Wall Street Managers Are Learning to Love Treasury Bonds Again

This article from Bloomberg may be of interest to subscribers. Here is a section:

Morgan Stanley projects that a multi-asset income fund can now find some of the best investing opportunities in nearly two decades in dollar-denominated securities, including inflation-linked debt and high-grade corporate obligations. The interest payments on regular 10-year Treasuries, for example, has hit 4.125%, the highest since the global financial crisis.

Meanwhile Pacific Investment Management Co. reckons long-dated securities, the biggest losers in this era of Federal Reserve hawkishness, will bounce back as a recession ignites the bond-safety trade, with government debt acting as a reliable hedge in the 60/40 portfolio complex once more.

“People are excited, believe it or not,” said Maribel Larios, founder and CEO of Fiduciary Experts, a Murrieta, California-based registered investment advisor. “It’s all relative, as they’ve seen these fixed-income accounts pay little to nothing in the past. So, 4% — or even about 2% to 3% in some cash accounts — is relatively good now.”

Banks like Deutsche and Morgan Stanley are taking an axe to their earnings estimates for the S&P500 next year. Corporate earnings have been resilient, even as the Fed has hiked rates faster than at any time in the last 40 years. That is unlikely to persist as the lagged effects of tightening catch up.

In an example of the procyclical nature of commodity demand, I saw an article this morning that there is 67 million square feet of warehouse space under construction in the Dallas-Fort Worth metroplex. That’s more than the next seven biggest warehouse areas combined. This is happening at the same time container traffic is crashing back to the pre-pandemic levels.

![]()

![]()

This graphic highlights how much money is being spent on semiconductor fabrication sites. Taiwan Semiconductor announced this week they will be building another factory in Arizona for example. It might take a year but the market is going to be flooded with both chips and memory within the next 18-months. The Philadelphia Semiconductors Index remains in a downtrend.

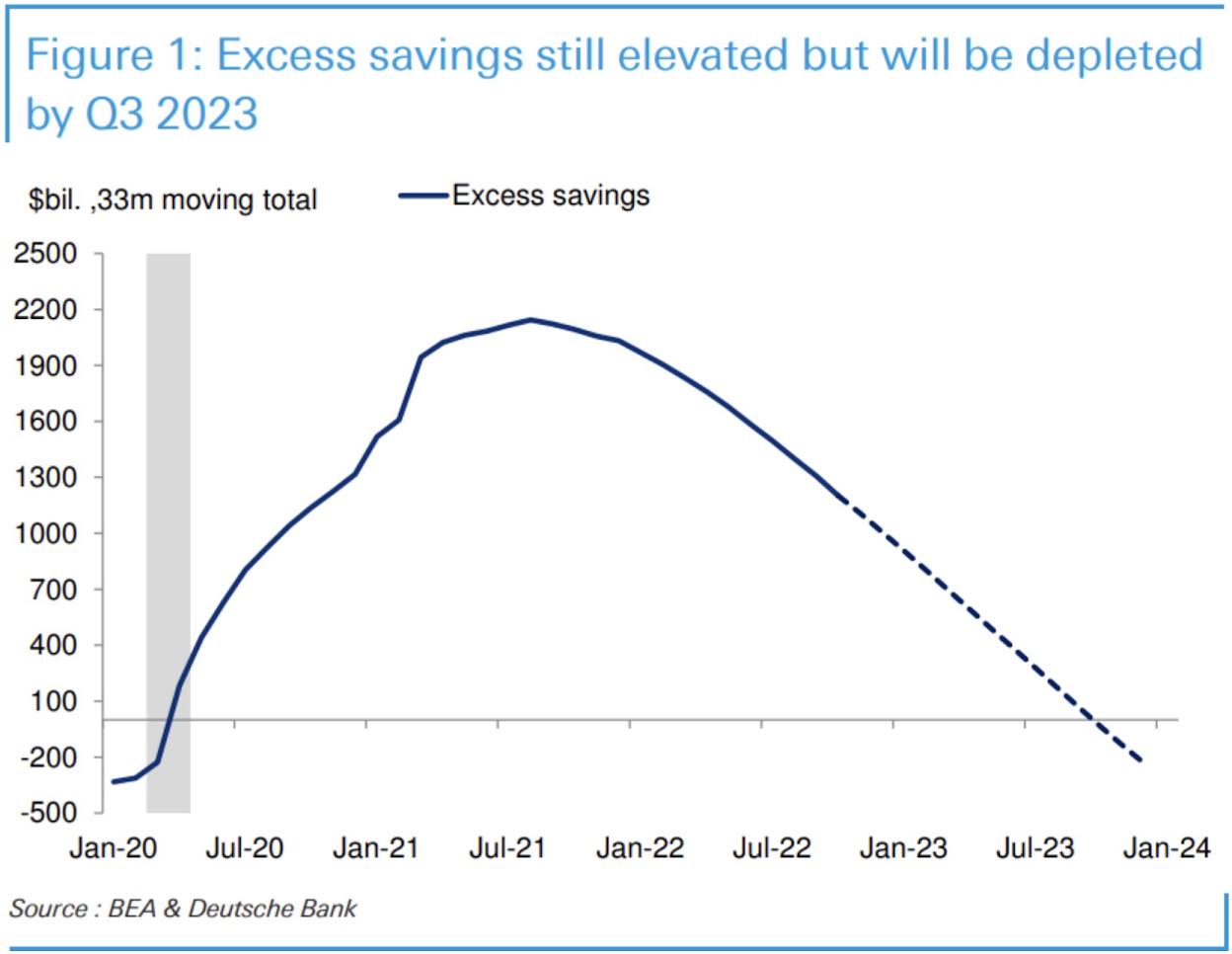

Meanwhile excess savings are being burnt off and credit card balances were at the 2019 peak at the last reading.

Against that background it is reasonable for long-dated bonds yields to contract. A deflationary shock is brewing as monetary conditions continue to tighten.