Volatility Grips Chinese Tech Shares Again as Traders On Edde

This article from Bloomberg may be of interest to subscribers. Here is a section:

Chinese tech giants like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. in the past year. Beijing’s clampdown on private enterprise appeared to intensify in recent weeks after authorities required food delivery platforms to cut fees they charge restaurants and warned of risks in investing in products

linked to the metaverse.

Since its February 2021 peak, the China tech gauge has slumped nearly 60%. Adding to the fragile sentiment are concerns about a potential interest rate hike from the U.S. Federal Reserve next week and elevated commodity prices fueled by the war in Ukraine.

“Investors may be looking to sell growth names into the brief rallies to reduce their risk exposure, given multiple headwinds including Russia and the upcoming rate hikes,” said Vey-Sern Ling, a senior analyst at Union Bancaire Privee.

JD.com reported strong 2021 earnings but guidance was the share’s downfall today. This is a trend which troubled many US growth companies during earnings season as well. Keeping up pandemic era growth when liquidity is less available, and the real world is competing for attention versus screens, is a tall order. JD.com broke lower on the news.

.png)

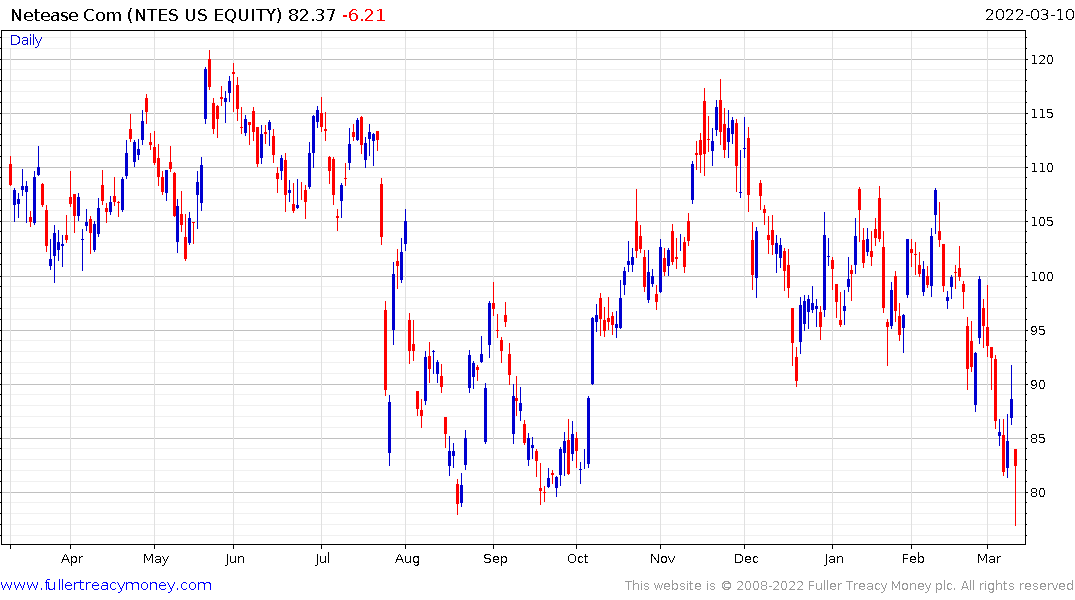

China’s growth stocks were the leading decliners on the Nasdaq today. Pinduoduo, JD.com, NetEase, and Baidu were the biggest drags on performance. Tencent and Alibaba are also making new lows.

China’s official growth target of 5.5% is ambitious. It is unlikely to be achieved with a good measure of support from monetary and fiscal stimulus. Even then national priorities have changed, the success of the domestic consumer plays is taking a backseat to the drive to become self sufficient in technology and energy.

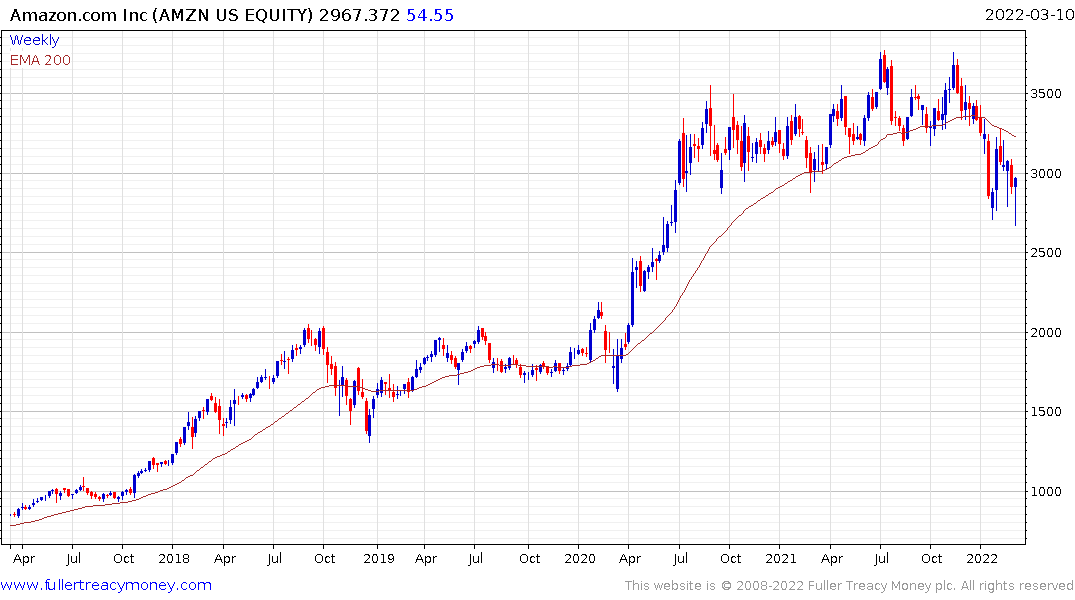

Amazon blunted some of the weakness on the Nasdaq-100 with some financial engineering. They are following the likes of Tesla and Apple in splitting their shares and buying back $10 billion in shares. That’s good for a short-term rebound but does nothing to insulate the company from the threat of slowing growth.