Wall Street Set for New ETF Gold Rush as Single-Stock Era Begins

This article from Bloomberg may be of interest to subscribers. Here is a section:

A new ETF-for-everything era may have just begun on Wall Street, swelling an industry that already boasts nearly 3,000 products and $6.2 trillion in assets.

The booming world of exchange-traded funds is about to get even more crowded after the very first single-equity ETFs launched Thursday -- despite a torrent of regulatory warnings over their risks while retail investors are still reeling from the crash in speculative trades from crypto to meme stocks.

The eight products from AXS Investments look like the start of a coming invasion of amped-up strategies that will seek to enhance or invert the performance of volatile companies, including Tesla Inc., Nvidia Corp. and PayPal Holdings Inc.Another proposed lineup from Toroso Investments offers to layer on a bullish options strategy in order to boost returns. All told, at least 85 more such ETFs are currently planned, according to filings tracked by Bloomberg, covering some 37 companies.

That’s just the start. With a never-ending fee war taking costs on index-tracking ETFs to rock-bottom levels, the arrival of single-stock products opens up a lucrative avenue for issuers, with leveraged or inverse trades tracking major companies up for grabs.

All told, the Securities and Exchange Commission may have inadvertently put new investing tools in the hands of day traders at a dangerous time with recession risk sparking bear markets.

The rational investor is going to question the wisdom of setting up single stock ETFs. Afterall can’t you simply buy the share? The reason for setting up single stock ETFs for shares like Nvidia and Tesla is because their options are expensive. Options sell in minimum sizes of 10 contracts for retail traders. If the underlying has a lower nominal value, the options will be cheaper to buy for smaller investors.

Several companies have resurrected the ‘90s practice of splitting stocks so they can keep prices low. The most notable examples are Tesla and Amazon. M1 Finance invented fractional ownership of shares in 2017. It was popularised by Robinhood and is now available from heavyweights like Schwab and Fidelity.

Every bull market comes up with new ways to separate new investors from their money. The proliferation of new vehicles over the last couple of years is not an encouraging sign. It is indicative of late cycle activity.

The common characteristic for all these products is access to ready funds. Oversold rallies are underway but speculation about an imminent end to tightening is probably misplaced.

Nevertheless, the Euro continues to bounce from the psychological $1 level. That’s putting upward pressure on yields. Steadier action on stock market indices gives the false impression this correction is over. We are only a week into earnings season and oil prices rebounded in a robust manner today.

A sorting mechanism is now evolving within the speculative tech sector. I ask myself a simple question. Is there anyone who has not tried the product/service on offer. For Zoom Media, the answer is no, so it will have a hard time recovering.

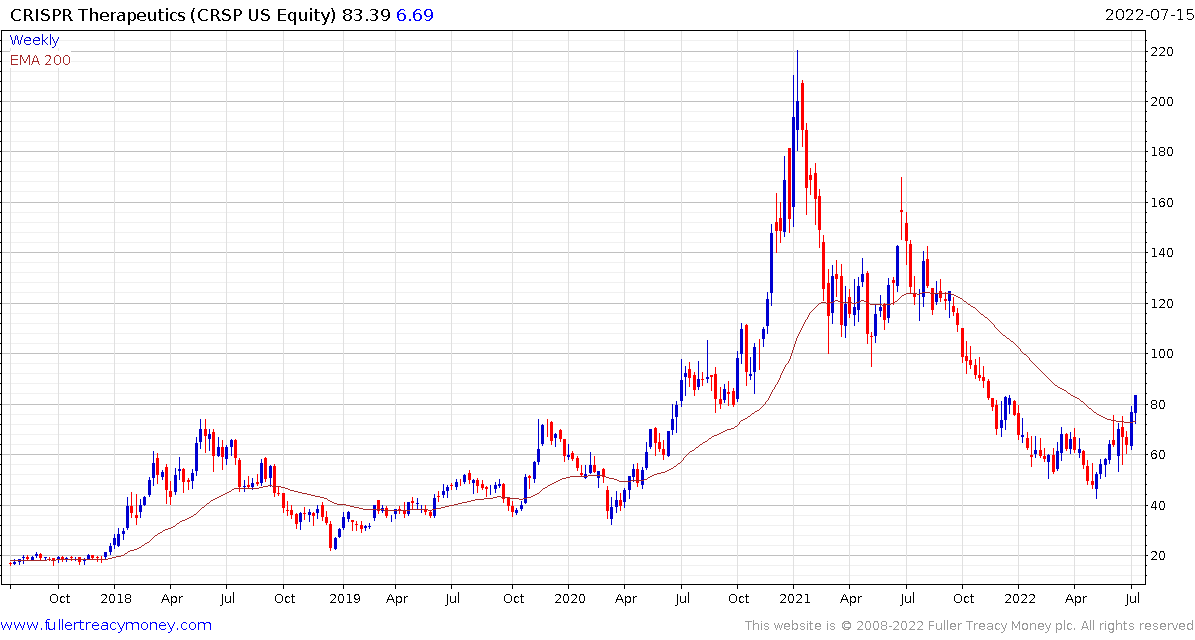

For CRISPR Technologies, the answer is yes so it is recovering faster. This helps to highlight that despite the broad process of deleveraging underway this year, there are still going to be relevant value/growth opportunities that can thrive even in this environment.