Weaker ad landscape, higher regulatory risk expected to weigh on Alphabet's Q2

This article from S&P Global may be of interest. Here is a section:

Alphabet Inc. is expected to report another quarter of slowing growth as macroeconomic headwinds and intensifying regulatory scrutiny weigh on its core advertising business.

Fears regarding a potential recession are driving many companies to scale back ad budgets, directly impacting Alphabet's growth prospects. The Google LLC parent company faces headwinds from difficult comparisons to 2021 when its revenue growth skyrocketed partly due to a rebound off early pandemic lows.

Alphabet is expected to report second-quarter revenue of $70.10 billion, up 13.3% from the prior year, according to S&P Capital IQ estimates as of July 20. The projected growth rate is down from 23% growth in the first quarter and significantly below Alphabet's performance through 2021.

"A challenging macro landscape and tougher comparisons will lead to a sharp deceleration in growth into the early parts of next year," said Angelo Zino, a senior equity analyst at CFRA Research.

Most companies understand that marketing/advertising are integral to both boosting and sustaining sales. Therefore, if revenue growth is falling at major advertising sellers, that’s a clear reflection of slowing demand within the wider economy. The disappointing manufacturing data last week’s sends the same message.

Alphabet continues to distribute below the 200-day MA and a sustained move back above it will be required to question the consistency of the medium-term downtrend.

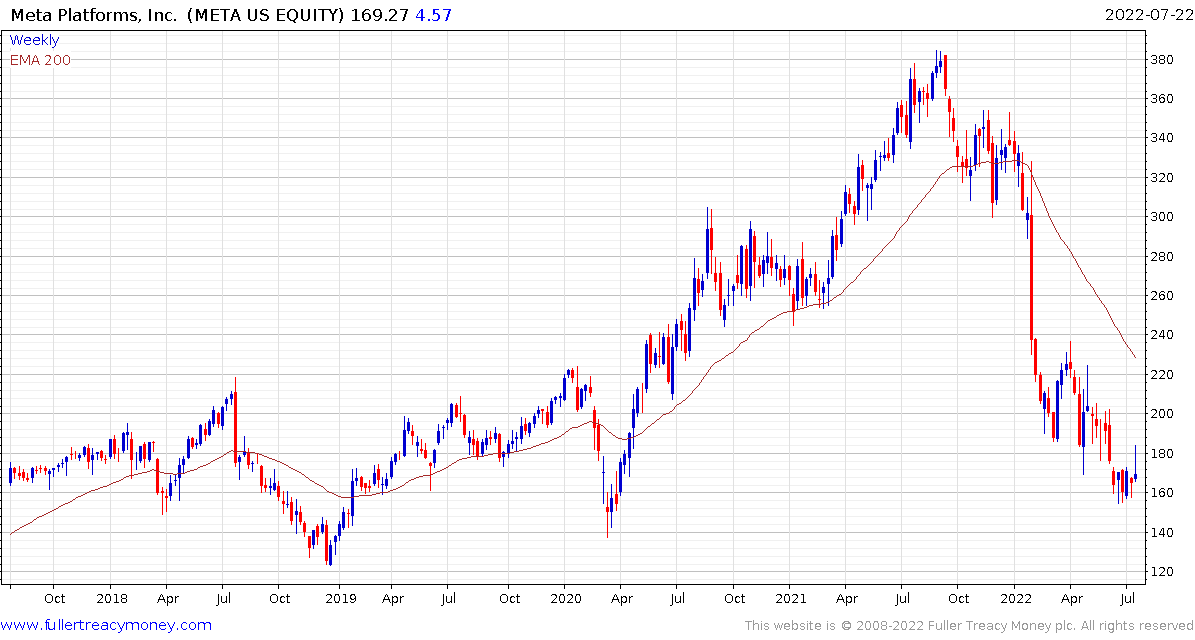

Meta Platforms is back in the region of the 2020 lows but continues to port lower highs and is still in a medium-term downtrend.

Snap extended its downtrend on poor results on Friday.

Amazon has grown its advertising revenue from zero in 2018 to a $30 billion business so it is much more likely to be affected by a slowdown in the sector than was previously the case.

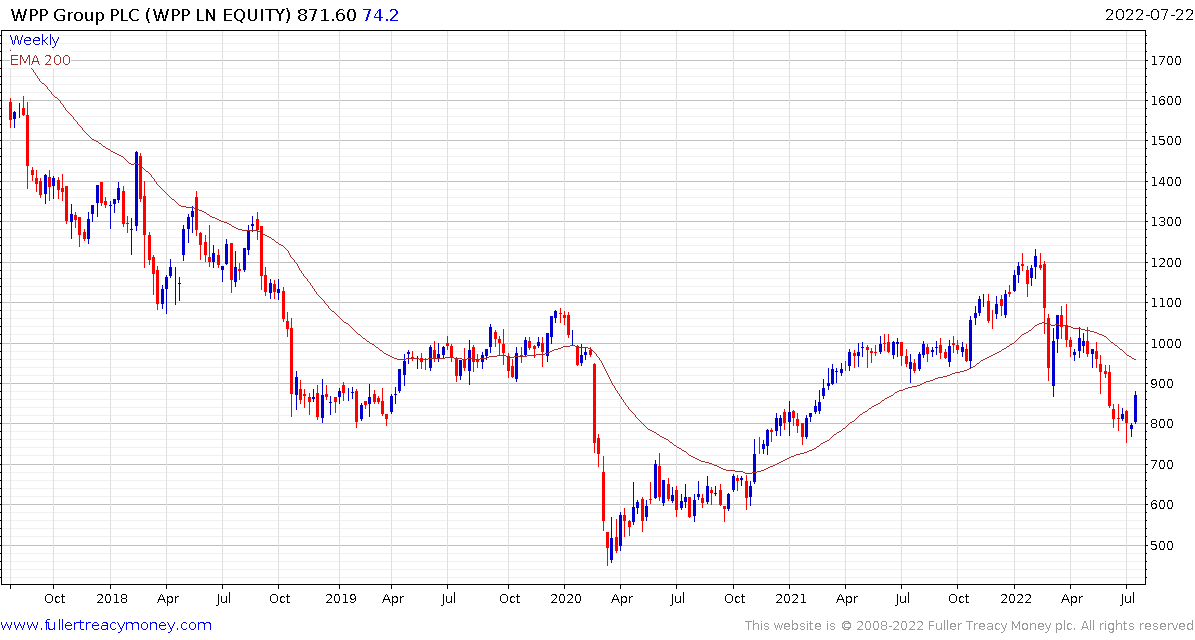

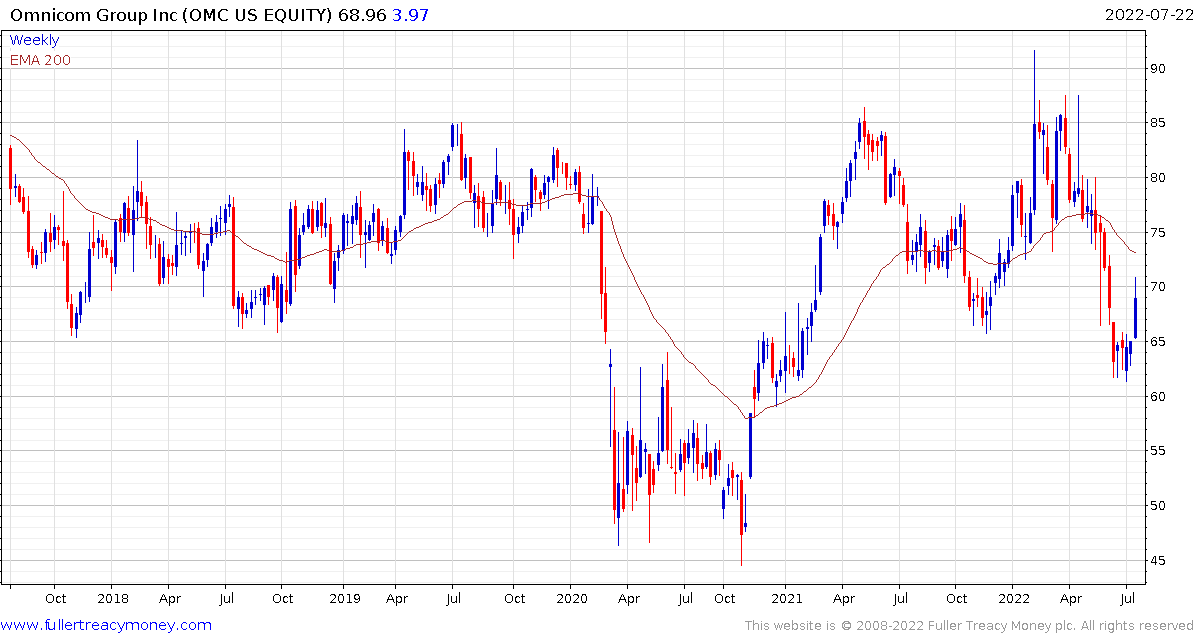

Conventional marketing companies like WPP and Omnicom have lower valuations and competitive yields. They have rebounded over the last couple of weeks but will need to improve on that performance to confirm more than short-term lows.