US Poised for Dutch, Japanese Help on China Chip Crackdown

This article from Bloomberg may be of interest to subscribers. Here is a section:

“I commend the Biden administration for working with our partners to apply export controls on equipment used to make advanced semiconductors and am eager to scrutinize the specifics of what comes out of these talks,” Texas Representative Michael McCaul, who chairs the House Foreign Affairs Committee, said in a statement to Bloomberg News. “A Republican Congress is ready to use its authorities to protect U.S. national security and defend human rights, should the outcomes not substantially match the controls currently in place.”

McCaul is set to meet with Raimondo to discuss the matter on Thursday. It’s uncertain how long it will take the other countries to implement their measures.

“It could even be something which just happens without big announcements,” Rutte said in the interview. “It’s still not clear. It depends a bit on how the discussions with various countries will evolve.”

After the US announcement in October, some American companies were forced to warn investors that they may lose out on billions of dollars in future China revenue. Since then, they’ve argued it also exposes them to losing market share, if overseas competitors are allowed to continue to operate in China relatively unrestricted.

Tokyo Electron has said the general clampdown on its Chinese customers is already hurting business, while ASML has said that demand elsewhere in the world for its most advanced products can make up for any revenue shortfall from China.

Despite the friendlier sounds coming from Chinese and American diplomats, the trajectory of the trade war has not changed. It is still the clear ambition of the US government to curtail China’s ability to compete technologically. It is viewed by both sides of the political divide as a national security priority.

The loss of trust over the last decade is not going to be erased quickly. In the meantime everyone is aware of the wisdom of not relying on one supplier or one customer following Russia’s invasion of Ukraine.

![]() The Philadelphia Semiconductors Index is at a critical juncture. It has posted a higher reaction low but the yearlong downtrend is still intact. It needs to sustain a move above 3000 to confirm a return to demand dominance.

The Philadelphia Semiconductors Index is at a critical juncture. It has posted a higher reaction low but the yearlong downtrend is still intact. It needs to sustain a move above 3000 to confirm a return to demand dominance.

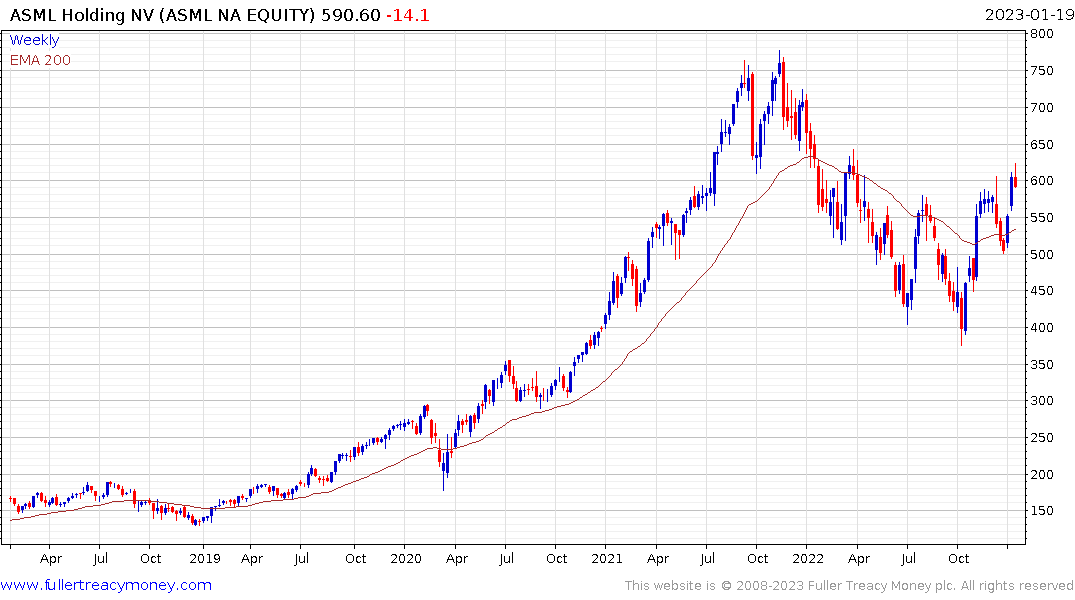

ASML has been a clear outperformer and has broken its downtrend. Nevertheless, the decline of Chinese buying suggests it could be a while before it retests the 2021 peak.

ASML has been a clear outperformer and has broken its downtrend. Nevertheless, the decline of Chinese buying suggests it could be a while before it retests the 2021 peak.

![]() Taiwan Semiconductor fell more but has a similar pattern overall.

Taiwan Semiconductor fell more but has a similar pattern overall.