Venezuelans Stockpile Food and Water Ahead of Maduro Power Grab

This article by Nathan Crooks and Fabiola Zerpa for Bloomberg may be of interest to subscribers. Here is a section:

Maduro -- who’s presided over an increasingly autocratic regime that has imperiled the country’s six-decade democracy and left the economy and society in shambles -- is showing few signs of backing down despite growing pressure. He’s broadcast a deluge of propaganda supporting the assembly even as outraged opposition leaders called a general strike Wednesday to forestall it. And opposition is international: The Trump administration sanctioned 13 senior Venezuela officials Wednesday, including the interior minister and the national oil company’s vice president for finance. The head of the Organization of American States has called for elections and Spain’s former prime minister is trying to broker a deal.

The Venezuelan president has been vague about goals for the so-called constituyente, although he’s said the body will convene Aug. 3 and sit atop all other branches of government. It alone will determine how long it should stay in power. While some analysts speculated that Maduro called the convention as a negotiating tactic to quell opposition protests and violence that has claimed more than 100 lives, others say Maduro will use the body to delay indefinitely elections he can’t win.

On Wednesday evening, Maduro said in a national address that he rejected the “illegal” U.S. sanctions and that the constituyente would be the country’s “revenge.” He reiterated that the vote would proceed as planned.

Governance is Everything has been an adage at this service for decades and the trend is certainly downwards in Venezuela. The only way the regime can be brought to heel is through a defection of the military against Maduro’s rule and, so far, there have been scant signs of that happening.

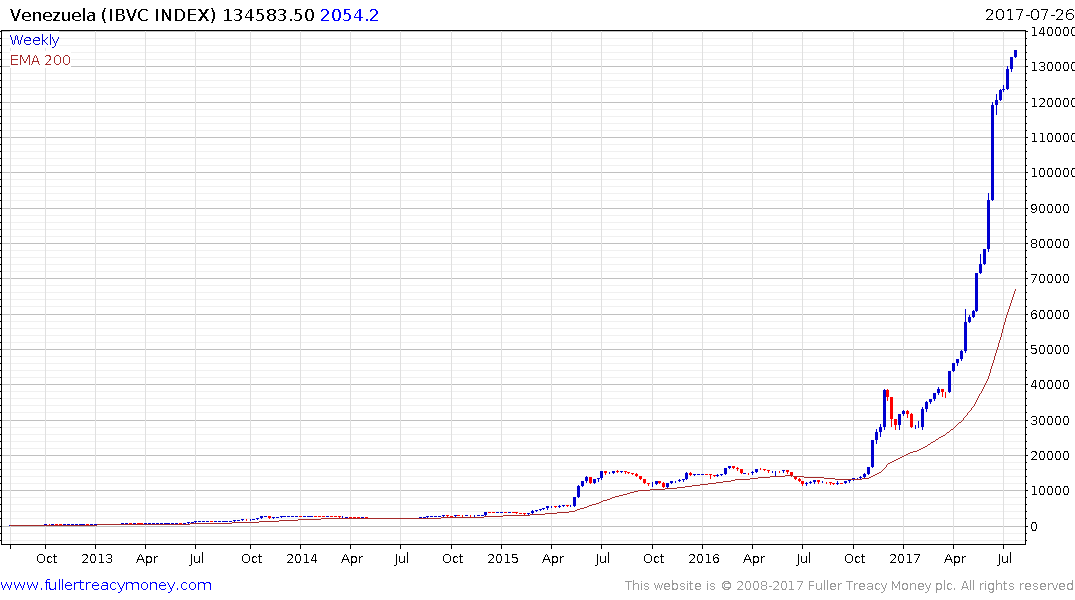

The Venezuela Bolsa have been the best performing market globally this year, at least in nominal terms. More than any other factor that exemplifies how stocks tend to reflect the inflation rate which in Venezuela is approaching worrying levels.

Most government debt, particularly for emerging markets and the Eurozone’s periphery, comes with collective bargaining agreements which give greater power to creditors in the event of a default. However, these don’t generally extend to corporates and Venezuela’s oil company is troubled both by bearing financial responsibility for a troubled regime as well as the low oil environment. PDVSA’s 5.375% 2027 bullet bond has been reasonably steady with a yield in the region of 21% for most of the last couple of years. A break upwards would like signal a more marked deterioration in the outlook for the country’s finances.

Back to top