US Inflation Tops Forecasts, Cementing Odds of Big Fed Hike

This article from Bloomberg may be of interest to subscribers. Here is a section:

US consumer prices were resurgent last month, dashing hopes of a nascent slowdown and likely assuring another historically large interest-rate hike from the Federal Reserve.

The consumer price index increased 0.1% from July, after no change in the prior month, Labor Department data showed Tuesday. From a year earlier, prices climbed 8.3%, a slight deceleration, largely due to recent declines in gasoline prices.

So-called core CPI, which strips out the more volatile food and energy components, advanced 0.6% from July and 6.3% from a year ago, the first acceleration in six months on an annual basis. All measures came in above forecasts. Shelter, food and medical care were among the largest contributors to price growth.

The acceleration in inflation points to a stubbornly high cost of living for Americans, despite some relief at the gas pump. Price pressures are still historically elevated and widespread, pointing to a long road ahead toward the Fed’s inflation target.

Inflation probably has peaked but that is not a commentary on how quickly it comes back down. The bullish narrative for inflation is that the pandemic was an anomaly. The surge in inflation was created by supply shocks and liquidity-fuelled asset price appreciation. With the end of the pandemic and less money supply, inflation will fall back as quickly as it rose, so buy the dip.

I’m reminded of the adage “there is many a slip between the cup and the lip”. In a perfect world everything moves in a linear fashion. Unfortunately, the real world is seldom so neat. The problem with that narrative is the pandemic is proving to have a long tail. It’s still causing economic disruptions in China for example with knock-on effects everywhere. However, the monetary and fiscal response to the pandemic will probably have even longer lasting repercussions.

Consumers and investors believe governments and central banks will intervene to void bankruptcy laws, create debt jubilees for troubled borrowers, shower cash on troubled citizens and other hitherto extraordinary measures to combat deflationary forces. With that belief, there is no reason to quench demand. In fact, consumers appear to be cottoning on to the fact that small debts are their problem, big debts are the government’s. Airlines and automakers have known that for years.

That’s a recipe for persistent inflation. The only way to combat it is to disappoint expectations and that implies a deep recession. Investors are still focusing on how much central banks will raise rates. The biggest question is how much they will cut rates and how long they will leave support in the system before restricting it again. The last twenty years has been characterised by central banks leaving support in the system for too long and blowing asset bubbles. Rising inflation suggests that pattern may now be over. It suggests shorter sharper cycles over the next decade.

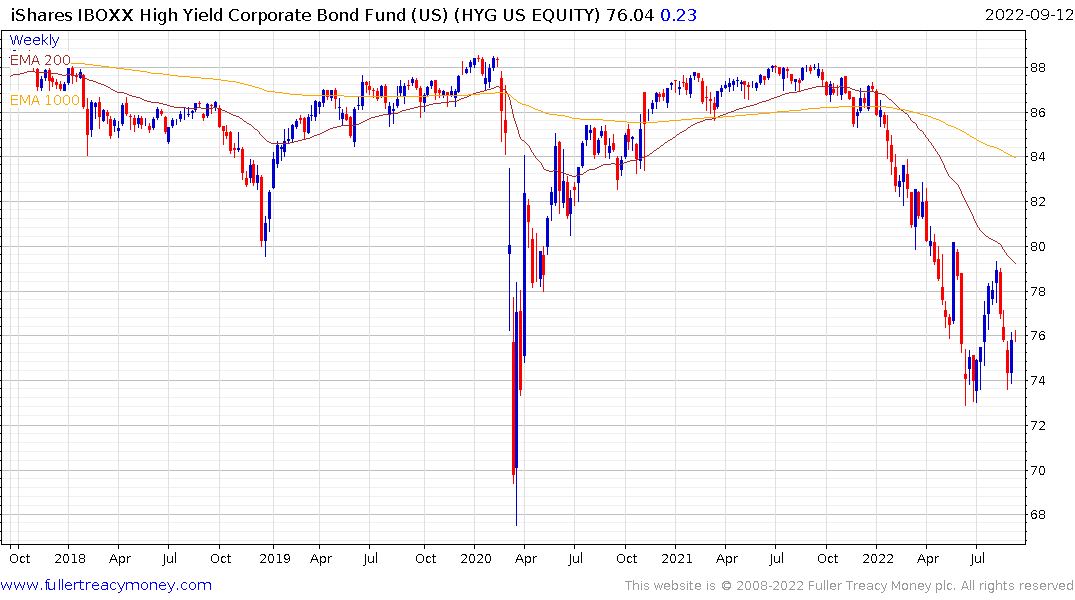

High yield bonds are pulling back again which increases scope for leveraged firms to run into credit trouble.

Funding dollar debt in a depreciating currency is going to become problematic for a significant swathe of the emerging markets. It’s also worth remembering that Chinese property developers have been by far the largest issuers of Dollar debt and the renminbi is only starting to fall.

Buying the dip always works in a secular bull market. If the Nasdaq-100 sustains a break below the 1000-day MA, that will break the secular uptrend. The Index has exemplified the success of companies that made the best use of cheap abundant credit to prosper on the back of 4G/wireless internet, globalization and low energy costs.

The unfolding cycle takes many of those fundamental supports and turns them on their head. New trends will develop. Biotech, for example, has the capacity to provide solutions to pressing issues with the rising cost of chronic disease care. Decoupling from the autocratic axis also implies replacing production and manufacturing capacity which will require infrastructure development. However, the chances are these trends will not begin to reach escape velocity until after a bear market.

Back to top