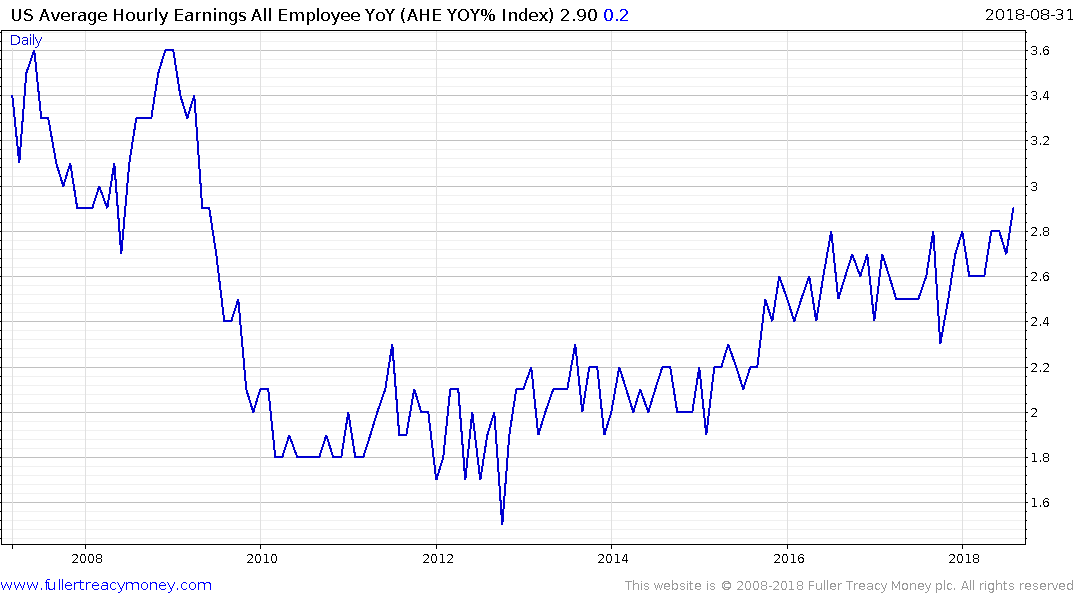

Wage Growth is breaking out

Wage growth in the USA has been volatile to say the least over the last couple of years but broke out to new highs in August. At almost 3% that is likely to contribute to inflationary pressures sooner or later and will form part of the Fed’s decision to continue raising rates.

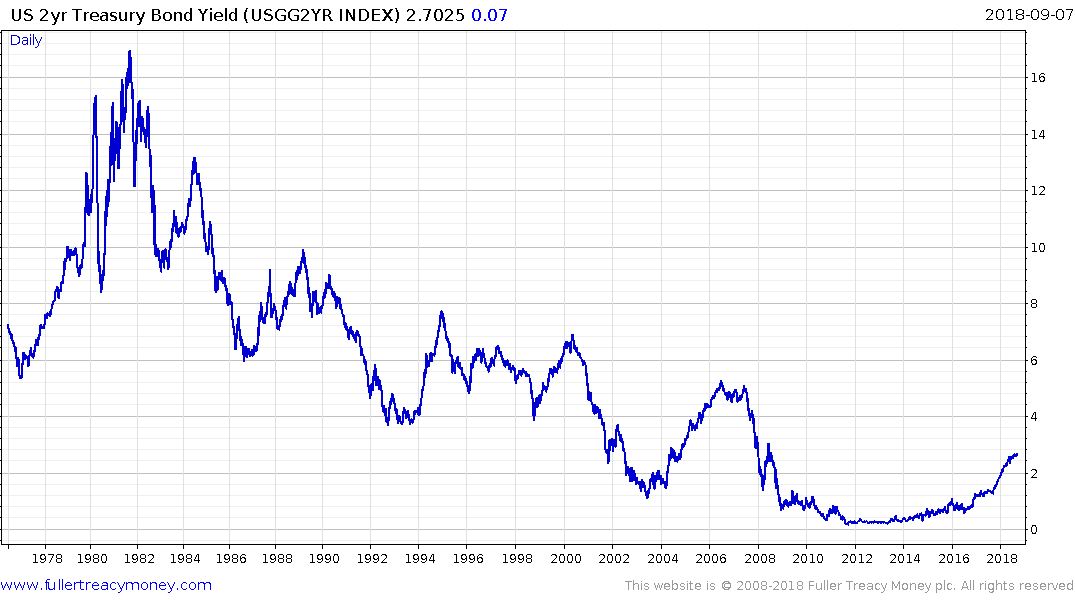

US 2-year yields broke out to new highs today to extend the medium-term trend and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

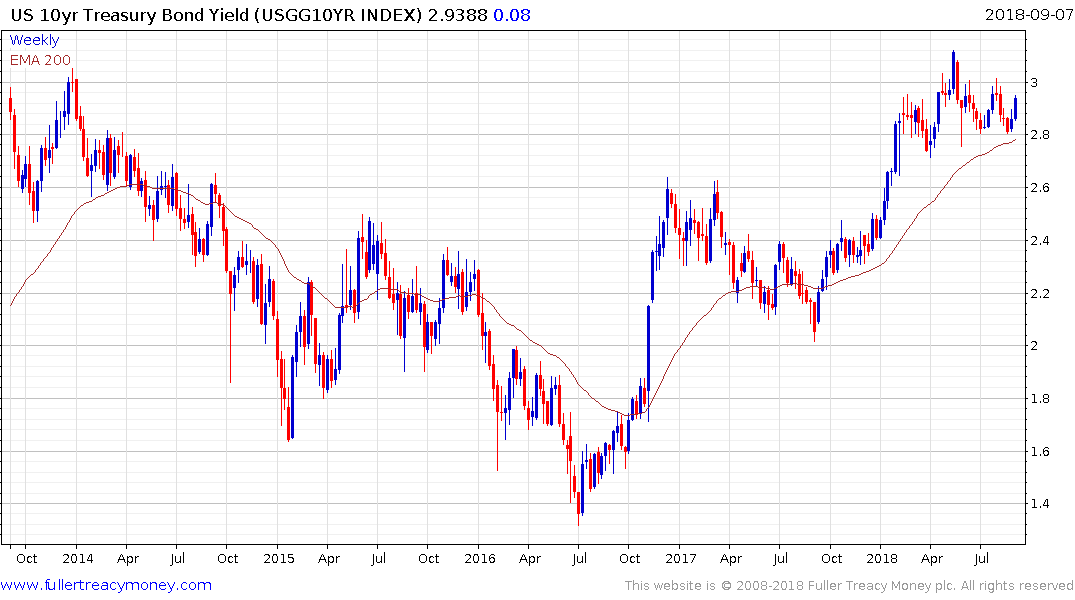

The 10-year yield is bouncing from the region of the lower side of its range and the region of the trend mean. The rate has been ranging below 3% since January as the bull and bear arguments returned to relative equilibrium. The prospect of wage induced inflationary pressures may enough to see the yield break out if the trend in average hourly earnings continues to rise.

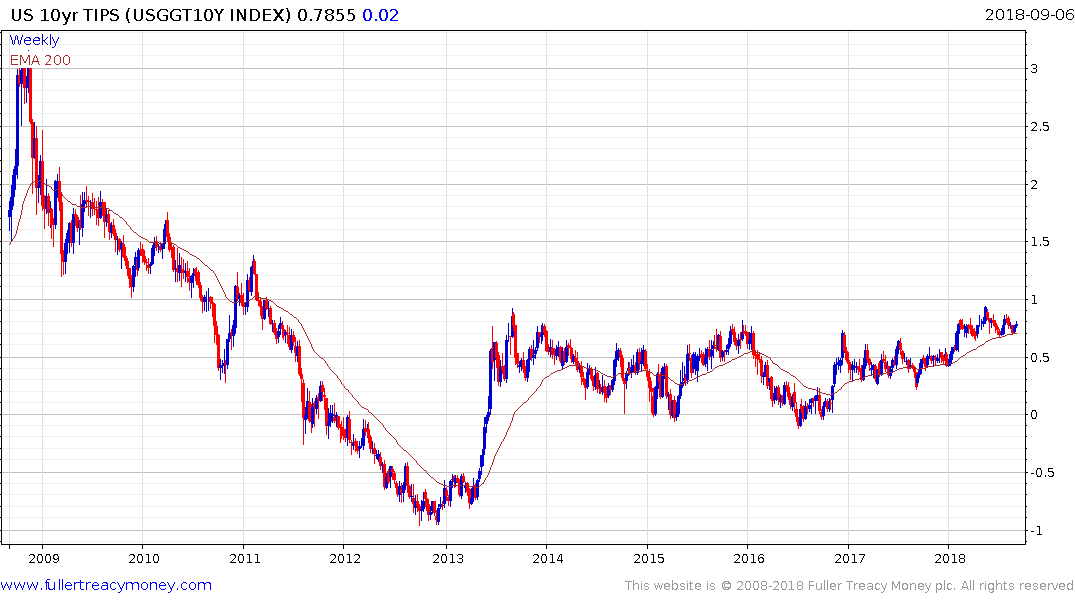

While additional issuance is likely to be a factor in the US Treasury market, there are no new TIPS planned. The 10-year TIPS has been ranging below 1% since 2013 and a break above that level would clearly signal a return to an inflationary bias.