Vietnam strengthens local stock market following strong fluctuations

This article from Xinhua may be of interest to subscribers. Here it is in full:

Vietnam's State Securities Commission (SSC) has carried out measures to strengthen the local stock market following strong fluctuations triggered by investors' cautious sentiment and global stock market, local media reported on Wednesday.

The recent market corrections were caused by investors' cautious sentiment while facing uncertainties and less positive prospects in the world economy and politics, local newspaper Vietnam News reported.

As part of an effort to ensure a stable, sustainable and transparent development of the Vietnamese stock market, the SSC has strengthened inspection and supervision to address violations on the stock market, the newspaper said.

It has also proposed amending regulations regarding private offering and trading of corporate bonds in the domestic and international markets to improve the management mechanism for the private placement of corporate bonds.

In the short term, domestic investor sentiment is still strongly influenced by information, wrong handling of enterprises, and fluctuation in the corporate bonds market.

However, given Vietnam's long-term macroeconomic growth and the profit gains of listed companies, long-term investment opportunities will appear quite clearly, investment strategist Thai Huu Cong told local newspaper Saigon Investment.

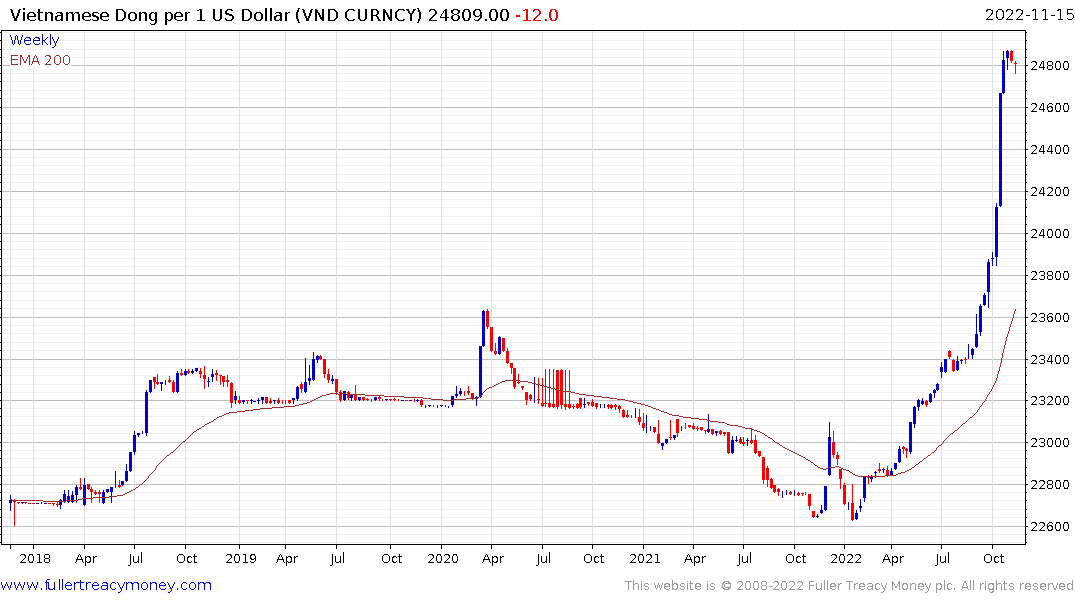

The Dong tends to be the Vietnamese government’s first recourse in attempting to stimulate the economy. The currency has been falling all year and only began to steady over the last couple of weeks.

Today’s action to support the stock market resulted in the Index posting a significant upside key day reversal from a deep short-term oversold condition.

Medium-term, the Index dropped precipitously from the most recent test of the 200-day MA in August. There is certainly room for steadier action but foreign investors will likely want some confidence the devaluation of the currency has abated before stepping in. The single digit valuation (P/E 9.86) will then begin to attract attention.

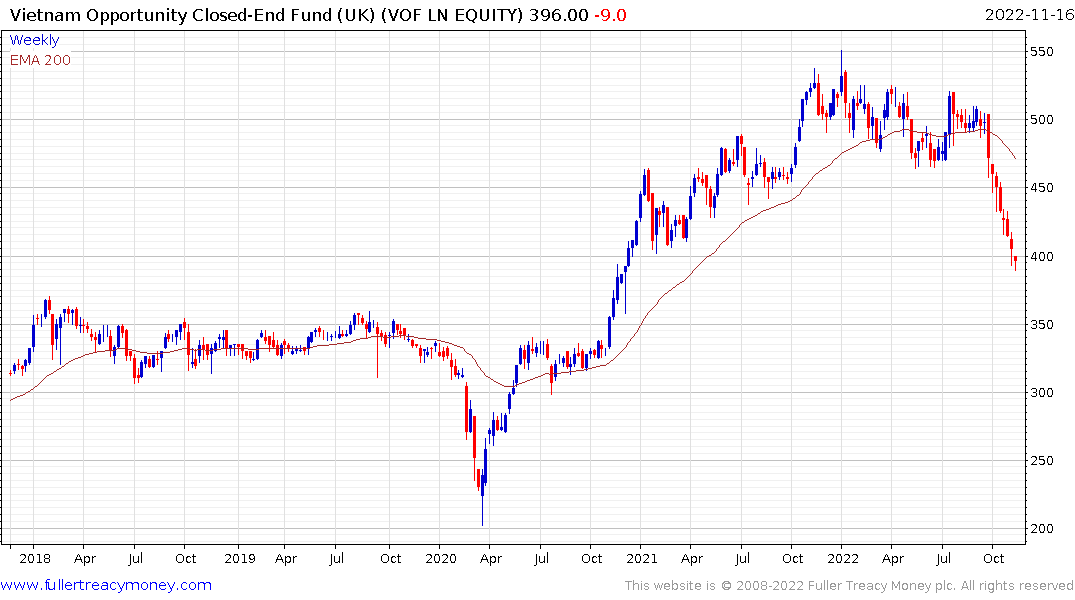

The actively managed UK listed Vietnam Opportunities Fund is beginning to steady in the region of the 1000-day MA.

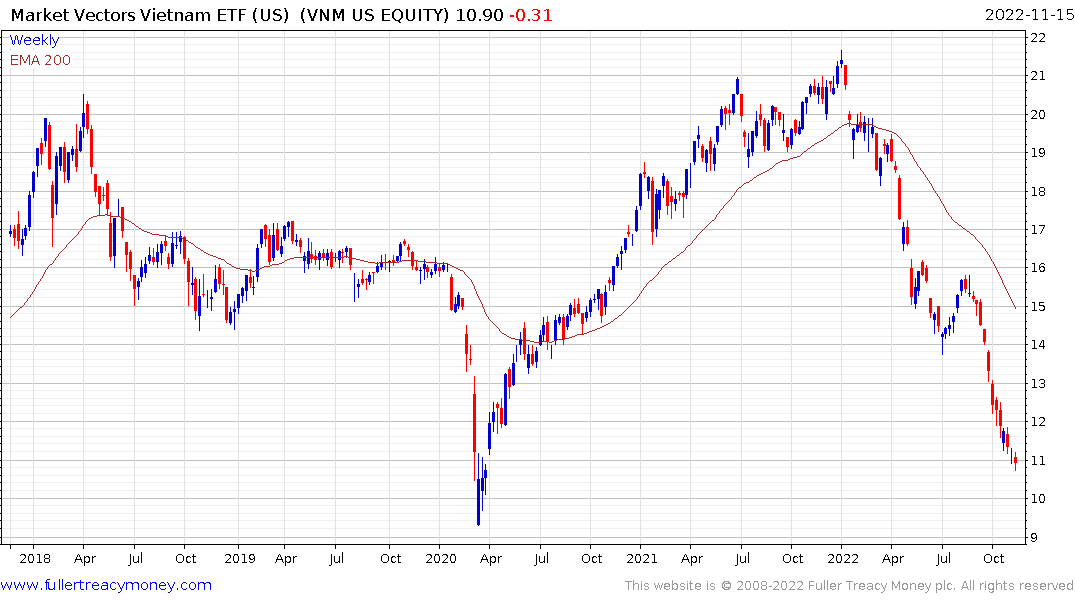

The US listed VanEck Vietnam ETF halved this year and is beginning to firm from the region of the 2020 lows.