We will continue to swim in a sea of liquidity

Thanks to a subscriber for this transcript of a roundtable between Felix Zulauf, James Montier and David Iben from Finanz und Wirtschaft. Here is a section:

Do your clients still believe in the much-cited low return environment? The further markets move up, the more you might have a credibility issue.

Montier: No doubt. We haven’t yet reached the kind of loathing that was displayed towards us in 1999 where we were just told we were complete idiots and several clients banned us from their buildings. I think there is a broader acceptance of the power of valuation, but the longer the rally goes on, the shorter people’s memory gets. Galbraith used to talk about the extreme brevity of financial memory and I fear that’s kind of what we’re experiencing now. People are looking at last year and say look, it can go up 30%, why on earth are you saying future returns are going to be dismal.

But markets have been expensive for quite some time. How opportunistic should a value investor be?

Montier: There are two possible states of the world: either they keep rates low for a very long period of time or they don’t. Anyone who says they know which one is going to happen is either a liar or a fool or possibly a linear combination with unknown weights. The reality is, nobody knows the future, particularly when it comes to policy rates. By second guessing we’re playing some sort of ridiculous beauty contest. Therefore we should try to build portfolios which are robust and can survive different outcomes.

How do these portfolios look like?

?Montier: That’s a challenge because the portfolios you want to hold in those two different worlds are almost diametrically opposed. If financial repression continues, you want to own the least bad thing out there, which is equities. In the other world, the only asset which does not hurt you when rates move to normal, is cash. So you end up with this bizarre portfolio where you own some equities where they are cheap. And you want to own some dry powder assets which protect you against inflation, provide liquidity and real return.

The question of when rates will normalise and what this will mean for financial markets is an important one where people tend to have some strong views. In monitoring the global liquidity situation let us proceed with the assumption that capital is mobile. Therefore money created by one central bank can be deployed just about anywhere. This means that in monitoring liquidity we cannot simply think about the Fed’s tapering. Quantitative easing might have been the most high profile of the extraordinary monetary policy tools employed but it is far from the only one.

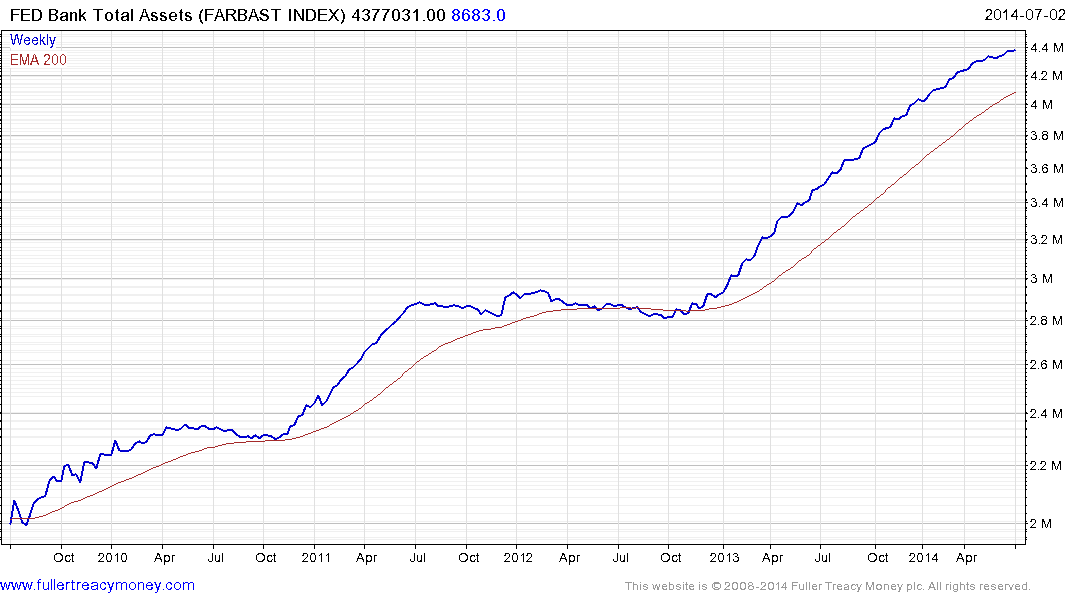

Despite tapering the Fed’s Balance Sheet continues to trend higher. The pace of the advance has moderated somewhat but it is still increasing. Wall Street continues to have a similar trajectory.

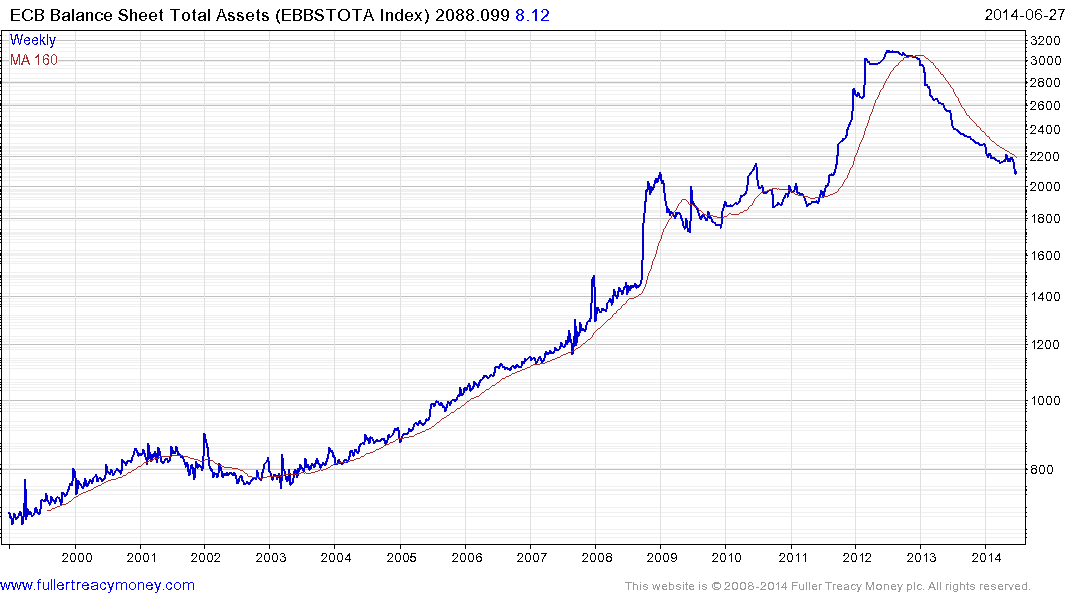

The ECB’s balance sheet has almost unwound its entire LTRO program expansion. Following the announcement of negative deposit rates, support for the asset backed market and other policies the ECBs balance sheet has in fact contracted. This suggests that they are still sanitising their capital infusions by withdrawing capital from other parts of the financial system.

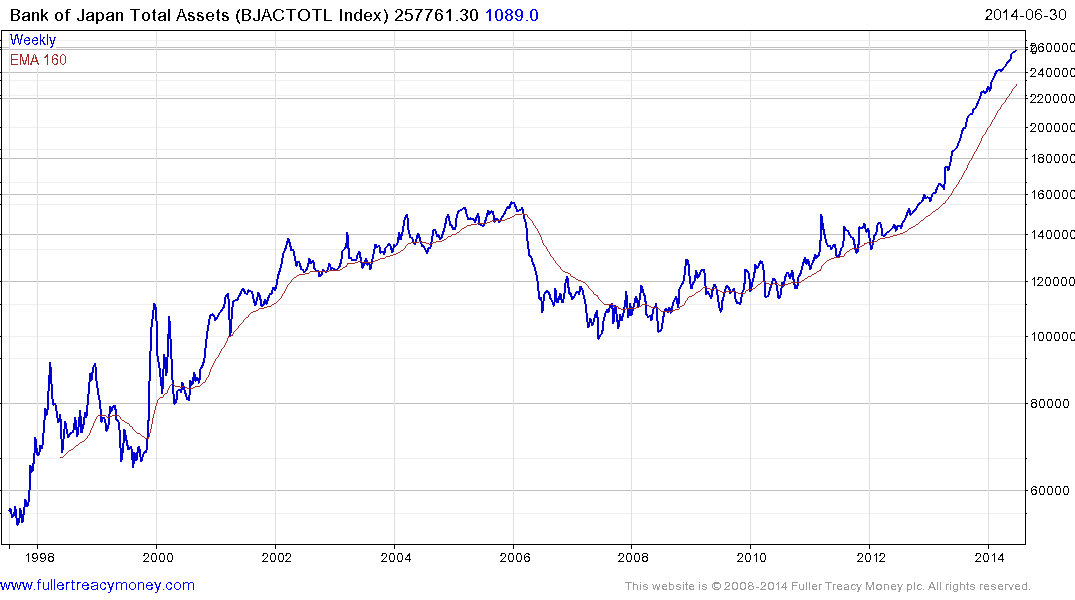

The Bank of Japan’s balance sheet broke out to new all-time highs in late 2012 and continues to expand at a steady rate.

While each of these programs will have the most influence on their domestic markets, I thought it would be instructive to create a chart of the total assets of these three central banks and redenominate them to US Dollars as a base.

The above chart demonstrates that the ECB’s withdrawal of liquidity has been tempered by the Bank of Japan’s additions. This suggests that the Fed’s QE represents the marginal supplier of global liquidity. It is reasonable to expect that the size of the Fed’s balance sheet will continues to moderate as tapering proceeds, so the peak the near 67 represents one of at least medium-term significance.

Back to top