We'll Live to 100 How Can We Afford It?

Thanks to a subscriber for this report from the World Economic Forum. Here is a section:

In Japan, which has one of the world’s most rapidly ageing populations, retirement can begin at 60. This could result in a retirement of over 45 years for those who will live to the current life expectancy of 1071 (see Figure 2). What is the impact of a population that will spend 20%-25% more time in retirement than they did in the workforce? How do we rethink our retirement systems that were designed to support a retirement of 10-15 years to prepare for this seismic shift?

One obvious implication of living longer is that we are going to have to spend longer working. The expectation that retirement will start early- to mid-60s is likely to be a thing of the past, or a privilege of the very wealthy.

Absent any change to retirement ages, or expected birth rates, the global dependency ratio (the ratio of those in the workforce to those in retirement) will plummet from 8:1 today to 4:1 by 2050. The global economy simply can't bear this burden. Inevitably retirement ages will rise, but by how much and how quickly demands urgent consideration from policy-makers.

Given the rise in longevity and the declining dependency ratio, policy-makers must immediately consider how to foster a functioning labour market for older workers to extend working careers as much as possible. Employers also have a key role to play in helping workers reskill and adapt their work styles to support a longer working career.

This paper focuses on the sustainability and affordability of our current retirement systems. To protect against poverty in old age, we believe that retirement systems should be designed to provide a level playing field and equal opportunity for all individuals. A well-designed system needs to be affordable for today’s workers and sustainable for future generations to ensure that all financial promises are met.

Healthy pension systems contribute positively towards creating a stable and prosperous economy. Ensuring that the public has confidence in the system, and that promised benefits will be met, allows individuals to continue to consume and spend through their working and retired years. If this hard-earned confidence is lost, there is a significant risk that retirees will moderate their spending habits and consumption patterns. Such moderation would have a negative impact on the overall economy, particularly in countries where the size of the retired population continues to grow.

Action is needed to realign our existing systems with the challenges of an ageing population. Those who take proactive steps will be better equipped in the years ahead.

Here is a link to the full report.

I’m 40 so according to this report I have a 50% chance of living to 94. The Chart Seminar is in its 48th year in 2017 so you never know I might manage to get it to the century because we are all going to be working a lot longer. It’s a good thing I’m doing something I enjoy and perhaps that is the best advice. You are going to be working for an awfully long time so be prepared to change jobs, adapt and enjoy what you do.

One of the biggest points this report makes is that no matter how much you move the numbers from high to low expectations of returns, the longer the investing time horizon the greater the potential for savings to grow. The main point then is to have savings rather than to eschew saving in favour of consumption today.

That’s a problem for many young people today because property prices are so high in a number of desirable locations, not least London, Sydney, Melbourne, Toronto, Vancouver, Montreal, New York etc. Many of the jobs created in the US over the last decade have been part time in nature and that makes saving for retirement difficult because employers tend not to make contributions.

These are significant issues and there is ample scope for them to emerge onto the political arena as demographics shift voting power over the next decade. The baby boomer generation currently holds a great deal of sway over voting patterns and we have ample evidence of this from recent elections and referenda in the USA and UK. However that is not a permanent condition. Over the next decade the millennial generation will move into its family formation age while baby boomers will begin to die off. Future elections are going to increasingly reflect that transition and the potential for longer retirement ages to be passed will increase accordingly.

By living longer we are much more likely to experience a sequence of investing cycles in our lifetimes and that means have an understanding of how these long-term secular moves play out puts us in a much better position to benefit from them.

For example, the Dow/Gold ratio tells us that in the last century there have been major periods when stocks outperformed commodities and vice versa; with circa 34 years between peaks. The last major trough was in 2010 so if the sequence holds there is ample potential for stocks to continue to outperform commodities.

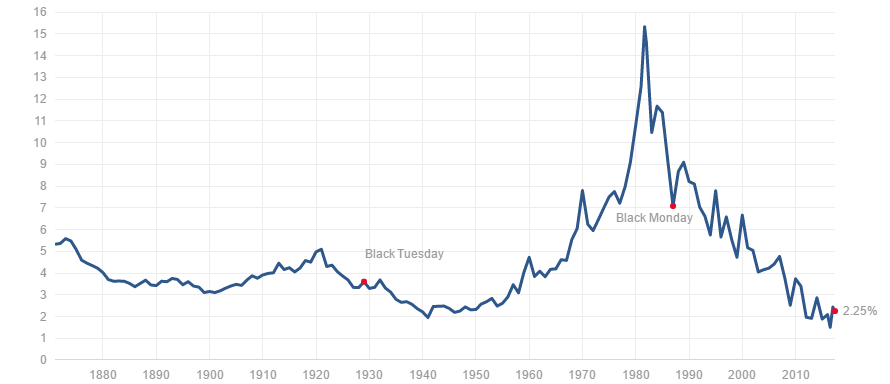

US Treasury yields peaked in 1981 with previous major yield peaks in 1920 and 1873 or to put that in context 61 and 47 years apart. If that long-term rhythm holds true then we can expect a major yield peak at some point around 2035. The long-term chart also highlights just how much of an overshoot the inflation bubble in the early 1980s was; being totally unprecedented in the previous century.

Both these charts suggest inflation will not remain banished forever since equities are one of the best hedges against it and bond yields would rise to offset it.

Back to top