Value Stocks, U.S. Dollar Among Top Trades After Hawkish Fed

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The Fed’s latest update is net negative for risk assets, as it seems to show that the Fed has a lower strike put than we thought - in other words Powell would be comfortable to allow further market weakness and volatility without intervening,” said Altaf Kassam, EMEA head of investment strategy and research at State Street Global Advisors.

“Investors should continue to avoid developed markets government bonds as there is only downside there. We are rotating into defensive equities, long-dated U.S. Treasuries, commodities and VIX futures - Volatility will be here for a while.”

The Fed is talking about raising rates faster than any other developed market central bank. That represents a strong tailwind for the Dollar Index and it broke upwards to new recovery highs today. This has been a consistent rebound from the lower side of the range and nothing has yet happened to question potential for a run back towards the psychological 100 level.

A stronger Dollar is weighing on the tech sector because of its reliance on low rates to fund growth. It is also weighing on the precious metals. Gold continues to pull back from its most recent test of the psychological $1850 area. It will need to hold the sequence of higher reaction lows if this support building phase is to remain consistent.

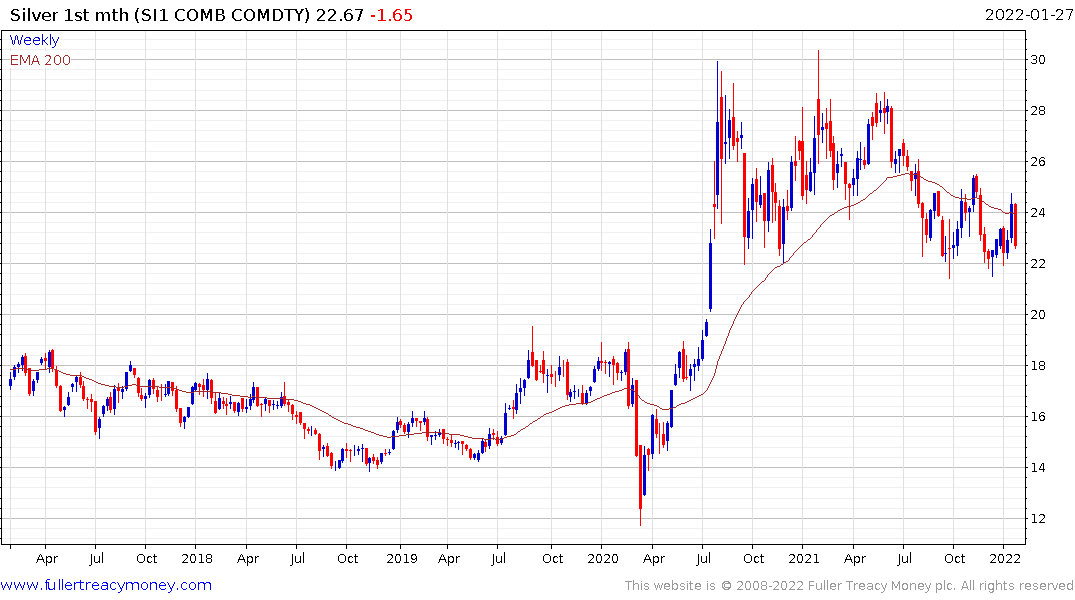

Silver continues to struggle to break the more than yearlong sequence of lower rally highs and pulled back sharply this week.

Smaller companies and the many recent IPOs struggling with profitability continue to exhibit grave sensitivity to higher interest rates.

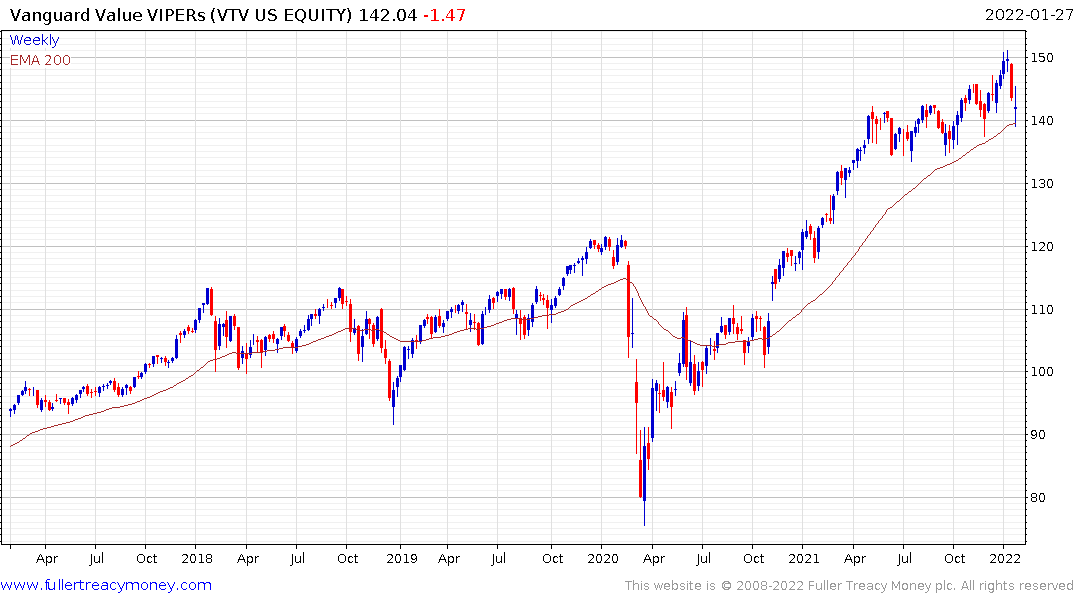

Meanwhile value shares are finally exhibiting relative strength. The Vanguard Value ETF remains steady in the region of the trend mean. It will not be immune from additional rounds of selling pressure but is likely to fall less during a drawdown phase.