Wall Street as Landlord: Blackstone Going Public with a $10 Billion Bet on Foreclosed Homes

This article by Ryan Dezember may be of interest to subscribers. Here is a section:

“We’re no longer trying to convince the investment world this is a legitimate business,” Fred Tuomi, Colony Starwood’s chief executive, said in an interview. “We’re not in this to simply fix and flip. We’re in this for the long-term, steady and growing income stream.”

Though the chance has passed to acquire thousands of houses at steep discounts, Colony and its competitors are still buying individual homes here and there as well as groups of homes bundled by other investors during the crisis, Mr. Tuomi said. Colony, he said, could manage about 100,000 homes without having to invest much more in the systems it built to manage them.

Economic factors have helped the stocks in the sector. Home prices have risen above their 2006 peaks in much of the country, boosting the value of these firms’ holdings. That and rising interest rates have pushed homeownership out of reach for many. Lately, the homeownership rate has hovered around its lowest level in at least 50 years, according to U.S. Census data.

Meanwhile, rental vacancies, including apartments, are at their lowest level in at least a decade at 6.8% in the third quarter. Rents are up, particularly in single-family homes, where rents are growing faster than at apartments, according to Green Street Advisors LLC.

Here is a link to a PDF of the story.

Large funds are betting big on the inability of a large demographic that will never be able or inclined to afford a home. Record student debt, underemployment of highly educated workers and rising living costs have all fed into the conclusion that millions of Americans will not be able to save enough to pay for a down payment.

That was certainly true in the last decade and student debt represents a significant challenge for the millennial generation. However if that debt can be wrapped into a fixed rate bundle, it becomes much less of a burden in a rising interest rate environment. With banks looking to lend the prospect of aggressive rent increases looks less likely. Therefore the potential for steady income rather than outsized income growth is probably the base case for residential property investments.

American Homes 4 Rent has been consolidating since its early August peak but has found support in the region of the trend mean and a sustained move below it would be required to question medium-term scope for additional upside.

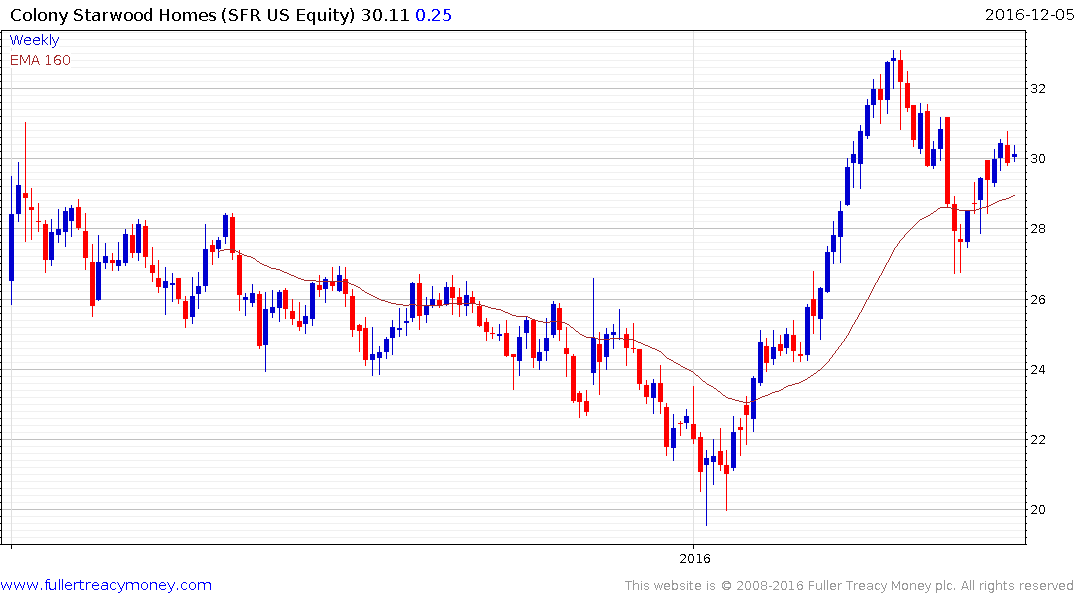

Colony Starwood Homes experienced a somewhat larger pullback from its August peak but has also bounced and a sustained move below $28 would be required to question medium-term upward bias.