Update on Positioning

Thanks to a subscriber for this snippet of a report from JPMorgan. Here is a section:

Here is a link to the above article and here is a section from it:

Given equities recorded their worst 1-month return in over 9 years, assert managers who rebalance to fixed weights on a monthly schedule are currently the most underweight equities since February 2009. Systematic investors are also near the bottom of their exposure – volatility targeting strategies’ equity holdings are similar to February low, and many CTAs are outright short or out of equities. A ~10% decline from the peak and markets turning negative for the year triggered all kind of institutional stops, driving the sell-off deeper.

Did the macro and fundamental outlook deteriorate enough to justify this extreme swing in investor positioning? In October, US GDP surprised expectations to the upside, core PCE remained steady, and ~80% of US companies reporting Q3 earnings beat analyst expectations that were formed before the sell-off, while forward guidance remains largely unchanged. Given the weakening economy in China and poor market performance in the US, there may be increased (rather than decreased) probability of November progress on trade.

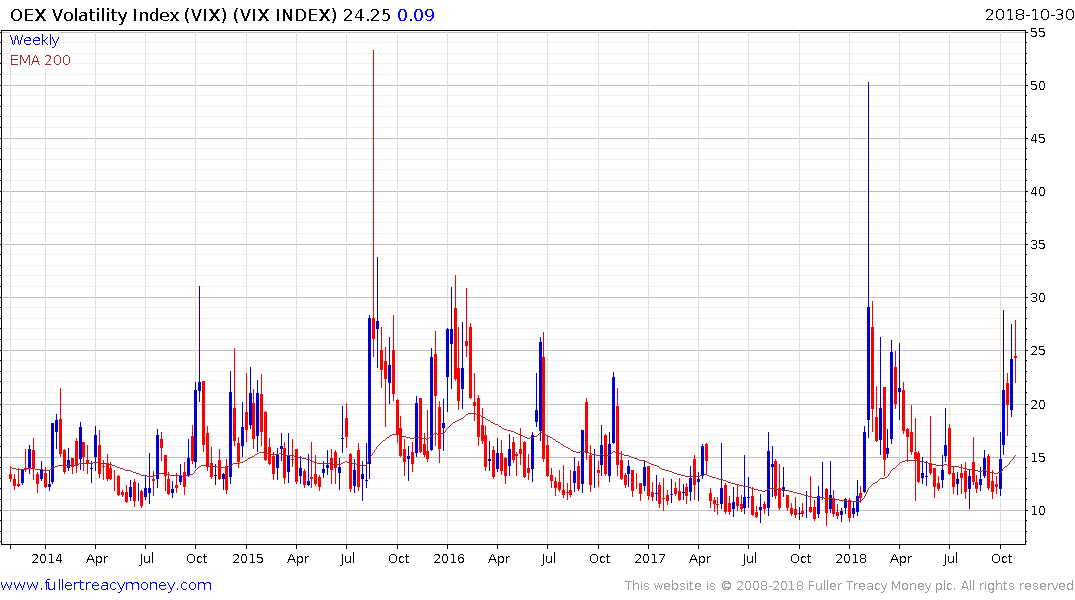

The VIX Index has not spiked on this occasion by nearly as much as the move we saw in February because the market fell more slowly this time than last. That also highlights the fact that the bulk of selling pressure has taken place in the highly leveraged part of the technology sector.

![]()

The Philadelphia Semiconductors Index has completing Type-2 top formation characteristics. The above commentary reminds me of when we discuss Type-2 formation characteristics at The Chart Seminar. After a very sharp decline, or proverbial bolt from the blue, there is always a discussion about whether it was economically justified and that helps people to think about the potential for a bounce. However, that ignores the fact that sentiment has been damaged and a lot of people have had stops triggered and are sitting in cash. That fact leads many institutions into a wait and seen attitude which means they stop buying, which brings supply and demand back into relative balance.

It almost to be expected that a range form following the massive reaction against the prevailing trends. That is either going to represent a first step below the top or it will be able to muster the wherewithal to push back up into the overhead range. Either way the Index is now quite oversold and a bounce is looking more likely that not.

Here is a link to this week’s report from Riverfront Asset Management which may be of interest to subscribers.

Back to top