of 2 percent.

Fed: “Have Distressed Neighborhoods Recovered?”

During the 2007-2009 housing crisis, concentrations of foreclosed and vacant properties created severe blight in many cities and neighborhoods. The federal Neighborhood Stabilization Program (NSP) was established to help mitigate distress in hard-hit areas by funding the rehabilitation or demolition of troubled properties. This paper analyzes housing market changes in areas that received investments during the second round of NSP funding, focusing on seven large urban counties. Grantees used NSP to invest in census tracts with high rates of distressed and vacancy properties, and tracts that had previously received other housing subsidies. The median NSP tract received quite sparse investment, relative to the overall housing stock and the initial levels of distress. Analysis of housing market outcomes indicates the recovery has been uneven across counties and neighborhoods. In a few counties, there is some evidence that NSP2 activity is correlated with improved housing outcomes.

Fed: “Consumers' Attitudes and Their Inflation Expectations”

This paper studies consumers' inflation expectations using micro-level data from the Surveys of Consumers conducted by University of Michigan. It shows that beyond the well-established socio-economic factors such as income, age or gender, other characteristics such as the households' financial situation and their purchasing attitudes are important determinants of their forecast accuracy. Respondents with current or expected financial difficulties, pessimistic attitudes about major purchases, or expectations that income will go down in the future have a stronger upward bias in their expectations than other households. However, their bias shrinks by more than that of the average household in response to increasing media reporting about inflation. Equivalent results are found during recessions.