Weaker USD, Commodity Rally A Mar/Apr Redux?

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section on sugar:

Investment Thesis

After more than a year of low prices, a shrinking global surplus, coupled with limited reinvestment in cane plantings, should conspire to lift prices YoY in 15/16.Supply

In Brazil, above-normal rain and limited reinvestment in cane fields have lowered the cumulative ATR, the amount of sugar produced per unit of cane crushed, to the lowest in at least 10 years.Demand

Falling sugar prices and increased gasoline taxes have lifted Brazilian hydrous demand to record levels, pulling more of the cane crush away from sugar and toward ethanol production. The sugar mix should fall to the lowest since 2008.Chinese import demand has exceeded expectations over the past year, as falling prices have led to sharp production declines. China’s internal debate on the future of its minimum support price policies should shape import demand in the long term.

Here is a link to the full report.

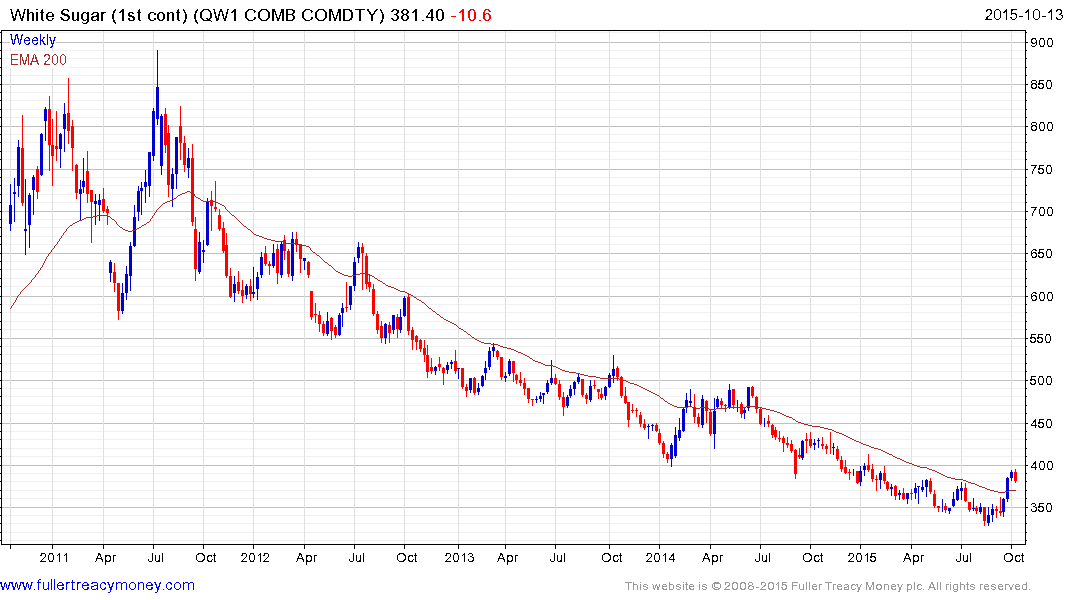

The removal of subsidies for European sugar production, concurrent demand growth for ethanol in gasoline production and demand for sweet treats among the global middle class created the conditions for sugar prices to rally impressively in the last decade. The ensuing boom in planting, particularly in Brazil and India resulted in supply overwhelming even the most ambitious demand forecasts and prices have trended lower for nearly 5 years.

The rally posted over the last month has seen prices push back above the 200-day MA and broke the medium-term downtrend. The real test of whether demand has returned to dominance beyond the short-term will be in how much of the rally can be held following today’s clear downward dynamic which has capped the near-term advance.

.png)