Wall Street Sounds Bond Warning as Holdings Shift Sparks Concern

This article by Alexandra Scaggs for Bloomberg may be of interest to subscribers. Here is a section:

“The problem is on the days when you need liquidity, it probably won't be there,'' said Cohn at a Deutsche Bank investor conference on Tuesday.

Large Wall Street banks, or dealers, are carrying a smaller share of bonds on their books, as regulations restrict the capital they can hold on their balance sheets. Money managers, meanwhile, are holding a lot more of them. Dealer inventories dropped by 27 percent between 2007 and early 2015 while assets held by bond mutual funds and exchange-traded funds almost doubled.

This article contained an interesting chart of the holders of Treasury bonds. In Boston a few years ago, Prudential had a poster beside the river proclaiming they managed a trillion Dollars. I remember thinking “What do they own?” The easy answer was bonds.

No one talks about yield to maturity anymore because momentum has been the only game in town for the last five years. However it is worth considering that bond funds do not have a yield to maturity. They have to constantly buy and sell bonds to manage the portfolio’s duration. This means they have issues as prices fall and they cannot hold to maturity.

The lack of liquidity in the bond markets has been a major topic of conversation over last few months not least because investment banks can no longer hold the same quantity of inventory they once did. As major holders bond funds will not sell until they face redemptions since they often cannot hold cash or are limited by duration concerns from holding short-dated Treasuries. This means that while liquidity might be an issue at present, it is nothing compared to the problem of oversupply that could arise if redemptions hit some of the larger open ended funds and ETFs.

I thought it might be instructive to look at some bond funds:

Pimco’s Total Return ETF has returned to test the region of the December low and has at least paused. A clear upward dynamic will be required to signal more than temporary steadying.

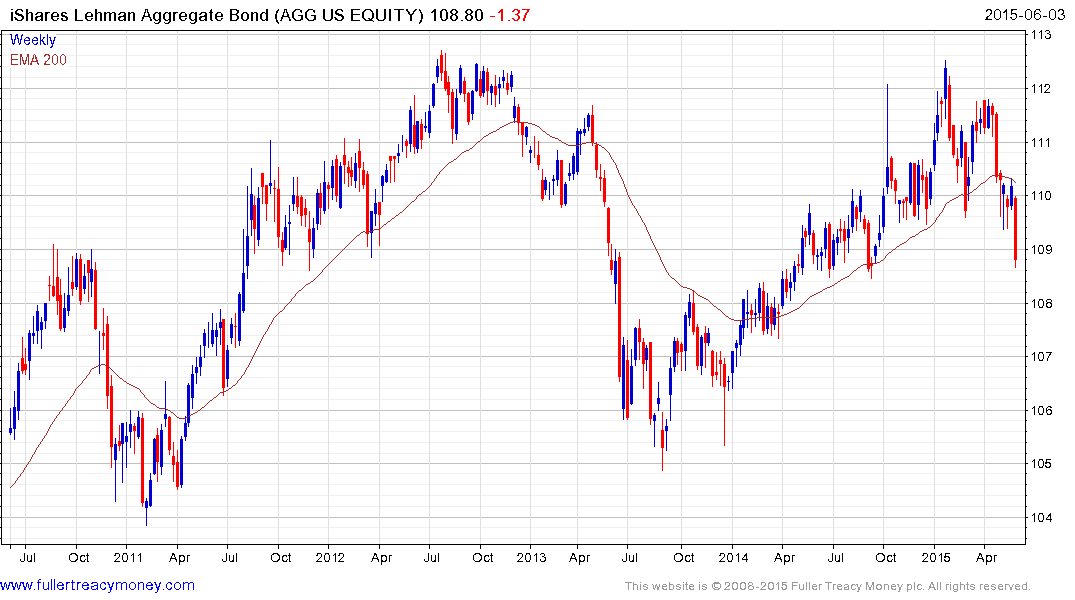

iShares Lehman Aggregate Bond ETF dropped below the 200-day MA in May to break the 18-month progression of higher reaction lows before extending the decline this week. A sustained move above 110 would be required to signal a return to demand dominance.

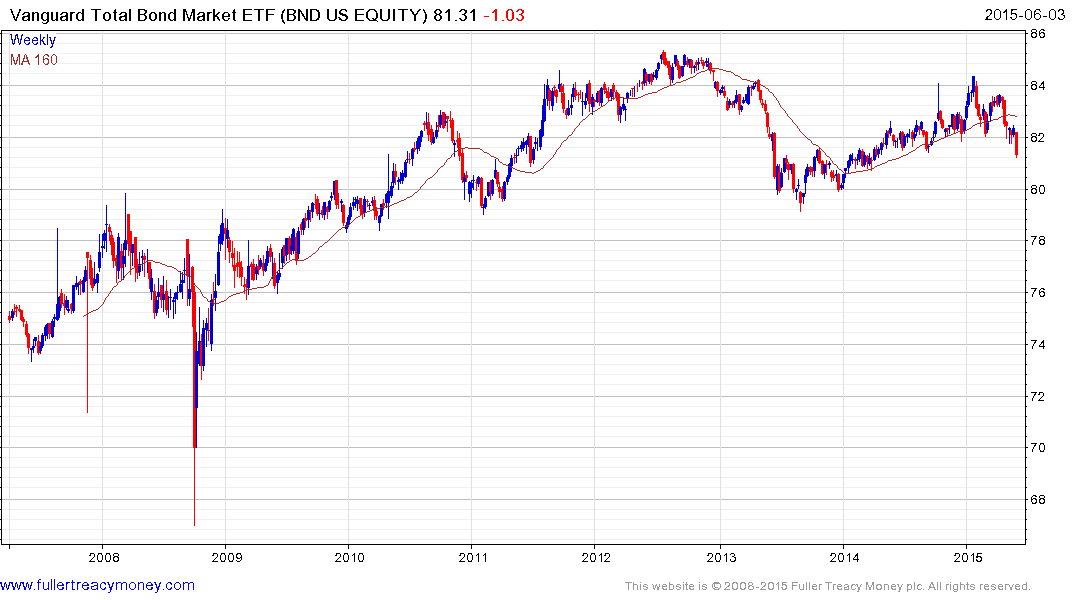

Vanguard Total Bond Market ETF has also fallen to break a medium-term progression of higher reaction lows.

With Treasury yields pausing today, there is scope for some steadying in the above ETFs but this does not detract from the fact that they have lost uptrend consistency and have a lot to do if they are to repair investor sentiment.