US Vacancies Fall, Layoffs Jump in Sign of Softer Job Market

This article from Bloomberg may be of interest to subscribers. Here is a section:

Vacancies at US employers fell in March by more than forecast and layoffs jumped, indicating softening demand for workers.

The number of available positions decreased for a third-straight month to 9.59 million from nearly 10 million a month earlier, the Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday. That was the lowest in nearly two years and fell short of the median estimate in a Bloomberg survey of economists.

The data point to a gradual moderation in labor demand, which should eventually bring the job market into better balance and alleviate upward pressure on wages. While some companies — notably in technology and finance — have cut employees, the labor market as a whole remains resilient and has been a stalwart between the US and recession.

We are a year into the hiking cycle, so it is reasonable to see some evidence of economic slowdown around now. The stress in the banking sector is mostly focused on the convexity of bond portfolios. Loan loss provisions have not been factored in yet but that is only going to make the situation worse. JPMorgan has a big balance sheet, but it can’t buy every bank.

Treasury yields dropped in a dynamic manner today to unwind yesterday’s advance. There is clear scope for further compression in yields as economic data surprises on the downside.

Gold popped higher this morning as prospect of stagflation (high inflation and unemployment) looks more likely. This has been a mild consolidation in the region of the previous highs and the psychological $2000 level which supports the view it will be able to sustain an upward break to new all-time highs rather than failing at this level.

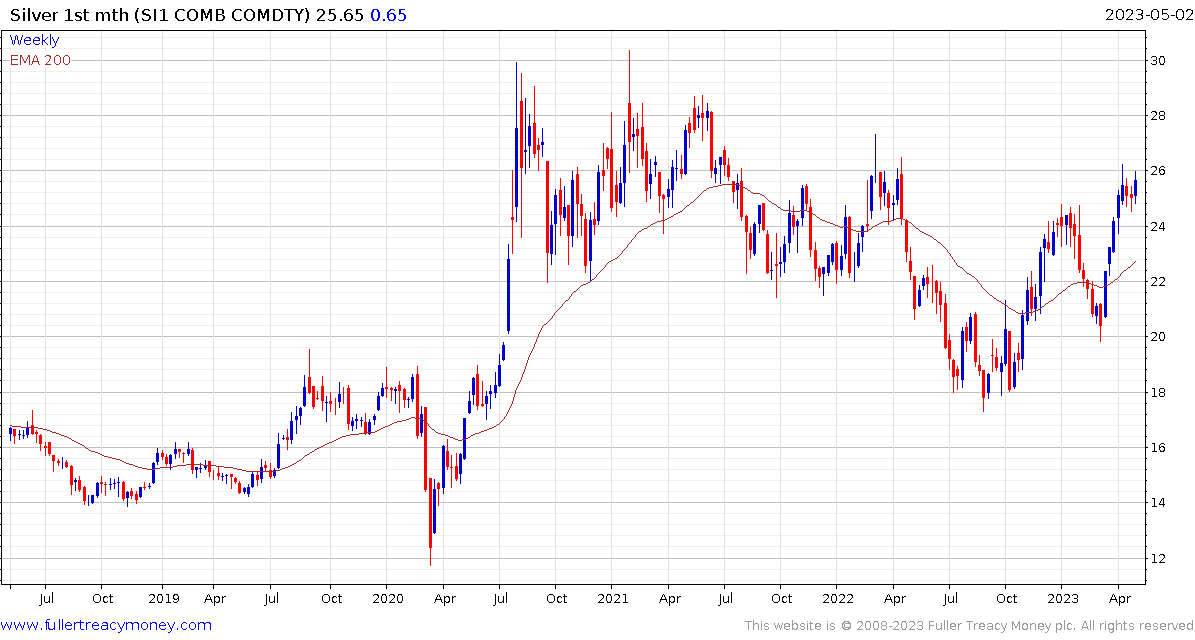

Silver reversed yesterday’s downward dynamic and continues to hold the break the medium-term downtrend.

Silver reversed yesterday’s downward dynamic and continues to hold the break the medium-term downtrend.

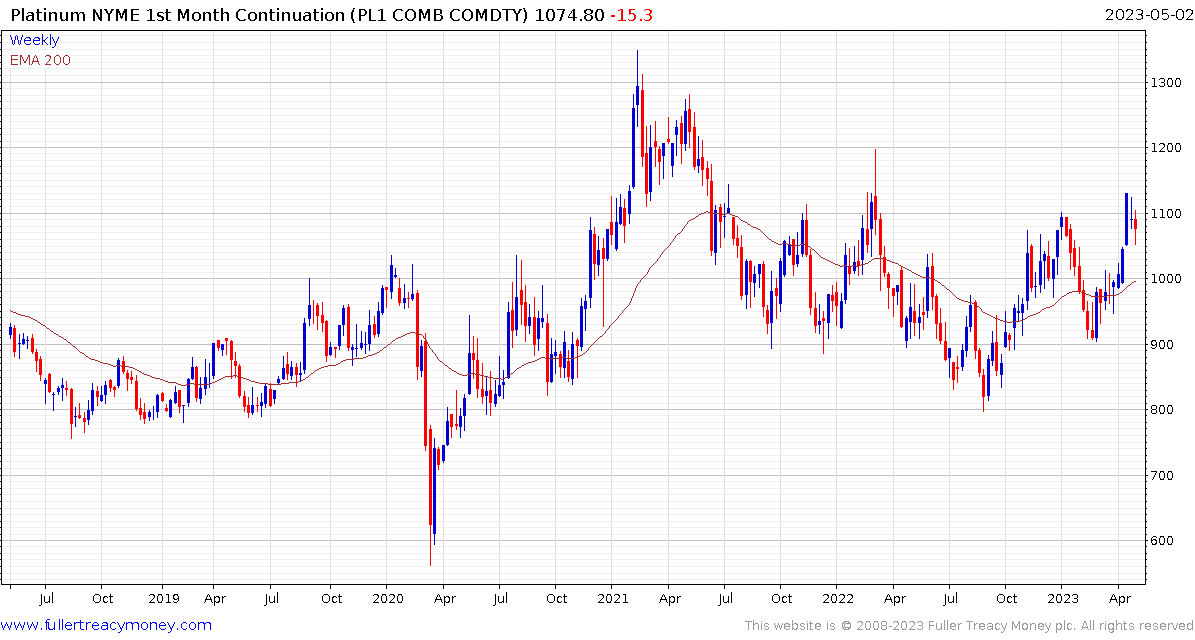

Platinum firmed today but will need upside follow through to confirm a low of near-term significance. A sustained break above $1200 would confirm a return to medium-term demand dominance.

Platinum firmed today but will need upside follow through to confirm a low of near-term significance. A sustained break above $1200 would confirm a return to medium-term demand dominance.

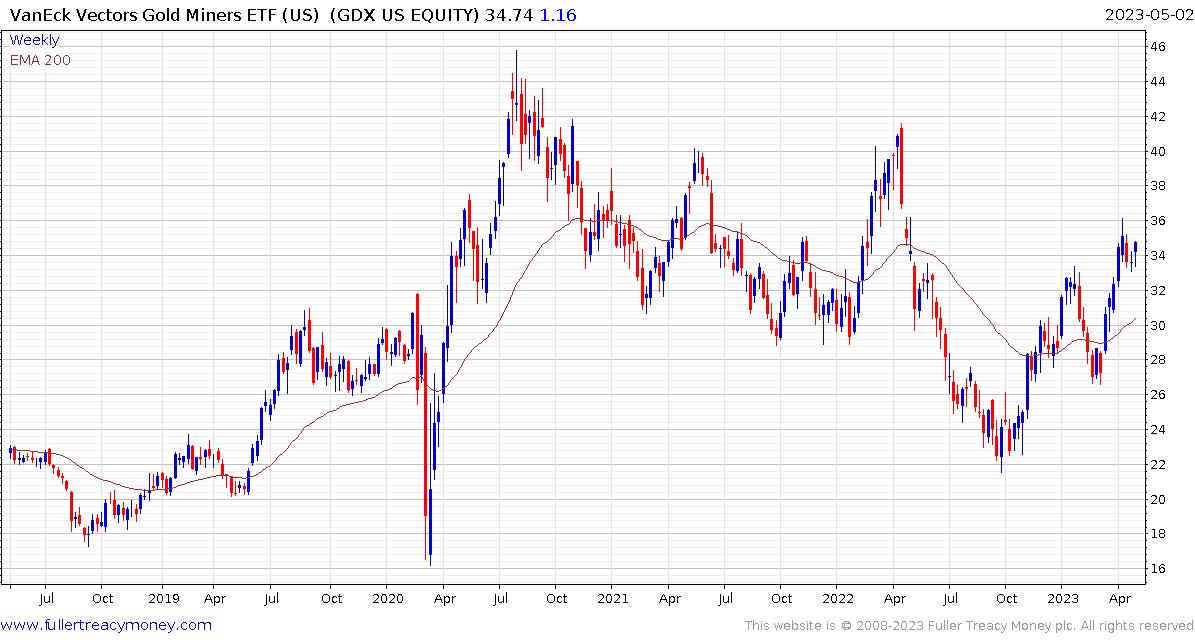

The VanEck vectors Gold Miners ETF is firming from the region of the January peak and remains on a recovery trajectory.

The VanEck vectors Gold Miners ETF is firming from the region of the January peak and remains on a recovery trajectory.