Weak market being obscured by megacap gains

This article by Martin Pelletier may be of interest. Here is a section:

It's understandable to assign higher revenue multiples to smaller and highly disruptive companies with exponential growth potential. However, the combined market capitalization of these seven companies now exceeds US$10 trillion, so how can they deliver such growth while defying the laws of diminishing returns, especially when they were unable to do so when they were smaller, more innovative and capital was next to free with interest rates hovering around zero per cent? Over the past decade, Nvidia's revenue has grown sixfold and yet the market is now giving it a 38 times multiple. Microsoft has grown revenue by 2.7 times with a current 12 times multiple, and Apple's revenue has grown 2.2 times and yet it has a seven times multiple.

It isn't as if this hasn't happened before. Take Sun Microsystems Inc., which traded at more than 10 times its revenue prior to the bursting of the 2000 tech bubble. In 2002, chief executive Scott McNealy responded to the aftermath with a thought-provoking quote.

"At 10 times revenues, to provide a 10-year payback, I would have to distribute 100 per cent of our revenues to shareholders for 10 consecutive years in the form of dividends. This assumption assumes that I can achieve such an arrangement with our shareholders, that we have no cost of goods sold (which is highly unlikely for a computer company), that we have zero expenses (difficult with 39,000 employees), that we pay no taxes (also challenging), and that you, as shareholders, pay no taxes on the dividends received (which is illegal)," he said.

"Additionally, this assumption presumes that, with no investment in research and development for the next 10 years, we can maintain the current revenue rate. Considering these unrealistic assumptions, would any of you be interested in purchasing our stock at US$64? Can you fathom the absurdity of these basic assumptions? We don't need any transparency or footnotes to recognize their implausibility. What were you thinking?" In a seemingly repetitive cycle, we wonder if we will eventually be questioning ourselves again with a "what were you thinking?" moment. If you are tempted to say "this time it's different," we checked with ChatGPT and will leave you with its answer.

…"It's prudent to exercise caution, diversify portfolios and focus on fundamental principles rather than getting carried away by the idea that the current situation is entirely unprecedented."

I created a chart today to demonstrate the dominance of mega-caps in the Nasdaq-100. The eight FANGMANT shares represent 61.86% of the Index’s market cap. Those companies are Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Netflix and Tesla.

The average price/sales ratio of the 100 stocks in the Index is 6.84. Basic earnings per share (shown above) peaked a year ago and continues to trend lower. That suggests valuation expansion is fuelling the advance and those valuations are already high. The only conclusion is we are in the mania stage of this bull market.

The ratio is back at testing the 2021 peak but interest rates are 5% higher today. There is a variable and lagged effect from tighter liquidity conditions but they do catch up eventually.

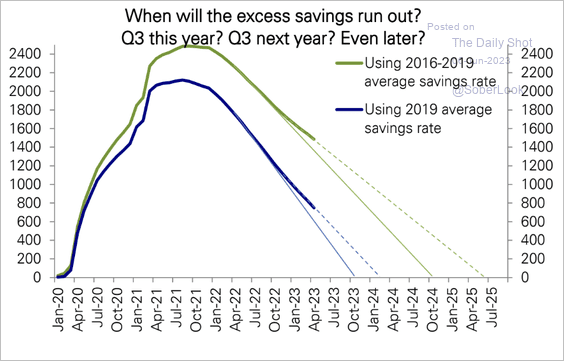

Excess savings surged during the pandemic and are one of the primary reason consumers have been resilient to higher rates. Estimates vary but the consensus is they will run out at some point between late 2023 and mid-2024.

This is the time in the cycle to be particularly disciplined with stops. Any sign that uptrend consistency is being lost is a reason to exit positioned in companies with excessively rich valuations.

Back to top