US Economy Shrinks for a Second Quarter, Fueling Recession Fears

This article from Bloomberg may be of interest to subscribers. Here is a section:

The drumbeat of recession grew louder after the US economy shrank for a second straight quarter, as decades-high inflation undercut consumer spending and Federal Reserve interest-rate hikes stymied businesses and housing.

Gross domestic product fell at a 0.9% annualized rate after a 1.6% decline in the first three months of the year, the Commerce Department’s preliminary estimate showed Thursday. Personal consumption, the biggest part of the economy, rose at a 1% pace, a deceleration from the prior period.

“The more important point is that the economy has quickly lost steam in the face of four-decade high inflation, rapidly rising borrowing costs, and a general tightening in financial conditions,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note. “The economy is highly vulnerable to slipping into a recession.”

It is always dangerous to say this time is different in markets. However, on this occasion there really is some justification that claim. Two consecutive quarters of negative growth meets the technical definition of a recession. However, there are some important mitigating circumstances. For one, unemployment has not risen significantly. There has also never been a recession when the PMI was among 50. That suggests muddier perspective than we might be accustomed to.

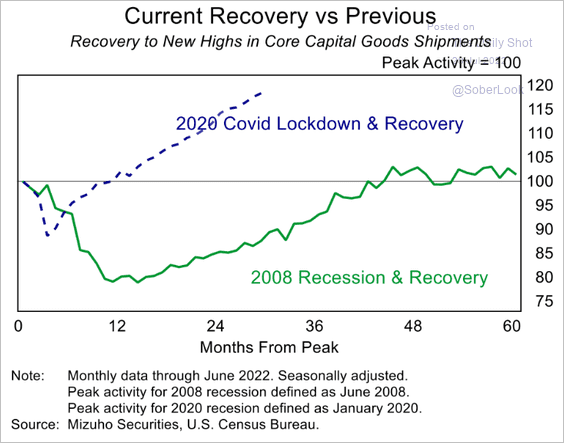

For me, I think of this market environment like a pendulum. We swung deep into recession as the world shut down in reaction to the COVID pandemic which is still ongoing. The massive surge in money supply, accompanied by direct fiscal transfers to consumers saw a V-shaped recovery and the pendulum swung to the other extreme. That created the inflation everyone now seems to believe is permanently entrenched.

Now the pendulum is swinging back in towards recession again. Money supply growth has evaporated, US interest rates are level with the peak from the last cycle, quantitative tightening has only just begun, yield curves are inverting and oil prices are close to historic highs.

If the pendulum analogy is accurate, it is reasonable to predict this contraction will not be as deep as the pandemic one. The easing required to arrest the decline will not be as large and central banks will be much swifter in reacting to any potential sign of inflation in future. That’s a recipe for shorter cycles because it will take time for the after-effects of the pandemic to settle down both in terms of supply and demand and geopolitics.

10-year yields broke below 2.75% today to suggest less angst about future inflation. That also lent support to the most interest rate sensitive portion of the market.

Shopify announced dismal earnings yesterday but the share rallied. It has put in a three-month base and a reversion towards the mean would represent a doubling of the share price.

Shopify announced dismal earnings yesterday but the share rallied. It has put in a three-month base and a reversion towards the mean would represent a doubling of the share price.

Etsy impressed with earnings today and broke out of its short-term base formation.

Etsy impressed with earnings today and broke out of its short-term base formation.

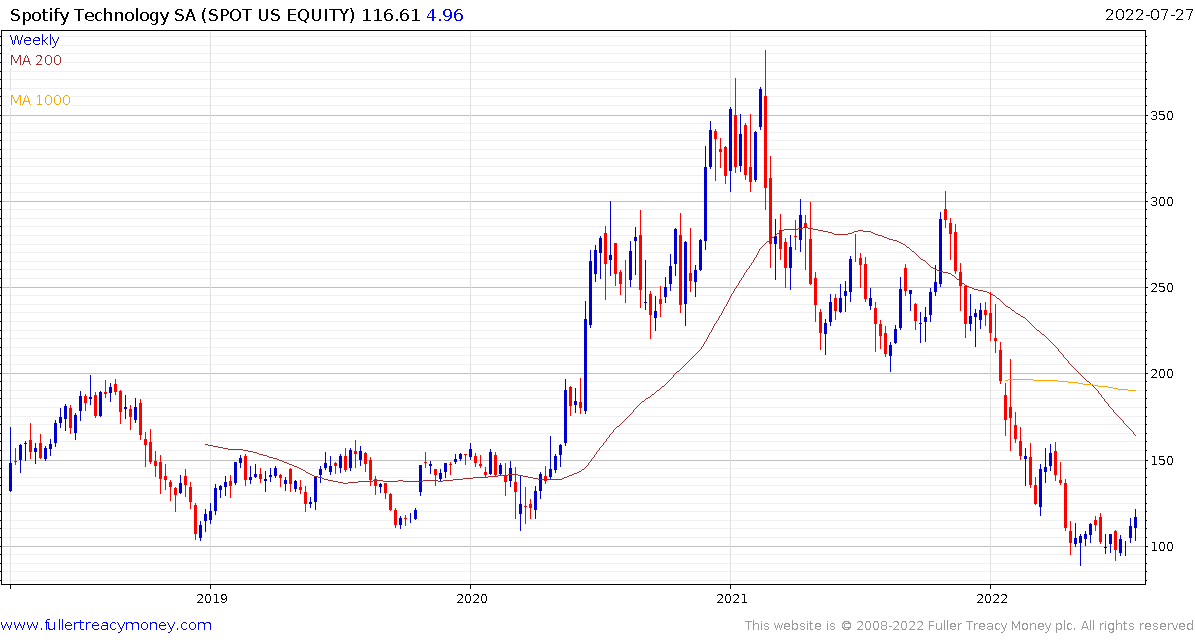

Spotify impressed with user growth and is at the upper side of its short-term base formation.

The weakness in the high growth sector over the last year has been about rising rates and access to affordable liquidity. Any prospect of financial conditions loosening is positive for these kinds of companies even if the heights seen during the pandemic are unlikely to be revisited.

This has also removed some of the pressure from the gold price which continues to rebound from the psychological $1700 level.

Bitcoin’s sequence of higher reaction lows also points towards renewed risk appetite.

Job Openings are only just beginning to roll over. This peaking activity suggests the data is going to get worse before it gets better. That’s the primary reason investors are willing to take risks today, they don’t expect tightening to last. However, it worth considering that job openings surged because of a jump in demand which was fuelled by excess money supply. That will have to be unwound before inflation is under control.