We interrupt this rally to bring you...fundamentals

Thanks to a subscriber for this report from Deutsche Bank focusing on the mining sector which may be of interest to subscribers. Here is a section:

The rally year to date reflects a rotation into sectors benefiting from a weaker US dollar, Chinese stimulus and the oil price rebound more than it reflects the slowly improving fundamentals - and we think each of these positives is now priced in. The sector has re-rated to a P/NPV of 0.86x, in line with the average trough multiple since 2003. It's the same for earnings multiples, where we now forecast a sector 2017e PE of 30x, well above the average trough PE of 9x, and the 17x of the most recent low in May 2015. We prefer Rio at 0.76x P/NPV compared with BHP at 0.92x. We have downgraded Glencore to Hold (0.8x NPV), but prefer it to Anglo (0.6x) given deleveraging progress.

FCF now healthy across the sector and gearing coming down

The 1Q16 commodity price recovery, with the oil price and producer currency weakness early in the quarter, plus continued ‘self-help’, has boosted free cash flow across the sector. 17 of the 19 companies under our coverage are now producing free cash flow after dividends in 2017. FCF yields average 10% for the big four diversified miners and 8.4% for the whole sector next year. Gearing is also reducing: we forecast a drop from 26% in 2015, to 22% in 2016 and 16% in 2017.Lots for sale, lots of window shopping, no real buying…yet

A few companies are starting to use their balance sheets in selective M&A, but for rich multiples which are too high for most to justify when downwards pressure on long-term commodity prices prevails: today we have cut our LT copper price by 7% to USc300/lb and our LT iron ore price by 14% to US$57/t. There is a lot of window shopping going on, but valuations have run hard very quickly and we think both buyers and quality “for sale” assets remain scarce.

Here is a link to the full report.

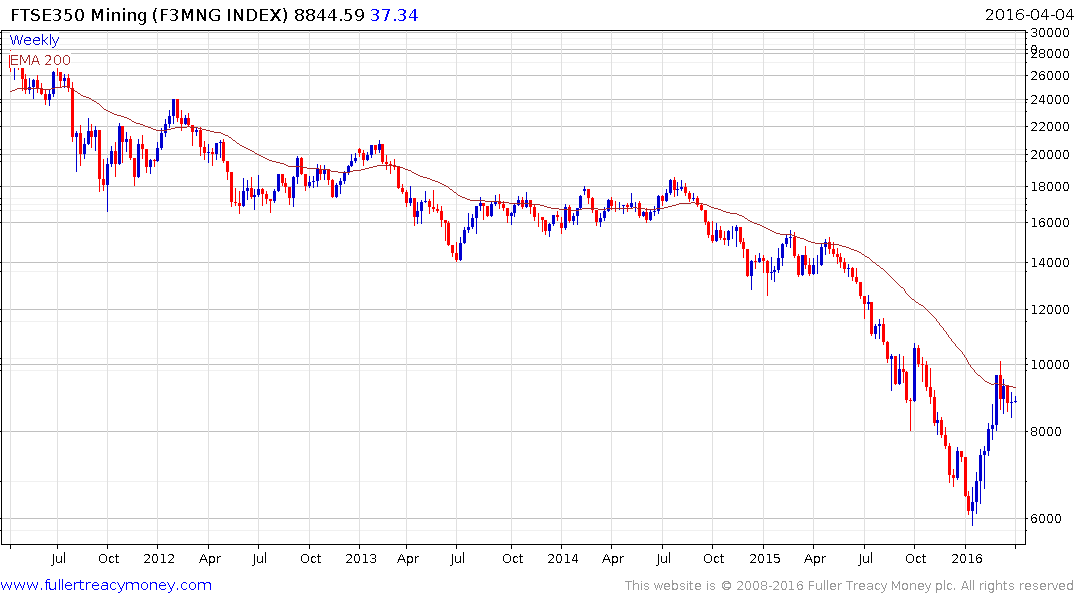

The commodities sector was about as unloved as is possible late last year and an impressive short covering rally has taken place over the first quarter. A similar move in oil prices has been the catalyst for renewed interest in miners because somewhat higher energy prices will have helped to push marginal supply out of the market.

The Continuous Commodity Index closed a deep overextension relative to the trend mean and some consolidation of that move is now underway. How successfully the Index finds support above the January low near 350 and whether a subsequent rally can succeed in pushing back above the trend mean will tell us a lot about how much of the move was predicated on short covering and how much on demand returning to dominance.

The FTSE-350 Mining Index shares a similar pattern and is now consolidating in the region of the trend mean and the psychological 10,000 level.